Last updated: July 27, 2025

Introduction

Azathioprine, a purine analog used primarily as an immunosuppressive agent, has established itself as a cornerstone in managing autoimmune conditions and preventing organ rejection. Originally developed in the 1960s, azathioprine’s multifaceted application spectrum—including Crohn’s disease, rheumatoid arthritis, and post-transplant therapy—has sustained its demand over decades. This article provides a comprehensive analysis of the current market landscape for azathioprine, examining key factors influencing supply, demand, and pricing, alongside future price projections driven by evolving clinical, regulatory, and market dynamics.

Market Overview

Historical Market Context

Azathioprine’s initial approval by regulatory agencies such as the U.S. Food and Drug Administration (FDA) in the 1960s established it as a standard immunosuppressant. Its affordability and proven efficacy have maintained steady use globally, especially in hospital formularies and generic drug markets. The global market for immunosuppressants, with azathioprine as a segment, was valued at approximately USD 2.5 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of about 4% through 2030 ([1]).

Market Drivers

- Clinical Demand: Increasing prevalence of autoimmune diseases like rheumatoid arthritis (RA), Crohn's disease, and ulcerative colitis propels demand.

- Organ Transplantation: Continued growth in transplant procedures sustains azathioprine’s role in immunosuppression.

- Cost-Effectiveness: As a generic agent, azathioprine remains a first-line, low-cost option in many treatment protocols, particularly in emerging markets.

- Regulatory Status: No recent major patent expiries or regulatory hindrances have negatively impacted supply or access.

Market Constraints

- Safety Concerns: Risk of myelosuppression, hepatic toxicity, and carcinogenic potential limit broader application.

- Alternative Therapies: The advent of targeted biologic agents (e.g., TNF inhibitors) for autoimmune diseases shifts some market share away from traditional agents like azathioprine.

- Regulatory Variations: Different countries’ approvals and manufacturing standards influence market access and pricing.

Manufacturing & Supply Dynamics

Major Producers

Numerous pharmaceutical companies, including Mylan, Teva, and Cipla, produce generic azathioprine, primarily in tablet form. Because patents have expired decades ago, the supply side is characterized by intense price competition, leading to thin profit margins but robust supply chains.

Supply Chain Considerations

- Raw Materials: Azathioprine synthesis involves complex chemical processes relying on high-purity intermediates. Fluctuations in raw material availability can influence production costs.

- Regulatory Compliance: Stringent manufacturing standards (e.g., cGMP) maintain supply reliability, though regulatory delays can disrupt distribution.

Pricing Analysis

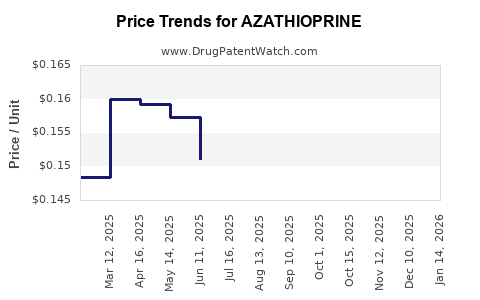

Current Price Trends

In developed markets (e.g., the US, Europe), azathioprine’s retail price for a 30-day supply (50 mg daily dose) hovers around USD 20-50 for generics, with wholesale acquisition costs (WAC) significantly lower, often <$10 ([2]). In low- and middle-income countries, prices can be even more competitive, driven by local manufacturing and market competition.

Factors Influencing Price Fluctuations

- Market Competition: An abundance of generic manufacturers sustains low prices.

- Regulatory Costs: Certification and compliant manufacturing practices influence price setting.

- Insurance & Reimbursement Policies: Payer coverage impacts pricing strategies, especially in managed healthcare systems.

- Supply Chain Disruptions: Raw material shortages or geopolitical factors can induce temporary price escalations.

Future Price Projections

Factors Impacting Future Pricing

- Introduction of Biosimilars & New Treatments: While biosimilars target biologics, the introduction of novel immunosuppressants and biologics with superior safety profiles may erode azathioprine’s market share, indirectly influencing pricing.

- Regulatory Changes: Stricter safety monitoring or manufacturing standards could elevate costs.

- Emergence of Alternative Strategies: Personalized medicine approaches, utilizing genetic profiles to tailor immunosuppressive therapy, may reduce azathioprine utilization, impacting demand and price.

- Market Expansion in Developing Countries: Growing healthcare infrastructure and increasing prevalence of autoimmune diseases will sustain demand, supporting stable or slightly increased prices.

Projected Price Range (2023–2030)

Considering current market trends, price stability is anticipated for the foreseeable future in mature markets due to established generic competition. Minor variations may occur owing to inflation, raw material costs, and regulatory compliance:

- Developed Markets: USD 15–60 per monthly supply

- Emerging Markets: USD 5–30 per monthly supply

Potential scenarios include marginal price decreases driven by the emergence of alternative therapies or sterilization of manufacturing costs, or slight increases if regulatory or supply chain issues arise.

Market Outlook

While azathioprine faces competition from newer immunosuppressive agents, its low-cost profile and established clinical efficacy secure its continued presence in treatment algorithms. The demand in transplant medicine, combined with autoimmune disease management, will support a stable market. However, technological and therapeutic developments may gradually diminish its relative use, outside regions where cost constraints favor older, cheaper medications.

Key Takeaways

- The global azathioprine market remains robust, predominantly driven by its cost-effective profile and its essential role in transplant and autoimmune disease management.

- Pricing in developed countries remains stable due to fierce generic competition, with retail prices around USD 20–50 monthly.

- Supply chain stability and regulatory compliance are critical to maintaining favorable pricing and availability.

- Future price trajectories are expected to remain stable with modest fluctuations, influenced by novel therapy competition, regulatory factors, and regional market dynamics.

- Emerging markets represent growth opportunities, underpinning sustained demand and potential price resilience.

FAQs

1. What are the main factors influencing azathioprine’s market stability?

Market stability hinges on its continued clinical utility, low manufacturing costs, robust generic competition, and minimal patent restrictions. Safety profile concerns and emergence of alternative therapies may gradually influence demand.

2. How do regulatory differences across countries affect azathioprine pricing?

Regulatory standards impact manufacturing costs and registration expenses. Countries with stringent approval processes may have higher prices, while regulatory harmonization facilitates more competitive pricing in certain regions.

3. What are the potential impacts of new immunosuppressive therapies on azathioprine’s market?

Introduction of targeted biologics and newer immunosuppressants with improved safety profiles may reduce azathioprine’s market share, exerting downward pressure on its price and demand in some segments.

4. How does global supply chain stability influence azathioprine availability?

Reliable raw material sourcing and manufacturing compliance are crucial. Disruptions due to geopolitical issues or raw material shortages can induce supply constraints, potentially leading to price increases.

5. Can azathioprine’s price decline in the future?

Yes. Continued market competition, patent expirations, and an expanding portfolio of safer, more targeted therapies could contribute to gradual price declines over the next decade.

References

[1] Grand View Research. (2023). Immunosuppressants Market Size, Share & Trends Analysis Report.

[2] GoodRx. (2023). Azathioprine Prices, Coupons, and Patient Assistance Programs.