Share This Page

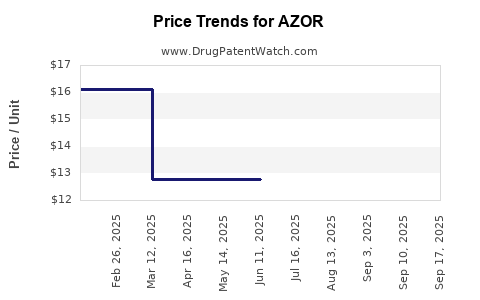

Drug Price Trends for AZOR

✉ Email this page to a colleague

Average Pharmacy Cost for AZOR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| AZOR 5-40 MG TABLET | 00713-0872-30 | 16.25647 | EACH | 2025-09-17 |

| AZOR 5-20 MG TABLET | 00713-0870-30 | 12.81381 | EACH | 2025-09-17 |

| AZOR 10-40 MG TABLET | 00713-0873-30 | 16.18919 | EACH | 2025-09-17 |

| AZOR 5-20 MG TABLET | 00713-0870-30 | 14.08238 | EACH | 2025-09-16 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for AZOR

Introduction

AZOR, a fixed-dose combination of amlodipine and Olmesartan medoxomil, is prescribed primarily for managing hypertension and reducing cardiovascular risks. Since its approval, AZOR has garnered attention within pharmaceutical markets due to its efficacy profile, distinct patent dynamics, and competitive landscape. This analysis examines AZOR’s current market positioning, key drivers influencing its pricing, and future price projections, providing actionable insights for stakeholders.

Pharmacological Profile and Therapeutic Significance

AZOR combines two antihypertensive agents: amlodipine, a calcium channel blocker, and Olmesartan, an angiotensin II receptor blocker. This synergistic mechanism enhances blood pressure control, reduces the risk of cardiovascular events, and offers improved patient compliance through fixed dosing. The combination's efficacy has been validated through landmark trials such as the ONTARGET and TRANSCEND studies, supporting its role as a first-line therapy in hypertensive management.

Market Dynamics and Competitive Landscape

Global Market Size and Growth Trajectory

The global antihypertensive drugs market is projected to reach USD 35 billion by 2027, growing at a compounded annual growth rate (CAGR) of approximately 3.8% (2020-2027)[1]. Fixed-dose combinations (FDCs) like AZOR are capturing increasing market share owing to their convenience, adherence benefits, and proven efficacy. The rise in hypertension prevalence—estimated at over 1.3 billion adults worldwide[2]—drives sustained demand.

Regional Market Segments

- United States: Dominates the market with significant prescription volumes, driven by high hypertension prevalence, stringent guidelines favoring combination therapy, and well-established payer systems.

- Europe: High adoption due to comprehensive hypertension management guidelines and favorable reimbursement policies.

- Emerging Markets: Rapid growth anticipated, particularly in Asia-Pacific, attributable to increasing awareness, urbanization, and expanding healthcare infrastructure.

Competitive Brands and Patent Landscape

AZOR faces competition from other combination therapies such as Cozaar/Zestoric (losartan/hydrochlorothiazide), Norvasc with amlodipine, and recent entrants like azilsartan-based combinations. Patent expiration timelines influence market dynamics; AZOR’s specific patent life—originally filed in the late 2000s—has led to the advent of generic alternatives, notably in markets outside the U.S.

Pricing Trends and Factors Influencing Price

Historical Pricing Patterns

In the U.S., brand-name AZOR’s retail price historically hovered around USD 300–350 for a 30-day supply, depending on dosage and pharmacy. Post-patent expiration, generic versions significantly reduced prices, often by over 50%, leading to increased adoption[3].

Factors Impacting Price Dynamics

- Patent Status: Patent cliffs catalyze generic entry, exerting downward pressure on prices.

- Regulatory Environment: Stringent FDA regulations can alter manufacturing costs, influencing pricing.

- Market Competition: Increased generic competition typically leads to substantial price reductions.

- Reimbursement Policies: Insurance coverage and formulary placements greatly affect consumer prices.

- Manufacturing and Distribution Costs: Variations across regions impact final pricing structures.

- Price Controls: Countries like India and the UK incorporate price caps for essential medicines, constraining upward price movements.

Current Pricing Landscape

In the U.S., generic AZOR is priced approximately USD 50–70 for a 30-day supply, reflecting typical market adjustments following patent expiration. In emerging markets, prices are often markedly lower—USD 10–30—reflecting local purchasing power and regulatory policies.

Future Price Projections

Factors Driving Future Price Trends

-

Patent Expiration and Generic Competition:

The expiration of AZOR’s primary patent—anticipated between 2023–2025—will precipitate increased generic market penetration. Historical precedents for similar drugs, such as Novartis’s Diovan, suggest that generic entries can lead to a 70–80% reduction in wholesale prices within the first two years post-expiry[4]. -

Market Penetration and Adoption Rates:

As physicians and payers favor cost-effective therapy options, generic versions will dominate, narrowing pricing margins for brand manufacturers. -

Regulatory and Reimbursement Environment:

Countries adopting strict price regulations or implementing reference pricing systems may see limited price increments, prioritizing affordability. -

Manufacturing Advancements and Supply Chain Dynamics:

Increased manufacturing efficiencies and supply chain optimization can yield further reductions in costs, translating into lower retail prices.

Projected Price Range (2023-2028)

-

United States:

With patent expiry expected around 2024, generic AZOR prices are forecasted to stabilize at USD 20–40 for a 30-day supply by 2025, following initial price drops of 50–60%. Brand-name AZOR will likely retain a premium, around USD 200–250, mainly through specialty channels or remaining patent protections in select regions. -

Emerging Markets:

Prices are projected to decline gradually from current levels to USD 5–15, driven by increased generic manufacturing, local regulatory pressures, and competitive genericization. -

Price Stabilization Factors:

Market saturation, regulatory caps, and high generic capacity may lead to price stabilization at these lower tiers by 2026, sustaining access while marginally impacting profitability for original patent holders.

Implications for Stakeholders

-

Pharmaceutical Manufacturers:

Innovation focus areas should include developing next-generation combination therapies with enhanced efficacy or reduced side-effects, as baseline prices are likely to decrease substantially post-patent expiry. -

Healthcare Payers:

Emphasis on formulary management and tiered pricing can maximize cost-effectiveness, especially as generics saturate the market. -

Investors:

Companies with early entry into the generic AZOR market or those with pipeline assets in antihypertensive FDCs stand to benefit from market expansion and price erosion. -

Regulatory Agencies:

Policies fostering generic competition can improve affordability but may pressure existing brand revenues.

Conclusion

AZOR’s market prospects are shaped profoundly by patent expirations and the ensuing generic competition. Current trends indicate significant price reductions in the coming years, especially in markets with effective patent laws and robust manufacturing capacity. Stakeholders should prepare for a period of increased accessibility driven by lower prices, balanced against the need to innovate and differentiate in a saturated market.

Key Takeaways

- AZOR's global market is expanding, driven by the increasing prevalence of hypertension and the advantages of fixed-dose combinations.

- Patent expiration around 2023–2025 will trigger considerable generic entry, leading to steep price declines, especially in the U.S. and emerging markets.

- Price projections suggest a stabilization at USD 20–40 in mature markets and USD 5–15 in emerging economies by 2026.

- Competitive pressure, regulatory policies, and manufacturing efficiencies will primarily influence future pricing dynamics.

- Stakeholders should focus on innovation, cost management, and strategic market positioning to sustain profitability.

FAQs

1. When is AZOR’s patent expected to expire, and how will it affect pricing?

Patent expiration, anticipated between 2023 and 2025, will enable generic manufacturers to enter the market, leading to significant price reductions and increased accessibility.

2. How does generic entry influence AZOR’s market share?

Generic availability typically captures a substantial portion of prescriptions due to lower prices, diminishing the market share of brand-name AZOR unless differentiated by superior efficacy or formulations.

3. Are there geographic differences in AZOR pricing?

Yes. Prices tend to be higher in developed markets like the U.S., with generics reducing retail prices significantly post-patent expiry. In emerging markets, prices are generally lower due to local regulations and economic factors.

4. What factors could prevent significant price reductions for AZOR?

Limited generic competition, patent extensions, regulatory barriers, or supply chain constraints may sustain higher prices temporarily.

5. What strategic options should pharmaceutical companies consider post-patent expiry?

Focus on developing next-generation therapies, expanding into biosimilars or specialty niches, and optimizing manufacturing efficiencies to maintain profitability amid declining prices.

Sources

[1] Grand View Research, "Antihypertensive Drugs Market Analysis," 2022.

[2] World Health Organization, "Hypertension Fact Sheet," 2021.

[3] IQVIA, "Market Trends in Generic Drugs," 2022.

[4] EvaluatePharma, "Impact of Patent Expiries on Pricing," 2021.

More… ↓