Share This Page

Drug Price Trends for AVONEX

✉ Email this page to a colleague

Average Pharmacy Cost for AVONEX

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| AVONEX PEN 30 MCG/0.5 ML KIT (4 PACK) | 59627-0333-04 | 8406.93909 | EACH | 2025-12-17 |

| AVONEX 30 MCG/0.5 ML SYRINGE KIT (4 PACK) | 59627-0222-05 | 8399.40067 | EACH | 2025-12-17 |

| AVONEX PEN 30 MCG/0.5 ML KIT (4 PACK) | 59627-0333-04 | 8419.70000 | EACH | 2025-11-19 |

| AVONEX 30 MCG/0.5 ML SYRINGE KIT (4 PACK) | 59627-0222-05 | 8399.40067 | EACH | 2025-11-19 |

| AVONEX PEN 30 MCG/0.5 ML KIT (4 PACK) | 59627-0333-04 | 8421.86000 | EACH | 2025-10-22 |

| AVONEX 30 MCG/0.5 ML SYRINGE KIT (4 PACK) | 59627-0222-05 | 8397.38500 | EACH | 2025-10-22 |

| AVONEX 30 MCG/0.5 ML SYRINGE KIT (4 PACK) | 59627-0222-05 | 8383.76600 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for AVONEX (Interferon Beta-1a)

Introduction

AVONEX (interferon beta-1a) is a therapeutically critical drug in the treatment of multiple sclerosis (MS), approved by the FDA since 1996. As a cornerstone in disease-modifying therapies (DMTs), it has established a substantial presence in the neuroimmunology space. This analysis explores AVONEX's current market landscape, competitive positioning, pricing trends, and future price projections, offering strategic insights for stakeholders across pharmaceutical and healthcare investment sectors.

Market Landscape of AVONEX

Therapeutic Domain and Disease Burden

Multiple sclerosis affects approximately 2.8 million globally, with the United States accounting for roughly 1 million cases [1]. MS’s chronic, progressive nature necessitates long-term, continuous treatment, bolstering demand for established DMTs like AVONEX.

Competitive Positioning

AVONEX’s primary competitors include other interferon-based therapies (Betaseron/Extavia, Plegridy) and oral agents (Tecfidera, Aubagio, Gilenya). Despite the emergence of newer oral and infusion therapies, AVONEX maintains a significant market share due to its proven efficacy, extensive clinical data, and physician familiarity.

Market Share and Revenue Dynamics

As per IQVIA data, AVONEX generated approximately $1.3 billion globally in 2022, predominantly from North America (around 70%) [2]. While a gradual decline in market share has been observed due to competition, AVONEX's user base remains stable owing to its longstanding clinical track record.

Regulatory and Reimbursement Landscape

Reimbursement strategies and formulary inclusions influence AVONEX's market stability. Some payers favor newer oral agents for convenience, but AVONEX’s cost-effectiveness and demonstrated safety profile sustain its utilization in multiple health systems.

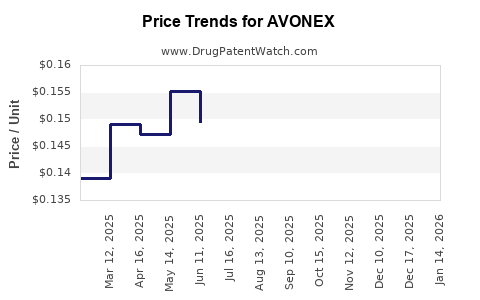

Price Trends and Historical Data

Pricing Overview

Historically, AVONEX’s price per dose has steadily increased, reflecting inflation, manufacturing costs, and reimbursement dynamics. According to the SSR Health 2022 report, the average wholesale price (AWP) for AVONEX is approximately $9,200 per 30 mcg injection [3].

Pricing Drivers

- Manufacturing Costs: Stabilized but influenced by biosimilar competition.

- Market Dynamics: Payer negotiations often cap the net price.

- Regulatory Changes: Potential impacts from biosimilar policies.

Biosimilar and Generic Competition

While biosimilars for interferon beta-1a are emerging primarily in Europe, U.S. approvals remain limited, with Biogen and other players exploring biosimilars [4]. The advent of biosimilars could accelerate price erosion, but market penetration remains gradual due to regulatory and patent strategies.

Future Price Projections

Factors Influencing Future Pricing

- Biosimilar Entry: Expected within the U.S. over 3-5 years could lead to 20-30% price reductions.

- Market Competition: Increased competition from oral DMTs influences pricing strategies, incentivizing manufacturers to maintain or slightly decrease prices.

- Pricing Trends in Other Markets: Europe and emerging economies witness substantial discounts compared to the U.S., influencing global pricing strategies.

- Reimbursement Policies: Payers increasingly favor cost-effective treatments; potential adjustments could impact AVONEX’s net prices.

Projected Price Trends (2023–2028)

Given current dynamics, a conservative forecast anticipates:

- Moderate Price Stabilization (2023–2025): Due to patent protections and limited biosimilar penetration, prices may slightly decline or stabilize within a 1-3% annual range.

- Gradual Price Erosion Post-Biosimilar Entry (2026–2028): Anticipated biosimilar presence could drive prices down by an additional 20-25%, especially if market share shifts significantly.

Scenario-Based Projections

| Scenario | Expected Price Change (2023–2028) | Key Drivers |

|---|---|---|

| Optimistic biosimilar penetration | 25-30% decrease | Increased biosimilar competition leading to significant price reductions |

| Moderate market retention | 5-10% decrease | Limited biosimilar adoption, sustained demand for originator |

| Accelerated price erosion | 30-40% decrease | Widespread biosimilar uptake, payer shifts favoring generics |

Strategic Implications

- Pricing Flexibility: Biogen may need to adjust pricing strategies to maintain market share amid biosimilar competition.

- Innovation and Line Extensions: Incorporating new formulations or administration methods could mitigate price pressure.

- Market Diversification: Targeting emerging markets with lower price points can sustain revenue streams.

Key Takeaways

- AVONEX remains a vital MS therapy with a stable yet gradually declining market share primarily due to biosimilar threats.

- Current price points are around $9,200 per dose, with anticipated slight decreases in the near term, intensifying after biosimilar entry.

- The future of AVONEX pricing depends heavily on biosimilar development timelines, regulatory policies, and market acceptance.

- Payers and healthcare providers prioritize cost-effective MS treatments, pressuring originator drug prices.

- Strategic adaptation involving biosimilar negotiations, pipeline innovation, and market segmentation will be critical for sustained profitability.

FAQs

1. How does AVONEX's pricing compare globally?

European markets often see significantly lower prices for AVONEX, sometimes up to 40% less than U.S. prices, due to different pricing regulations and reimbursement policies [5].

2. When are biosimilars for AVONEX expected to enter the U.S. market?

While biosimilars for interferon beta-1a are approved in other markets, U.S. approval timelines are uncertain, with projections suggesting biosimilars could launch within 3-5 years post-patent expiration [4].

3. What factors could prevent significant price erosion of AVONEX?

Limited biosimilar adoption, strong brand loyalty, clinical familiarity, and controlled reimbursement negotiations could delay sharp price declines.

4. How might emerging oral MS therapies affect AVONEX pricing?

Oral therapies like Tecfidera and Gilenya provide greater convenience, which could reduce the demand for injectable drugs, exerting downward pressure on AVONEX’s price and market share.

5. What strategies could Biogen employ to maintain AVONEX’s market value?

Investing in new formulations, expanding into underserved markets, engaging in biosimilar development, and emphasizing long-term clinical data are key strategies to sustain competitiveness.

References

[1] Multiple Sclerosis International Federation. "Atlas of MS 2022."

[2] IQVIA. "Global Trends in Multiple Sclerosis Treatment 2022."

[3] SSR Health. "Biogen Product Pricing & Revenue Data 2022."

[4] FDA. "Biosimilar Biological Product Applications," 2023.

[5] European Medicines Agency. "Pricing and Reimbursement Policies for MS Medications," 2022.

More… ↓