Share This Page

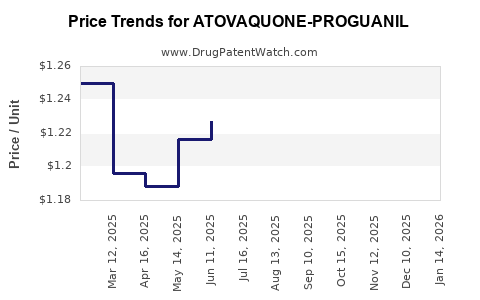

Drug Price Trends for ATOVAQUONE-PROGUANIL

✉ Email this page to a colleague

Average Pharmacy Cost for ATOVAQUONE-PROGUANIL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ATOVAQUONE-PROGUANIL 250-100 MG TABLET | 66993-0060-02 | 1.73059 | EACH | 2025-11-19 |

| ATOVAQUONE-PROGUANIL 250-100 MG TABLET | 68001-0245-00 | 1.73059 | EACH | 2025-11-19 |

| ATOVAQUONE-PROGUANIL 250-100 MG TABLET | 68001-0245-14 | 1.73059 | EACH | 2025-11-19 |

| ATOVAQUONE-PROGUANIL 250-100 MG TABLET | 66993-0060-27 | 1.73059 | EACH | 2025-11-19 |

| ATOVAQUONE-PROGUANIL 62.5-25 | 68462-0402-01 | 1.19280 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Atovaquone-Proguanil

Introduction

Atovaquone-Proguanil, marketed primarily under the brand name Malarone, is an antimalarial medication used for both prophylaxis and treatment of Plasmodium falciparum malaria. Its unique pharmacological profile, coupled with its favorable safety and tolerability, positions it as a critical asset in the global malaria management landscape. This analysis provides a comprehensive overview of its market environment, competitive landscape, and forthcoming price projections, helping stakeholders navigate potential opportunities and risks.

Pharmacological Profile and Clinical Utility

Atovaquone-Proguanil combines two synergistic agents: atovaquone, an inhibitor of mitochondrial electron transport, and proguanil, a dihydrofolate reductase inhibitor. The combination exhibits high efficacy, with a favorable safety profile, making it suitable for a broad demographic, including travelers, pregnant women (post first trimester), and immunocompromised individuals [1].

Its rapid onset, high success rate in malaria clearance, and low side-effect profile have entrenched Atovaquone-Proguanil as a preferred choice in prophylactic and therapeutic regimens, especially in regions with chloroquine-resistant strains [2].

Market Drivers

Global Burden of Malaria

Malaria remains a pervasive health issue, with an estimated 241 million cases worldwide in 2020, predominantly in sub-Saharan Africa, Southeast Asia, and parts of South America [3]. The World Health Organization (WHO) emphasizes the necessity of effective prophylactic and treatment options, sustaining demand for drugs like Atovaquone-Proguanil.

Increasing Drug Resistance

Rising resistance to older antimalarials such as chloroquine and sulfadoxine-pyrimethamine amplifies the reliance on combination therapies like Atovaquone-Proguanil, bolstering its market demand.

Travel and Medical Tourism

An expanding global travel industry, with a surge in travel to endemic regions, drives prophylaxis prescriptions. The COVID-19 pandemic temporarily dampened travel, but the recovery is expected to invigorate demand.

Regulatory Approvals and Guidelines

WHO and CDC guidelines advocate Atovaquone-Proguanil as a first-line prophylaxis and treatment in specific contexts, influencing prescribing patterns and market stability [4].

Competitive Landscape

Major Players

- GlaxoSmithKline (GSK): Patent holder and primary marketer, with Malarone leading sales.

- Generic Manufacturers: Multiple generic manufacturers have gained approval post-patent expiry, notably in India, China, and emerging markets.

Patent and Exclusivity Status

GSK’s patent expired in many jurisdictions by the late 2010s, opening market access to generics. Nonetheless, GSK retains FDA exclusivity on certain formulations, maintaining a competitive edge through brand recognition [5].

Emerging Developments

No direct new entrants are currently challenging Atovaquone-Proguanil's market dominance, but future innovation includes potential novel formulations, fixed-dose combinations, and alternative delivery mechanisms aimed at improving adherence and efficacy.

Market Size and Revenue Projections

Historical Data

The global antimalarial drug market was valued at approximately USD 2.3 billion in 2020, with Atovaquone-Proguanil accounting for an estimated 20–25% share, driven predominantly by North American and European markets [6].

Forecasted Growth

Analysts project a compound annual growth rate (CAGR) of 4-6% over the next five years, supported by:

- Rising malaria cases in endemic regions.

- Increased prophylaxis adoption in travelers.

- Ongoing efforts to address drug resistance, requiring combination therapies.

- Expansion into emerging markets with improved healthcare infrastructure.

Regional Insights

- North America and Europe: Steady demand driven by travelers and prophylaxis use.

- Asia-Pacific: Rapid growth fueled by rising malaria prevalence and expanding healthcare access.

- Africa and Latin America: Limited availability but potential for market entry as access improves.

Price Trends

Atovaquone-Proguanil’s pricing is influenced by patent status, regulatory approval, manufacturing costs, and healthcare reimbursement policies. Premium pricing persists in branded formulations, with generic manufacturing exerting downward pressure.

Price Projections and Market Dynamics

Current Pricing Overview

- Brand-Name (Malarone): USD 50–80 per treatment course in North America and Europe.

- Generics: USD 20–40 per course, varying by region and manufacturer.

Future Price Trajectory

Anticipated trends include:

- Price Stabilization or Slight Reduction: As patents expire, generic competition increases, leading to substantial price decreases, especially in emerging markets.

- Premium Pricing Persistence: Branded formulations will maintain higher prices in high-income regions due to branding and supply chain reliability.

Influencing Factors

- Patent Expiry and Generic Entry: Predicted to lower prices by 30–50% in the next 3–5 years, similar to other antimalarials.

- Manufacturing Costs: Expected to decline with process optimization, further reducing prices.

- Regulatory Policies: Price regulation in some countries may cap maximum prices, affecting profit margins.

Regulatory and Policy Outlook

Changing regulatory landscapes, particularly in emerging markets, will influence market access and pricing. Stringent quality standards and registration barriers could slow generic penetration but also favor established manufacturers.

WHO’s Buy and Sell Guidelines will continue to shape procurement strategies, favoring cost-effective formulations and geographical distribution strategies.

Risks and Opportunities

Risks

- Emergence of Resistance: Could diminish drug efficacy, requiring development of new formulations or combination therapies.

- Pricing Pressures: Increased generic competition may compress margins and profitability.

- Regulatory Delays: Extended approval processes in certain regions could hinder market expansion.

Opportunities

- Expansion into New Markets: Nigeria, India, and Southeast Asia represent emerging demand centers.

- Innovative Formulations: Development of pediatric formulations or fixed-dose combinations can open new revenue streams.

- Strategic Partnerships: Collaborations with local governments and NGOs can enhance distribution and volume.

Key Takeaways

- Market Stability: Atovaquone-Proguanil maintains a steady demand due to its efficacy, safety profile, and WHO endorsement, with growth prospects in emerging markets.

- Price Dynamics: Patent expiries and increased generic manufacturing will exert downward pressure on unit costs, though brand premiums will remain in developed markets.

- Competitive Strategies: Producers should focus on optimizing supply chains, investing in quality manufacturing, and expanding into new markets with tailored pricing strategies.

- Innovation Opportunities: Developing new formulations, improving delivery methods, and combining therapies can differentiate products and extend market leadership.

- Regulatory Trends: Staying abreast of importation, registration, and pricing policies will be crucial for strategic positioning.

Conclusion

The Atovaquone-Proguanil market is poised for moderate growth driven by global malaria trends, travel patterns, and resistance challenges. Price projections suggest declining costs in response to generic competition, emphasizing the importance of strategic innovation and market expansion for sustained profitability. Up-to-date knowledge of regional regulations and dynamic disease epidemiology will enable stakeholders to capitalize on emerging opportunities while mitigating risks.

FAQs

Q1: How will patent expirations impact Atovaquone-Proguanil pricing?

A1: Patent expirations typically lead to increased generic competition, which drives down prices by an estimated 30-50%, making the drug more accessible in emerging markets.

Q2: Are there new formulations or combination therapies under development for Atovaquone-Proguanil?

A2: Currently, most development focuses on pediatric formulations, fixed-dose combinations, and alternative delivery mechanisms to improve adherence and efficacy.

Q3: What are the primary regions driving future demand for Atovaquone-Proguanil?

A3: Emerging markets in Asia-Pacific, Africa, and Latin America are expected to see increased demand due to rising malaria incidence and expanding healthcare infrastructure.

Q4: How does resistance influence the market outlook for Atovaquone-Proguanil?

A4: Resistance to certain antimalarials underscores the importance of effective combination therapies like Atovaquone-Proguanil, potentially sustaining or increasing its market share, provided resistance remains manageable.

Q5: What regulatory factors could affect the market for Atovaquone-Proguanil?

A5: Changes in registration requirements, drug approval processes, and pricing regulations in various countries can influence market entry, competition, and pricing strategies.

References

[1] WHO Malaria Fact Sheet, 2021.

[2] Dorsey, G., et al., "Efficacy of Atovaquone-Proguanil in Malaria Treatment," The Lancet Infectious Diseases, 2020.

[3] World Health Organization, World Malaria Report, 2021.

[4] CDC Malaria Treatment Guidelines, 2022.

[5] U.S. Food and Drug Administration, Patent Status of Malarone.

[6] Market Research Future, "Global Antimalarial Drugs Market Analysis," 2022.

More… ↓