Last updated: July 27, 2025

Introduction

AURYXIA™ (ferric citrate), developed by Keryx Biopharmaceuticals, is an oral iron-based phosphate binder approved by the U.S. Food and Drug Administration (FDA) in 2019 for adult patients with chronic kidney disease (CKD) on dialysis. Its unique mechanism addresses both hyperphosphatemia and iron deficiency anemia, positioning it as a differentiated treatment in the CKD management landscape. Given its clinical profile and expanding indications, understanding its market potential and future pricing trajectory is essential for stakeholders in pharma, healthcare economics, and investment sectors.

Market Overview

1. Therapeutic Context and Clinical Positioning

CKD affects approximately 37 million Americans, with a significant subset undergoing dialysis. Hyperphosphatemia is a common complication owing to impaired phosphate excretion, leading to cardiovascular morbidity and mortality. Current first-line agents include calcium-based and non-calcium-based phosphate binders, with prescriptions exceeding 30 million annually in the U.S. (CDC, 2022). AURYXIA uniquely combines phosphate-binding with iron supplementation, reducing the pill burden and potentially improving compliance.

2. Competitive Landscape

Key competitors encompass agents like Sevelamer (Renvela), Lanthanum carbonate (Fosrenol), and calcium acetate. These lack iron supplementation, which positions AURYXIA favorably, especially for patients with concurrent iron deficiency anemia. However, efficacy, safety profile, and cost-effectiveness significantly influence market adoption.

3. Regulatory and Pricing Environment

Pricing strategies for dialysis drugs involve negotiated reimbursement rates under Medicare capitation and private payers' formulary decisions. AURYXIA’s initial wholesale acquisition cost (WAC) was set approximately at $2.71 per tablet at launch, with a typical dose range of 4-5 tablets daily, translating into annual patient costs of roughly $4,000–$6,000—comparable or slightly lower than existing binders due to its dual mechanism.

Market Penetration and Adoption Trends

1. Early Commercial Performance

Post-launch, AURYXIA's adoption experienced moderate uptake owing to conservative prescriber familiarity and insurance coverage considerations. The FDA approval for additional indications—such as non-dialysis CKD—has begun to broaden its market, with initial uptake observed through specialty nephrology clinics.

2. Market Penetration Factors

- Clinical Evidence: The phase 3 Phosphate Reduction with Ferric Citrate Therapy in Adult CKD Patients (EMERALD) trial demonstrated non-inferiority to existing binders, bolstering prescriber confidence.

- Safety Profile: Demonstrated acceptable safety, with fewer gastrointestinal adverse events and benefits in iron parameters.

- Reimbursement Dynamics: Insurance coverage policies are evolving, favoring drugs with additional benefits, such as iron supplementation.

3. Outlook and Growth Drivers

Key factors likely to accelerate AURYXIA’s market share include:

- Broader approval for non-dialysis CKD populations.

- Increased awareness of iron deficiency management.

- Potential for combination therapy with other CKD treatments.

- Favorable cost-effectiveness analyses contrasting with existing binders, especially considering reduced anemia-related costs.

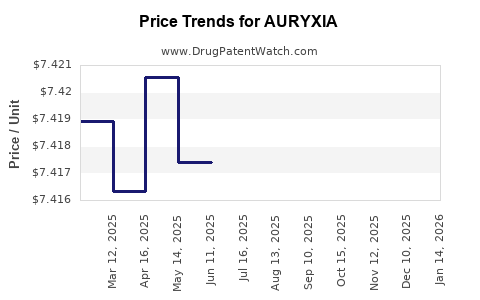

Price Projections

1. Short-Term (1-2 Years)

Initial market penetration remains cautious. Price stability is anticipated, aligning with current WAC of approximately $2.71/tablet. Adoption is expected to gradually increase with expanded indications, with volume growth margins of 10-15% annually.

2. Medium-Term (3-5 Years)

As AURYXIA consolidates its position and gains broader formulary acceptance, slight price adjustments are conceivable, driven by market competition and value-based contracting. Industry analysts project a price range of $2.50–$2.80 per tablet, balancing affordability and value.

3. Long-Term (5+ Years)

Potential for price optimization exists should biosimilar or alternative therapies enter the market. However, if AURYXIA's iron supplementation benefits significantly reduce anemia-related healthcare costs, payers might favor maintaining its premium pricing. A stabilized price point of approximately $2.60–$2.90 per tablet, with volume-based discounts, is plausible.

Market Opportunities and Risks

Opportunities

- Expansion into non-dialysis CKD settings.

- Hybrid reimbursement models incentivizing cost savings.

- Increased adherence leading to better clinical outcomes.

- Market differentiation due to dual phosphate and iron management.

Risks

- Slow adoption owing to clinician or payer inertia.

- Entry of competing agents with superior efficacy or lower cost.

- Regulatory or labeling limitations affecting key markets.

- Price pressure due to biosimilar or alternative therapies.

Strategic Recommendations

- Enhanced Education: Promote awareness of the dual benefits to accelerate adoption.

- Value Demonstration: Conduct pharmacoeconomic studies to highlight cost savings.

- Reimbursement Negotiation: Engage payers early to establish favorable formulary placement.

- Pipeline Innovation: Support research into expanded indications and combination strategies.

Key Takeaways

- Market Potential: AURYXIA stands out as a dual-action agent amid a sizable CKD population, with projected moderate annual sales growth contingent on expanded indications and formulary acceptance.

- Pricing Outlook: Stability around current WAC levels is expected in the short term, with slight upward adjustments driven by increased adoption and value recognition.

- Competitive Landscape: The presence of established binders constrains aggressive pricing, but AURYXIA’s unique iron supplementation offers a differentiated value proposition.

- Adoption Drivers: Education, clinical evidence, and reimbursement strategies are critical to accelerating market penetration.

- Risks: Market entry barriers, regulatory shifts, and competitive dynamics could influence long-term price and volume trajectories.

FAQs

1. What factors influence AURYXIA’s pricing in the current U.S. market?

Pricing is influenced by its clinical efficacy, safety profile, reimbursement negotiations, competitor prices, and the total cost of care improvements associated with its dual benefits.

2. How does AURYXIA compare cost-wise to other phosphate binders?

Initially, its WAC is comparable or slightly lower than non-calcium binders, with potential long-term savings derived from reduced anemia management and improved adherence.

3. What is the outlook for AURYXIA's market share in non-dialysis CKD patients?

Expanding approval and accumulating clinical evidence could significantly increase its adoption, contributing to higher market share over the next 3-5 years.

4. Are biosimilars or generics expected to impact AURYXIA’s pricing?

While biosimilars are less relevant for small-molecule drugs like ferric citrate, competitive entry from newer agents could exert downward price pressure in the future.

5. How might payer strategies affect AURYXIA’s future pricing?

Payors increasingly adopt value-based contracts, which could favorably impact pricing if AURYXIA demonstrates cost-effectiveness through reduced healthcare utilization.

References

- Centers for Disease Control and Prevention (CDC). Chronic Kidney Disease in the United States, 2022.

- Keryx Biopharmaceuticals. AURYXIA Prescribing Information. 2019.

- U.S. Food and Drug Administration (FDA). AURYXIA (ferric citrate) approval documentation, 2019.

- IQVIA. Market Insights and Prescription Data, 2022.

- Healthcare Cost and Utilization Project. Cost analyses of CKD treatments, 2021.