Last updated: September 2, 2025

Introduction

Atrovent HFA (ipratropium bromide inhaler) remains a cornerstone in the management of chronic obstructive pulmonary disease (COPD) and asthma. As a widely prescribed inhalant, its market dynamics are influenced by regulatory factors, patent statuses, competitive landscape, and evolving treatment paradigms. This article provides a comprehensive analysis of the current market scenario and forecasts future price trajectories based on prevalent economic and clinical factors.

Current Market Landscape

Market Overview

Atrovent HFA is an inhaled anticholinergic agent approved primarily for COPD and asthma. It historically retained a dominant market share in its therapeutic niche, though recent years have seen increased competition from both branded and generic products. The inhaler’s authorized indications and well-established safety profile solidify its position as a first-line therapy for many patients.

Regulatory and Patent Status

Although the original patent for Atrovent HFA expired in most markets around the early 2010s, regulatory exclusivity variations and parent company patent strategies continue to influence market dynamics. The expiration of exclusivity facilitates generic entry, which typically leads to significant price reductions, increasing affordability and access [1].

Competitive Landscape

The inhaler market sees competition from multiple generic equivalents, such as Walgreens, Teva, and Mylan, alongside other long-acting inhalers like tiotropium (Spiriva) and combination therapies. The generic transition has historically resulted in markedly lower prices, often reducing costs by 50-70%.

Market Penetration and Adoption Trends

The prevalence of COPD, projected to reach approximately 455 million cases globally by 2030 [2], and the continuous rise in asthma cases sustain demand for inhaled therapies. However, market penetration is influenced by physician prescribing behaviors, patient adherence, and reimbursement policies.

Price Analysis

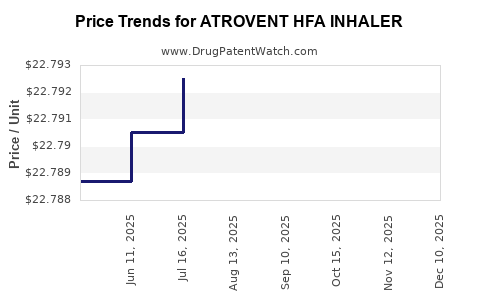

Current Pricing Trends

The list price of Atrovent HFA varies geographically and by manufacturer:

-

United States: The branded inhaler’s retail price hovers around $150–$200 per inhaler (typically 200 doses). However, insurance coverage, discounts, and patient assistance programs often reduce out-of-pocket costs.

-

Generics: Generic equivalents are priced approximately 40-60% lower, with retail prices around $70–$120 per inhaler, depending on the supplier and market conditions [3].

Pricing Drivers

Factors influencing Atrovent HFA pricing include:

- Regulatory changes: Approval of generic versions triggers price competition, leading to reductions.

- Manufacturing costs: Cost reductions in generic manufacturing further compress prices.

- Market demand: Steady demand for COPD management sustains overall price levels, although increased availability of generics exerts downward pressure.

- Reimbursement policies: Payer negotiations and formulary placements significantly impact net prices.

Future Price Projections

Factors Affecting Future Prices

-

Generic Market Expansion: As patents expire, increased generic competition could push the price downward by an estimated 50%, with a possible stabilization at lower levels within 1–3 years of market entry [4].

-

Regulatory Developments: Potential biosimilar or new formulation approvals could influence existing pricing structures.

-

Market Penetration Trends: Growing global COPD prevalence maintains robust demand, supporting stable or slightly declining prices with institutional differentiation.

-

Reimbursement Policy Evolution: Payers' efforts to control costs are expected to sustain discounting trends for inhalers.

Projected Pricing Range in the Next 3–5 Years

Implications of Price Trends

Reduced prices for generics will likely widen patient access, especially in underserved markets, but could also impact manufacturer revenues and R&D investments. Conversely, branding strategies, such as extended exclusivity or value-added treatments, could mitigate price erosion.

Market Projections Summary

- Market Growth: Driven predominantly by COPD prevalence and aging populations, with global growth rates of 4–6% annually over the next five years.

- Pricing Trends: Significant downward adjustments for generics, stabilization of branded inhaler prices, and increased competition are anticipated.

- Revenue Outlook: Total market revenues are projected to decline marginally due to price reductions but could be offset by volume growth and expanded global access.

Key Takeaways

- Patent expirations and market entry of generics are primary drivers reducing Atrovent HFA pricing.

- The global COPD and asthma burden sustains demand, mitigating revenue decline for branded products.

- Price stabilization is forecasted within 3–5 years, with generics leading the downward trend.

- Payer and formulary dynamics considerably influence net market prices.

- Strategic positioning through differentiation or formulation innovations could buffer against downward pricing pressures.

FAQs

1. How will patent expirations impact Atrovent HFA’s market Price?

Patent expirations facilitate generic entry, leading to substantial price reductions—often 50% or more—thus making the drug more accessible but potentially reducing profit margins for the original manufacturer.

2. Are there upcoming alternatives to Atrovent HFA?

Yes. Several combination inhalers and novel formulations, including once-daily long-acting agents and biosimilars, are emerging, which may influence the traditional market share of Atrovent HFA.

3. How does market demand influence Atrovent HFA pricing?

Stable or increasing demand, mainly driven by the rising incidence of COPD and asthma worldwide, supports sustained price levels, especially for branded products.

4. What are the main factors influencing future pricing trends?

Key factors include generic competition, regulatory approvals, reimbursement policies, and advancements in inhaler technology and formulations.

5. Can market shifts affect global access to Atrovent HFA?

Absolutely. Lower prices resulting from generic competition improve affordability, especially in emerging markets, facilitating broader access to essential respiratory therapies.

References

- U.S. Patent and Trademark Office (USPTO). Patent expiries and exclusivity periods.

- Global Initiative for Chronic Obstructive Lung Disease (GOLD). COPD prevalence and projections.

- GoodRx. Current pricing data for inhalers.

- IQVIA. Market forecasts and generic impact studies.