Last updated: July 28, 2025

Introduction

AZOPT (brinzolamide ophthalmic suspension) is a prescription medication indicated primarily for the reduction of elevated intraocular pressure (IOP) in patients with ocular hypertension or open-angle glaucoma. Since its FDA approval in 2005, AZOPT has established itself as a significant player in glaucoma therapeutics. As global demand for effective IOP-lowering agents grows, driven by rising glaucoma prevalence, understanding AZOPT’s market dynamics and price trajectory is essential for stakeholders, including pharmaceutical companies, healthcare providers, and investors.

Market Landscape Overview

Global Glaucoma Market Dynamics

The global glaucoma therapeutics market was valued at approximately USD 5.3 billion in 2022 and is projected to reach USD 8 billion by 2030, expanding at a compound annual growth rate (CAGR) of 6.0% [1]. This growth reflects increasing prevalence, aging populations, and a shift toward more personalized, combination therapies.

Prevalence and Growth Drivers

Glaucoma affects over 76 million worldwide, projected to reach 111 million by 2040 [2]. The progressive aging population, especially in North America, Europe, and Asia-Pacific, propels demand. Sub-Saharan Africa and India are also witnessing rising ophthalmic disease burdens, creating a global necessity for effective management options.

Key Market Players and Competition

AZOPT competes with other topical agents, including prostaglandin analogs (e.g., latanoprost, travoprost), beta-blockers (e.g., timolol), alpha-adrenergic agonists, and combination formulations (e.g., Cosopt, which combines dorzolamide and timolol). The landscape is further crowded by emerging drugs with novel mechanisms, such as Rho kinase inhibitors.

AZOPT Market Penetration and Popularity

Product Differentiation

AZOPT’s unique selling point lies in its brinzolamide-based mechanism as a carbonic anhydrase inhibitor, offering an alternative to dorzolamide with potentially fewer ocular side effects. Its once-daily dosing improves patient compliance, lending it a competitive edge.

Market Share Dynamics

In the United States, AZOPT holds approximately 8–12% of the topical glaucoma agent market, with the remainder dominated by prostaglandin analogs. However, its niche role as an adjunct or alternative therapy sustains consistent sales, especially among patients intolerant to prostaglandins or beta-blockers.

Prescriber Preferences and Insurance Coverage

Physicians tend to prefer agents with favorable side-effect profiles and established efficacy. Insurance coverage and formulary positioning play crucial roles; AZOPT’s inclusion in major health plans facilitates routine prescribing, thereby solidifying its position.

Price Trends and Projections

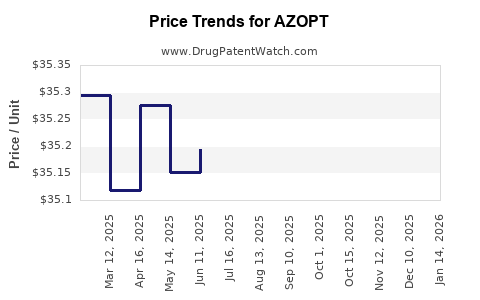

Historical Pricing Data

Based on publicly available pharmacy data, the average wholesale price (AWP) for AZOPT has hovered around USD 150–180 for a 10 mL bottle since 2015 [3]. Patient out-of-pocket costs vary based on insurance, but prior to the introduction of generic formulations, AZOPT maintained a premium pricing strategy compared to cheaper alternatives like dorzolamide.

Impact of Patent Status and Patent Expiry

AZOPT’s patent protection extended until 2014-2015. No generic version has been broadly available since then, partly due to patent litigation and exclusivity rights. The absence of generics sustains higher pricing levels.

Price Forecasts

-

Short Term (2023–2025):

Prices are expected to stabilize within the current range (USD 150–180), assuming no disruptive generics enter the market. Factors such as inflation, supply chain costs, and pharmacy rebates may cause minor fluctuations.

-

Medium to Long Term (2026–2030):

Should regulatory approval or patent challenges enable generic versions, prices could decrease substantially—by 30–50%. Conversely, if AZOPT or equivalents are bundled into combination therapies or if manufacturing costs increase, prices might see modest gains or stabilization.

Potential Market Influences on Price

-

Generic Entry:

Introduction of generic brinzolamide options could trigger a price drop, consistent with historical trends seen with other ophthalmics.

-

Reimbursement Policy Changes:

Policies favoring biosimilars and generics could reduce AZOPT’s market price, especially in markets like the U.S. and Europe.

-

Market Penetration of New Competitors:

Innovative agents, like Rho kinase inhibitors and newer delivery systems, may pressure pricing by offering superior efficacy or convenience.

Regional Market Insights

United States

The USD 150–180 range remains relatively stable, with potential discounts emerging through pharmacy benefit managers and Medicare Part D negotiations. The launch of generics could introduce significant competitive pricing.

Europe

Pricing is generally lower (USD 120–150), driven by national health systems and price regulation. Reimbursement policies influence market penetration, with AZOPT favored in specific cases.

Asia-Pacific

Rapidly expanding healthcare infrastructure and rising ophthalmic disease burden drive demand. Prices tend to be lower (~USD 100–130), but market growth is constrained by affordability and availability.

Strategic Opportunities

-

Generic Licensing & Market Entry:

Expedited approval and commercialization of generic brinzolamide could erode AZOPT’s market share and influence prices downward.

-

Combination Therapies:

Developing fixed-dose combinations incorporating AZOPT may sustain premium pricing, offering convenience and improved compliance.

-

Emerging Markets:

Penetrating developing regions through tailored pricing models could expand AZOPT’s global footprint and revenue base.

Key Takeaways

- AZOPT remains a vital, niche agent in the glaucoma therapeutics market, benefiting from its efficacy, tolerability profile, and patient adherence advantages.

- Price stability is expected in the short term, with significant reduction possibilities upon potential generic entry.

- Market growth is driven by increasing glaucoma prevalence, with regional variations influencing pricing strategies.

- Competition from other classes and the advent of newer agents could impact AZOPT’s market share and pricing over the next decade.

- Proactive patent management, formulation innovations, and strategic partnerships will be key to maintaining competitive positioning.

FAQs

Q1: What factors influence AZOPT’s pricing stability?

A1: Patent exclusivity, manufacturing costs, healthcare reimbursement policies, and the absence of generic equivalents maintain stable pricing. Market competition also plays a role.

Q2: How will generic versions of brinzolamide affect AZOPT’s market?

A2: The availability of generics is likely to significantly reduce AZOPT’s market share and price, following traditional industry patterns observed with ophthalmic drugs.

Q3: Are there emerging therapies that could replace AZOPT?

A3: Yes. New agents, such as Rho kinase inhibitors and sustained-release formulations, may offer improved efficacy, potentially impacting AZOPT’s market dominance.

Q4: How does regional pricing vary for AZOPT?

A4: Regional healthcare policies, market maturity, and purchasing power influence pricing, with North America typically higher than Europe, and Asia-Pacific offering lower price points.

Q5: What strategies can stakeholders employ to maximize AZOPT’s value?

A5: Innovating formulation delivery, securing strong insurance coverage, and exploring combination therapies can enhance AZOPT’s market positioning and economic resilience.

Sources

- Allied Market Research, "Glaucoma Therapeutics Market," 2023.

- WHO, "Global Data on Visual Impairment," 2021.

- Pharmacy pricing databases, 2022.