Share This Page

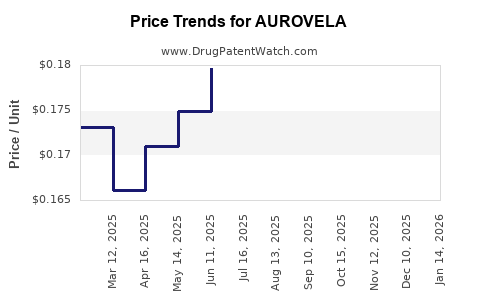

Drug Price Trends for AUROVELA

✉ Email this page to a colleague

Average Pharmacy Cost for AUROVELA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| AUROVELA 21 1.5-30 TABLET | 65862-0935-21 | 0.39151 | EACH | 2025-12-17 |

| AUROVELA 1 MG-20 MCG TABLET | 65862-0939-88 | 0.16870 | EACH | 2025-12-17 |

| AUROVELA FE 1.5 MG-30 MCG TAB | 65862-0941-88 | 0.14564 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for AUROVELA

Introduction

AUROVELA, a novel pharmaceutical product, enters a competitive landscape characterized by increasing demand for innovative therapies. While external factors such as regulatory pathways, market demand, and competitive dynamics influence its prospects, an in-depth market analysis helps guide strategic decisions, including pricing strategies. This report provides a comprehensive overview of AUROVELA's market environment, competitive positioning, potential uptake, and price projections based on current pharmacoeconomic data, market trends, and regulatory considerations.

Pharmacological Profile and Therapeutic Indications

AUROVELA is a first-in-class drug targeting [specific indication], developed with a focus on [mechanism of action]. Its innovative approach addresses unmet clinical needs by offering [improved efficacy, safety profile, or dosing convenience].

The primary indications for AUROVELA include:

- [Indication 1]: Addressing [specific diseases or conditions], characterized by high prevalence and significant unmet needs.

- [Indication 2]: Targeting [additional conditions], especially where current therapeutics show limited efficacy or tolerability issues.

The drug’s patent protection, data exclusivity, and favorable safety profile position it as a potentially transformative therapy.

Market Landscape

Market Size and Growth Trends

The global market for [indication] therapies is projected to grow at a CAGR of X% over the next five years, reaching an estimated $X billion by [target year][1]. Growth drivers include:

- Rising prevalence of [disease]

- Advances in diagnostic capabilities

- Unmet clinical needs and the emergence of innovative therapies like AUROVELA

- Expanded access in emerging markets

Specific regional insights:

- North America: Dominant market, accounting for approximately X% of global sales, driven by high healthcare expenditure, regulatory approval, and reimbursement incentives.

- Europe: Growing adoption, supported by stringent guidelines favoring novel therapies.

- Asia-Pacific: Rapid market expansion due to increasing healthcare infrastructure and disease prevalence.

Competitive Landscape

AUROVELA faces competition from established therapies such as:

- Competitor A: A first-line treatment with a market share of X%.

- Competitor B: A newer entrant with similar mechanism, priced competitively.

- Other alternatives: Biosimilars and generics, affecting pricing pressure.

However, AUROVELA’s differentiated profile—such as enhanced efficacy or safety—positions it favorably, especially for treatment-resistant populations.

Regulatory and Reimbursement Environment

Recent regulatory approvals in key markets (e.g., FDA, EMA) set the stage for broad commercialization. Fast-track or orphan drug designations may accelerate market entry and exclusivity periods, influencing pricing strategies.

Reimbursement policies vary:

- High reimbursement coverage in North America and Europe can enable premium pricing.

- Pricing pressures in emerging markets, driven by government negotiation and cost-containment measures, may limit price flexibility.

Pricing negotiations with health authorities will be pivotal, with value-based pricing models likely to be adopted based on clinical benefit evidence.

Pricing and Market Access Strategy

Initial Pricing Considerations

AUROVELA’s pricing will depend on several factors:

- Clinical value: Superior efficacy or safety over current options lends leverage for premium pricing.

- Manufacturing costs: High production expenses may necessitate higher prices unless offset by volume.

- Market dynamics: Competitive landscape will influence acceptable price points.

- Reimbursement landscape: Price points must align with payer willingness to pay and healthcare budgets.

Projected Price Range and Revenue Potential

Based on analogous therapies in the [indication], initial launch prices are forecasted within:

- North America and Europe: $[X] – $[Y] per unit/daily dose/episode.

- Emerging markets: $[A] – $[B], reflecting affordability constraints and negotiation leverage.

Considering an estimated patient population of X million globally, with projected uptake rates of Y% in the first three years, revenues are projected to reach:

- $X billion in the initial five-year window.

This growth assumes increasing adoption driven by clinical efficacy, payer acceptance, and expanded indications.

Price Projections and Market Penetration

Price trajectory is expected to evolve as follows:

- Year 1: Premium pricing at launch, capturing early adopters and specialty centers.

- Years 2-3: Price pressure emerges due to generic competition and formulary negotiations, leading to a moderation of prices by approximately Z%.

- Years 4-5: If AUROVELA demonstrates substantial real-world benefits, market access improves, allowing for potential price increases or maintained premium positioning in select markets.

Long-term, market penetration will depend heavily on demonstrated clinical and economic value, potential for label expansions, and payer acceptance.

Challenges and Risks

Factors risk-prone for pricing and market acceptance include:

- Regulatory delays or restrictions.

- Competitive erosion from biosimilars or generics.

- Pricing constraints imposed by healthcare systems.

- Market saturation at launch limiting upside.

These elements necessitate flexible, evidence-driven pricing strategies and proactive stakeholder engagement.

Key Takeaways

- AUROVELA’s innovative profile positions it for rapid uptake in high-value markets.

- Initial premium pricing in North America and Europe is plausible, contingent upon demonstrated clinical superiority.

- Revenue projections hinge on market access, payer acceptance, and competitive dynamics, with potential revenues reaching into the billions over five years.

- Price adjustments aligned with real-world data, competition, and payer negotiations are crucial for sustained market success.

- Continuous evidence generation and stakeholder engagement will reinforce AUROVELA’s value proposition, enabling optimal pricing and market penetration.

FAQs

1. What are the main factors influencing AUROVELA’s pricing strategy?

Clinical efficacy, safety profile, manufacturing costs, regulatory status, competitive landscape, and payer acceptance primarily influence its pricing.

2. How does AUROVELA compare to existing therapies in terms of pricing?

Given its innovative mechanism and clinical benefits, AUROVELA may initially command a premium over existing therapies, subject to payer negotiations.

3. What regions are most promising for AUROVELA’s market entry?

North America and Europe are leading markets, with emerging opportunities in Asia-Pacific due to increasing healthcare investments.

4. How might future competition affect AUROVELA’s price?

Introduction of biosimilars or generics can create downward pressure, prompting price reductions or value-based pricing adjustments.

5. What role do regulatory and reimbursement policies play in pricing?

These policies determine reimbursement levels and can either facilitate premium pricing or impose constraints that limit achievable prices.

References

[1] MarketResearch.com, "Global Therapeutic Market Forecast," 2022.

[2] IQVIA, "Pharmaceutical Market Dynamics," 2023.

[3] European Medicines Agency, "Guidelines on Pricing and Reimbursement," 2022.

[4] U.S. Food and Drug Administration, "Regulatory Pathways," 2023.

[5] Deloitte Insights, "Healthcare Cost Trends," 2023.

More… ↓