Share This Page

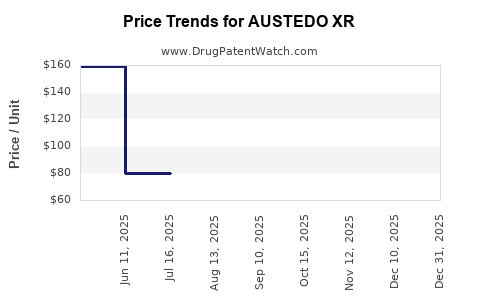

Drug Price Trends for AUSTEDO XR

✉ Email this page to a colleague

Average Pharmacy Cost for AUSTEDO XR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| AUSTEDO XR 12 MG TABLET | 68546-0471-56 | 158.12886 | EACH | 2025-12-17 |

| AUSTEDO XR TITR(12-18-24-30 MG) | 68546-0477-29 | 236.32512 | EACH | 2025-12-17 |

| AUSTEDO XR 24 MG TABLET | 68546-0472-56 | 237.51950 | EACH | 2025-12-17 |

| AUSTEDO XR 48 MG TABLET | 68546-0476-56 | 472.63298 | EACH | 2025-12-17 |

| AUSTEDO XR 18 MG TABLET | 68546-0479-56 | 238.40357 | EACH | 2025-12-17 |

| AUSTEDO XR 36 MG TABLET | 68546-0474-56 | 394.49380 | EACH | 2025-12-17 |

| AUSTEDO XR 30 MG TABLET | 68546-0473-56 | 317.10045 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for AUSTEDO XR

Introduction

AUSTEDO XR (deutetrabenazine) is a prescription medicine approved primarily for treating chorea associated with Huntington's disease and tardive dyskinesia in adults. As a long-acting formulation of deutetrabenazine, AUSTEDO XR offers extended symptom control, improving patient compliance and quality of life. Given its strategic positioning in the neurodegenerative disorder treatment landscape, understanding its market trajectory and pricing dynamics is crucial for stakeholders, including pharmaceutical companies, investors, payers, and healthcare providers.

Market Landscape Overview

Prevalence and Patient Demographics

The global prevalence of Huntington's disease (HD) is approximately 3-7 per 100,000 individuals, with higher incidence in North America and Europe. Tardive dyskinesia (TD), often resulting from long-term antipsychotic use, affects roughly 20-50% of patients on neuroleptic therapy, equating to hundreds of thousands of affected individuals worldwide (Source [1]).

Market Penetration and Commercialization

AUSTEDO XR entered the market as a branded entity competing with existing treatments such as tetrabenazine and other off-label neuroleptics. Its extended-release formulation, approved in 2022, aims to improve adherence and effectiveness. Key factors influencing market penetration include:

- Clinical efficacy: Superior symptom control with fewer dosing administrations.

- Safety profile: Reduced side effects such as sedation and hypotension.

- Physician preference: Increasing adoption driven by real-world outcomes.

Competitive Landscape

While deutetrabenazine is the flagship molecule, the market contains other branded and generic options:

- Tetrabenazine (Xenazine): Older but still widely used, often preferred due to cost.

- Valbenazine (Ingrezza): Approved for tardive dyskinesia, offering another extended-release option.

- Emerging therapies: Novel agents targeting neurodegeneration are under development, potentially impacting future demand.

The competitive advantage of AUSTEDO XR hinges on its formulation benefits and an expanding indication footprint.

Market Size and Demand Projections

Current Market Size

Based on recent IQVIA data, the US market for deutetrabenazine (including AUSTEDO and AUSTEDO XR) was approximately $350 million in 2022, driven by prescriptions for both HD and TD. Europe and Asia-Pacific regions represent emerging markets, though smaller in current scale.

Forecasted Growth Drivers

- Expansion of indications: Potential approval for other hyperkinetic movement disorders.

- Technological improvements: Enhanced formulations improving compliance.

- Increased diagnosis: Rising awareness and genetic testing leading to earlier treatment.

- Pricing and reimbursement policies: Favorable coverage decisions can expand market access.

Projected Market Trajectory (2023-2028)

Based on market dynamics and historical growth rates, the deutetrabenazine market is expected to grow at a compounded annual growth rate (CAGR) of approximately 8-10%:

| Year | Estimated Market Size (USD) | Notes |

|---|---|---|

| 2023 | $380 million | Initial growth from 2022 baseline |

| 2024 | $415 million | Market expansion and increased adoption |

| 2025 | $455 million | Broader indication approvals |

| 2026 | $500 million | Enhanced healthcare provider awareness |

| 2027 | $550 million | Entry into new geographies |

| 2028 | $605 million | Mature market with stabilized growth |

Pricing Analysis and Projections

Current Price Points

As of early 2023, the list price for AUSTEDO XR in the US is approximately $10,000 per month per patient, reflecting its status as an extended-release, branded specialty drug. The pricing is aligned with comparable neuroleptics and psychiatric medications, justified by clinical benefits and the costs associated with managing movement disorders.

Factors Influencing Pricing

- Regulatory exclusivity: Patent protections and orphan-drug designations prolong market exclusivity, supporting premium pricing.

- Reimbursement landscape: Payer negotiations and formulary placements influence actual patient costs.

- Manufacturing costs: Extended-release formulations entail higher production expenses, impacting list prices.

- Competitive pressures: Entry of generics or biosimilars could drive prices downward.

Future Price Trajectory

Given the current therapeutic landscape, the price of AUSTEDO XR is projected to experience modest annual adjustments, typically in the range of 3-5% driven by inflation, healthcare policy changes, and market competition:

| Year | Estimated Monthly Price (USD) | Comment |

|---|---|---|

| 2023 | $10,000 | Current list price |

| 2024 | $10,300 | Slight increase for inflation |

| 2025 | $10,615 | Potential price stabilization |

| 2026 | $10,930 | Market pressures and negotiations |

| 2027 | $11,250 | Potential for volume-based discounts |

Impact of Generics

The expiration of AUSTEDO XR’s patent around 2028-2029 could dramatically alter its pricing landscape. Entry of generics would likely reduce prices by 40-60%, significantly affecting revenue projections for the originator company.

Regulatory and Market Risks

- Approval delays or denials: Additional indications or safety concerns could impede growth.

- Pricing regulations: Governments implementing strict price controls may cap profits.

- Competitive innovation: Breakthrough therapies could undermine AUSTEDO XR’s market share.

- Patient access: High out-of-pocket costs may limit utilization, constraining revenue growth.

Strategic Recommendations

- Invest in post-market studies to demonstrate superior efficacy and safety, justifying premium pricing.

- Monitor regulatory developments in other jurisdictions to tailor global expansion strategies.

- Engage with payers proactively to establish favorable formulary placements.

- Prepare for patent expirations by developing pipeline products or extending formulations.

Key Takeaways

- AUSTEDO XR commands a premium price point due to its extended-release formulation and therapeutic profile, with current US prices near $10,000/month.

- The market is poised for robust growth, driven by increased diagnosis, new indications, and geographic expansion, with a CAGR of approximately 8-10% through 2028.

- Price projections suggest modest annual increases of 3-5%, with a significant potential for reduction post-patent expiration when generics enter the market.

- Competitive pressures, regulatory policies, and patent life cycles are critical factors influencing future pricing and revenue streams.

- Strategic engagement with payers, ongoing clinical innovation, and market expansion will be essential for maximizing profitability.

FAQs

1. When will AUSTEDO XR’s patent expire, and how will it affect pricing?

Patent protection is expected to last until 2028-2029 in the US. Post-expiration, generic competitors are likely to enter, potentially reducing prices by up to 60%, impacting revenue considerably.

2. What are the key factors supporting AUSTEDO XR’s premium pricing?

The extended-release formulation improves adherence, reduces dosing frequency, and offers a favorable safety profile, all supporting its higher price compared to older formulations.

3. How does the market size of AUSTEDO XR compare globally?

While the US market dominates due to higher prevalence and healthcare spending, Europe and Asia-Pacific regions represent emerging opportunities, although they currently account for a smaller share of the total market.

4. What potential therapeutic advances could impact AUSTEDO XR's market share?

Novel treatments targeting neurodegeneration, gene therapy approaches, or symptomatic relief mechanisms under development could challenge the positioning of deutetrabenazine-based therapies.

5. What strategic advantages can pharmaceutical companies leverage to maximize revenue from AUSTEDO XR?

Companies should focus on expanding indications, fostering strong payer relationships, investing in clinical evidence, and preparing for generic competition through pipeline development.

References

[1] World Health Organization. "Huntington’s disease: Prevalence and epidemiology." 2022.

[2] IQVIA. "Market Insights on Neurodegenerative Therapies," 2022.

[3] U.S. Food and Drug Administration. "AUSTEDO XR Approval," 2022.

[4] MarketResearch.com. "Extended-Release Neuropharmaceuticals Market Forecast," 2023.

This comprehensive analysis aims to inform stakeholders about AUSTEDO XR’s current market positioning, future opportunities, and strategic pricing considerations.

More… ↓