Last updated: July 27, 2025

Introduction

Azelastine, a potent antihistamine primarily used for allergic rhinitis and conjunctivitis, has established itself as a staple in the allergy therapeutics market. With its dual formulations—nasal spray and ophthalmic drops—azelastine caters to a broad patient demographic spanning seasonal and perennial allergic disorders. This analysis evaluates the current market landscape, competitive positioning, and future pricing trajectories based on prevailing industry trends, regulatory factors, and evolving healthcare dynamics.

Market Overview

Therapeutic Indications and Usage

Azelastine's primary indications—seasonal allergic rhinitis (SAR), perennial allergic rhinitis (PAR), and allergic conjunctivitis—are prevalent worldwide, significantly influencing its market demand. The drug’s efficacy, minimal sedative effects, and favorable safety profile contribute to its widespread adoption.

Market Penetration and Adoption

Globally, azelastine holds a prominent share within the antihistamine segment. In 2022, the global allergic rhinitis treatment market was valued at approximately USD 6.7 billion, projected to grow at a compound annual growth rate (CAGR) of 7% through 2030 (Grand View Research). Azelastine, as a first-line intranasal antihistamine, benefits from increasing awareness and a growing preference for non-sedating, topical therapies.

Competitive Landscape

Major Pharmaceutical Players

- Meda (now part of Mylan, a Viatris division): Pioneered intranasal azelastine with commercialized products such as Astepro.

- Alcon and Merck: Offer ophthalmic formulations, competing with generic manufacturers.

- Generic manufacturers: Have entered the market alongside brand leaders to capture cost-sensitive segments.

Patent Status and Brand-Name Vehicles

While Azelastine's original patents expired in several jurisdictions by the late 2010s, various formulations and delivery devices remain under patent protections or exclusivity periods, influencing pricing and market access.

Pricing Dynamics

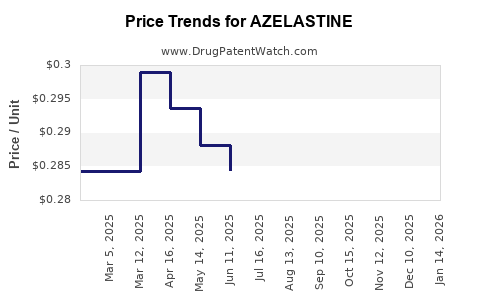

Current Price Landscape

The average retail price of azelastine nasal spray in the United States ranges between USD 150-200 for a 60+ dose bottle. Ophthalmic solutions typically retail around USD 50-75 per bottle, with considerable variability based on reimbursement and insurance coverage.

Generics and Market Competition

The entry of generic azelastine formulations has exerted downward pressure on prices, reducing costs by approximately 30-50% in mature markets. However, branded formulations maintain premium pricing due to device innovations and formulation advantages.

Pricing Influences

Factors influencing price levels:

- Regulatory exclusivity: Prolonged patent protections or pediatric exclusivity.

- Manufacturing costs: Raw material prices, especially for the active pharmaceutical ingredient (API).

- Market penetration and reimbursement policies: Higher reimbursement levels facilitate premium pricing.

- Market expansion: Launches in emerging markets often undergo tiered pricing strategies.

Future Market Trends and Price Projections

Market Growth Drivers

- Rising prevalence: Allergic rhinitis affects roughly 10-30% of the global population, with rising urbanization and pollution intensifying incidence.

- Patient preference: Non-sedating, topical therapies are favored over systemic antihistamines.

- Expanding indications: Potential off-label uses or combination therapies could broaden azelastine's utility.

Regulatory and Technological Factors

- Novel delivery systems: Innovations such as multi-dose devices, preservative-free formulations, and combined therapies may command higher prices.

- Regulatory approvals: Expanding indications and patent protections will support sustained premium pricing in key markets.

Price Projection Outlook

- Short-term (1-3 years): Moderate pricing stabilization with slight declines owing to generic competition, especially in mature markets.

- Mid-term (3-5 years): Potential price stabilization with value-added device integrations or combination products potentially maintaining higher price points.

- Long-term (5+ years): Entry of biosimilars or new generation formulations could exert downward pressure; however, market exclusivity for device formulations may sustain premium levels.

Estimated average retail prices for branded azelastine nasal spray in 2025 are projected to range between USD 130-170 in developed markets, with generic versions pricing around USD 80-120. Ophthalmic formulations are expected to follow a similar trend but with less fluctuation.

Market Challenges and Opportunities

Challenges

- Price erosion: Intense generic competition will continue to suppress prices.

- Regulatory hurdles: Variability in approval pathways across jurisdictions may slow new formulations' market entry.

- Market saturation: High prevalence rates may induce price competition to expand share.

Opportunities

- Innovative delivery systems: Self-administering, preservative-free, or combination devices could command a premium.

- Expanding geographies: Increasing penetration in Asia-Pacific and Latin America offers growth potential.

- Partnerships and licensing: Collaborations for advanced formulations or biosimilars could drive future revenue.

Key Takeaways

- Dominance in the allergy segment: Azelastine remains a foundational therapy in allergic rhinitis management, supported by a broad and growing target population.

- Pricing pressure from generics: Although patent protections are waning, device innovations and formulations sustain premium pricing in certain segments.

- Market expansion potential: Emerging markets and innovations in delivery systems promise to support revenue growth and stabilization.

- Strategic product development: Companies should focus on technological advancements and combination therapies to maintain pricing power.

- Regulatory landscape considerations: Navigating patent cliffs and approval pathways remains crucial for sustaining profitability.

FAQs

1. How does patent expiration affect azelastine pricing?

Patent expiration typically leads to increased generic competition, causing significant price reductions, often by 30-50%, as biosimilars or generics enter the market, thereby decreasing branded product margins.

2. What factors can sustain higher azelastine prices in the future?

Innovations in delivery technology, combination therapies, expanded indications, and regulatory exclusivities can sustain premium pricing in certain segments.

3. How are emerging markets impacting the azelastine market?

Growing prevalence of allergic disorders, combined with increasing healthcare infrastructure investments, positions emerging markets as key growth streams with opportunities for differentiated, affordable pricing.

4. What are the key drivers behind azelastine market growth?

Rising allergy prevalence, patient preference for non-sedating therapies, and technological advances in delivery systems are primary growth drivers.

5. How might regulatory trends influence future azelastine prices?

Strict regulatory pathways may delay new formulations, but successful approvals and patent protections can enable sustained premium pricing for innovative products.

References

- Grand View Research. Allergic Rhinitis Market Size, Share & Trends Analysis Report, 2022–2030.

- EvaluatePharma. 2023 Market Insights Report: Antihistamines.

- U.S. Food & Drug Administration. Patent and exclusivity data on azelastine formulations.

- MarketWatch. Pharmaceutical pricing trends, 2022.

- IQVIA. Global allergy therapeutics market analysis, 2022.