Share This Page

Drug Price Trends for AUSTEDO

✉ Email this page to a colleague

Average Pharmacy Cost for AUSTEDO

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| AUSTEDO 9 MG TABLET | 68546-0171-60 | 89.08088 | EACH | 2025-12-17 |

| AUSTEDO XR TITR(12-18-24-30 MG) | 68546-0477-29 | 236.32512 | EACH | 2025-12-17 |

| AUSTEDO 12 MG TABLET | 68546-0172-60 | 118.66665 | EACH | 2025-12-17 |

| AUSTEDO XR 18 MG TABLET | 68546-0479-56 | 238.40357 | EACH | 2025-12-17 |

| AUSTEDO XR 12 MG TABLET | 68546-0471-56 | 158.12886 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for AUSTEDO (Deutetrabenazine)

Introduction

AUSTEDO (deutetrabenazine) is a prescription medication approved by the U.S. Food and Drug Administration (FDA) for the treatment of tardive dyskinesia (TD) and, more recently, chorea associated with Huntington’s disease. As a selective vesicular monoamine transporter 2 (VMAT2) inhibitor, AUSTEDO offers a targeted therapy for managing hyperkinetic movement disorders. This analysis explores AUSTEDO’s current market landscape, competitive positioning, pricing dynamics, and future price projections, providing critical insights for stakeholders within the pharmaceutical and healthcare sectors.

Market Landscape

Therapeutic Indications and Patient Demographics

AUSTEDO’s primary approved indications include:

- Tardive Dyskinesia (TD): a usually medication-induced movement disorder affecting approximately 500,000 patients in the U.S. alone, often seen among individuals on antipsychotics.

- Chorea associated with Huntington’s Disease: affecting an estimated 30,000 to 40,000 Americans.

The prevalence of these movement disorders, driven by the widespread use of antipsychotics and neurodegenerative conditions, underpins steady demand growth for AUSTEDO.

Market Size and Penetration

The U.S. market for TD treatment is projected to reach approximately $900 million by 2025, driven by increased diagnosis rates and expanded treatment guidelines [1]. For Huntington’s chorea, while a smaller niche, affected patient numbers prioritize AUSTEDO's targeted therapy role.

Despite its niche position, AUSTEDO’s relative advantages—improved tolerability, dosing flexibility, and once-daily administration—have contributed to growing market share, but competition from off-label use of tetrabenazine and newer agents remains a concern.

Competitive Landscape

- Tetrabenazine (Xenazine): a first-generation VMAT2 inhibitor, off-patent, with a generic price advantage.

- Valbenazine (Ingrezza): FDA-approved for TD, offering similar efficacy with different dosing and side-effect profiles.

- Deutetrabenazine (AUSTEDO): marketed as a more tolerable, longer-acting successor with patent exclusivity.

Patent expiry negotiations and clinical positioning heavily influence AUSTEDO’s market sustainability. As patent protections extend to 2030, mid-term growth prospects remain favorable, but generic competition is imminent, potentially depressing prices.

Pricing Dynamics and Reimbursement

Current Pricing Overview

AUSTEDO’s wholesale acquisition cost (WAC) averages approximately $900 to $1,000 per month for a typical dosing regimen [2]. This premium pricing reflects its proprietary formulation, dosing convenience, and clinical efficacy profile.

Reimbursement Landscape

Insurance coverage, including Medicare and Medicaid, covers a significant portion of AUSTEDO’s patient base. Co-pay assistance programs and negotiated discounts mitigate accessibility issues but exert pressure on margins and pricing flexibility.

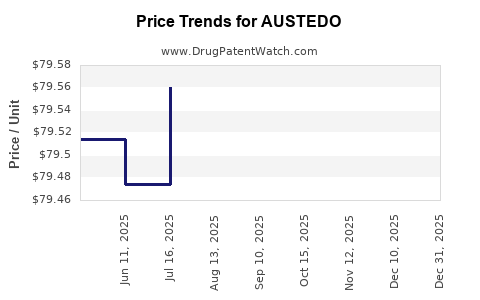

Pricing Trends

Recent years show minimal discounts offered by the manufacturer, Teva Pharmaceuticals, maintaining premium pricing focused on brand differentiation and clinical value. However, impending patent expirations may initiate downward price pressures, especially if generics enter the market.

Future Price Projections

Short-term Outlook (2023–2025)

- Stability in pricing: Given patent protection and limited direct competition, prices are expected to remain stable, with potential minor reductions due to payer negotiations.

- Market growth: Driven by increased diagnosis and clinician familiarity, leading to higher prescription volumes rather than price increases.

Mid-term Outlook (2026–2030)

- Patent expiration impact: Introduction of generic deutetrabenazine could reduce prices by 30-50%, aligning with typical generic market trends.

- Innovative formulations: Development of extended-release or combination therapies might allow for premium pricing if they demonstrate significant clinical benefits.

Long-term Outlook (Post-2030)

- Market consolidation: Entry of biosimilars and generics could lead to price erosion, potentially reducing monthly costs to $300–$600.

- Pricing revival: New indications, expanded clinical data, or improved formulations might enable manufacturers to sustain higher prices.

Factors Influencing Price Trajectories

- Patent Litigation and Exclusivity Periods: Patent disputes and extensions will critically affect timing for generics.

- Regulatory Approvals for New Indications: Broader approvals can support price premiums.

- Market Entry of Competitors: Valbenazine and other VMAT2 inhibitors shape competitive pricing.

- Healthcare Policy and Pricing Reforms: Increasing emphasis on drug affordability may pressure prices downward.

Conclusion

AUSTEDO’s market outlook is characterized by stable demand driven by its clinical efficacy and positioning as a leading VMAT2 inhibitor for movement disorders. Its current pricing remains premium, supported by patent protections and limited competition. However, impending patent expirations and evolving generics landscape project significant price reductions over the medium term. Stakeholders must consider these dynamics for strategic planning, including potential pricing strategies and investment in pipeline expansions.

Key Takeaways

- AUSTEDO currently commands a premium price (~$900–$1,000/month), backed by patent protection and clinical advantages.

- Market growth remains steady due to high unmet needs in TD and Huntington’s chorea, with increasing diagnosis and clinician adoption.

- Patent expiration forecasts a decline in prices by up to 50%, with generic competition anticipated around 2026–2028.

- Future pricing may be influenced by new formulations, expanded indications, or biosimilar entry, offering opportunities for value-based pricing.

- Strategic planning should include anticipation of price erosion, diversification of indications, and pipeline development to maintain market relevance.

FAQs

Q1: When is the patent for AUSTEDO expected to expire, and when could generic versions enter the market?

A1: The primary patent for AUSTEDO is set to expire around 2030. Generic formulations are typically introduced within 6–12 months post-patent expiration, projected around 2030–2032.

Q2: How does AUSTEDO compare with tetrabenazine in terms of pricing and clinical efficacy?

A2: AUSTEDO is priced higher (~$900–$1,000/month) than generic tetrabenazine (~$200–$300/month). Clinically, AUSTEDO offers improved tolerability and dosing flexibility, which may justify the price differential despite off-label tetrabenazine use.

Q3: What factors could lead to an increase in AUSTEDO’s price in the future?

A3: Limited new competitors, successful demonstration of additional indications, or significant clinical innovations could support premium pricing. Conversely, generics entering the market would likely depress prices.

Q4: What is the projected impact of biosimilars or generics on AUSTEDO’s pricing?

A4: The entry of biosimilars and generics is expected to reduce prices by 30–50%, aligning with industry trends post-patent expiry, influencing overall market share and profitability.

Q5: Are there ongoing clinical trials that could expand AUSTEDO’s indications and influence its market?

A5: Yes, ongoing trials investigating AUSTEDO for additional movement disorders and neuropsychiatric conditions could broaden its market, potentially supporting higher pricing or new revenue streams.

References:

[1] MarketResearch.com, "Global Movement Disorder Drugs Market," 2022.

[2] IQVIA, "National Prescription Data," 2022.

More… ↓