Last updated: July 27, 2025

Introduction

Azithromycin, a macrolide antibiotic first introduced in the 1980s, remains a cornerstone in antimicrobial therapy, particularly for respiratory, skin, and sexually transmitted infections. Its broad-spectrum efficacy, favorable pharmacokinetic profile, and convenient dosing regimen support its continued market presence. This analysis explores current market dynamics, competitive landscape, regulatory environment, and future price projections, providing industry stakeholders with comprehensive insights.

Current Market Landscape

Global Market Size and Growth Trajectory

The global azithromycin market was valued at approximately USD 2.4 billion in 2022 and is projected to reach USD 3.2 billion by 2030, reflecting a compound annual growth rate (CAGR) of around 4.1% (2023-2030). The growth drivers include rising respiratory infections due to COVID-19 and influenza outbreaks, increasing prevalence of sexually transmitted diseases, and expanding use in emerging markets.

Key Market Segments and Applications

- Respiratory Tract Infections: Dominates sales due to widespread use in pneumonia, bronchitis, and sinusitis.

- Sexually Transmitted Infections: Especially for chlamydia and gonorrhea.

- Skin and Soft Tissue Infections: Utilized owing to efficacy and convenient dosing.

- Off-Label and Combination Uses: Elevated use in COVID-19 management, though Off-label uses fluctuate based on clinical guidelines.

Regional Market Dynamics

- North America: Largest market, driven by high healthcare expenditure, antibiotic consumption, and antibiotic stewardship programs.

- Europe: Stable growth, with regulatory updates impacting pricing.

- Asia-Pacific: Fastest-growing due to increasing healthcare infrastructure and infection rates, alongside rising antibiotic accessibility.

- Emerging Markets: Enhanced access to generic azithromycin secures expanding market share.

Key Industry Players

Major pharmaceutical companies manufacturing azithromycin include Pfizer, Teva Pharmaceuticals, Sandoz, and Mylan. Pfizer’s branded product, Zithromax, retains significant market share, but generics dominate due to patent expirations occurring around 2014-2015.

Regulatory and Patent Landscape

Patent Expirations and Generic Entry

Generic azithromycin entered the market post patent expiry, resulting in significant price erosion. Current formulations enjoy extensive generic competition, which constrains prices but sustains volume growth.

Regulatory Approvals and Guidelines

Guidelines from the CDC and WHO endorse azithromycin's role in treatment protocols, bolstering demand. However, rising concerns about antimicrobial resistance (AMR) influence regulatory scrutiny, potentially affecting prescribing patterns and pricing strategies.

Market Challenges and Opportunities

Challenges

- Antimicrobial Resistance: Increasing resistance levels reduce clinical efficacy, possibly limiting market longevity.

- Regulatory and Ethical Concerns: Stricter oversight impacts prescribing and pricing.

- Generic Competition: Continual price suppression restricts profit margins.

Opportunities

- New Formulations: Efforts in developing long-acting injectables or combination products could command premium pricing.

- Expanding Indications: Clinical trials exploring azithromycin's role in COVID-19 adjunct therapy highlight potential new markets.

- Access in Low-Income Regions: Growing penetration offers volume-based growth in emerging markets.

Price Projections and Future Outlook

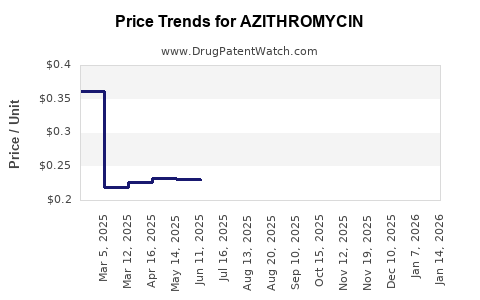

Historical Pricing Trends

- Brand Name (Zithromax): Historically, the average wholesale price (AWP) per 250 mg tablet was approximately USD 2.50 before patent expiration.

- Generic Azithromycin: Post-generic entry, prices plummeted—currently averaging USD 0.20–USD 0.50 per tablet, depending on formulation and region.

Projected Pricing Dynamics (2023-2030)

Given the dominance of generics, unit prices are expected to remain stable or decline slightly. Factors influencing future prices include:

- Regulatory changes aimed at combating AMR may introduce price controls or incentivize newer formulations.

- Market saturation and competition likely constrain prices, with modest inflation driven by supply chain costs.

- Potential innovation—such as extended-release formulations—could command higher prices, offsetting generic downward pressure.

Forecast Summary

- Price Range (2023): USD 0.20 – USD 0.50 per tablet.

- Price outlook (2028-2030): Slight decline or stabilization around USD 0.15 – USD 0.40, with premium for novel formulations.

Strategic Implications

For pharmaceutical companies and investors, the key lies in balancing volume-driven revenues from generics with innovation in formulations to sustain margins. Stakeholders should monitor resistance trends, regulatory shifts, and evolving treatment guidelines, as these factors directly impact azithromycin's pricing and market utilization.

Key Takeaways

- The azithromycin market is mature, characterized by widespread generic availability and declining prices, but volume growth sustains profitability.

- Increasing antimicrobial resistance poses a significant threat, potentially reducing effective demand and influencing future pricing structures.

- Regulatory pressures and emerging formulations may create pockets of premium pricing, yet overall downward pressure is expected.

- Emerging markets present growth opportunities owing to expanding healthcare infrastructure and antibiotic access.

- Variations in regional policies and stewardship programs necessitate tailored market strategies.

FAQs

1. How will antimicrobial resistance impact the future of azithromycin pricing?

Rising resistance diminishes clinical efficacy, potentially reducing demand. This could lead to lower prices and shifts toward new formulations or combination therapies that overcome resistance.

2. Are there opportunities for branded azithromycin products to command higher prices?

Yes, formulations such as long-acting injectables or combination drugs may command premium pricing, especially if they demonstrate superior efficacy or patient adherence.

3. How do regulatory policies influence azithromycin costs?

Stringent antimicrobial stewardship and policies promoting generic usage keep prices low. Conversely, regulations supporting innovation and patent protections may enable higher pricing for new formulations.

4. What role do emerging markets play in azithromycin’s pricing dynamics?

In emerging markets, lower manufacturing costs and high demand help sustain volume growth despite low unit prices, representing key growth avenues.

5. Will the COVID-19 pandemic affect azithromycin’s market long-term?

Initial increased use during the pandemic has declined as evidence did not support widespread efficacy for COVID-19. Future use depends on ongoing clinical research and guideline updates.

References

- [1] MarketWatch. "Global Azithromycin Market Size, Share & Trends Analysis 2023-2030."

- [2] World Health Organization. "Antimicrobial Resistance Global Report," 2021.

- [3] IQVIA. "Medicine Price Trends and Market Insights," 2022.

- [4] CDC. "Guidelines for the Treatment of Respiratory Infections," 2022.

- [5] European Medicines Agency. "Drug Approvals and Patent Data," 2023.