Last updated: September 17, 2025

Introduction

Atorvastatin, a widely prescribed statin for hyperlipidemia and cardiovascular disease prevention, continues to dominate the global lipid-lowering therapy market. Developed by Pfizer and introduced as Lipitor in 1997, its patent expiration in 2011 paved the way for a surge of generic versions, transforming its market dynamics. This comprehensive analysis examines current market trends, competition, regulatory influences, and future pricing trajectories for atorvastatin, guiding stakeholders in strategic decision-making.

Market Landscape and Size

Global Market Overview

The global atorvastatin market was valued approximately at USD 10 billion in 2022, with projections indicating a compound annual growth rate (CAGR) of 3.5% through 2030[1]. The widespread adoption of statins for primary and secondary prevention of cardiovascular events sustains high demand, particularly in North America and Europe, accounting for about 60% of the market share, driven by aging populations and increased cardiovascular risk awareness.

Generic Entrance and Market Penetration

Following patent expiry, generic atorvastatin flooded markets, dramatically reducing drug prices and expanding access. Generic formulations now are dominant, especially in emerging economies where pricing sensitivity is higher. As of 2023, generic versions hold approximately 85% of the market share globally, emphasizing affordability over brand loyalty[2].

Market Drivers

- Cardiovascular Disease Burden: The persistent rise in cardiovascular disease (CVD) incidence globally sustains demand, with over 18 million deaths attributed to CVD annually[3].

- Clinical Guidelines: Updated treatment guidelines advocating early lipid management bolster atorvastatin prescriptions.

- Cost-Effectiveness: Favorable cost profiles of generic formulations enhance patient compliance.

- Expanding Indications: Emerging evidence supports use in diverse populations, further expanding eligible patients.

Market Challenges

- Price Competition: Entry of multiple generics has precipitated aggressive price erosion.

- Regulatory and Patent Landscape: Patent litigations and regulatory barriers sometimes influence market access.

- Alternative Lipid-Lowering Agents: Growing prominence of PCSK9 inhibitors and other novel agents pose competitive threats, particularly for high-risk patients.

Competitive Landscape

Post-patent, the atorvastatin market fragmentation intensified. Leading generic manufacturers include Teva, Mylan (now part of Viatris), and Sandoz, which offer bioequivalent products at markedly lower costs. Patent litigations and authorized generics have further influenced pricing strategies, with brand manufacturers later launching "authorized generics" or reformulations to retain market share.

Pricing Dynamics

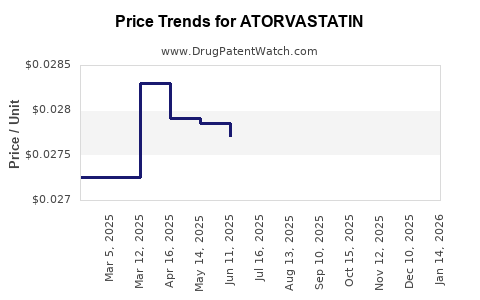

Historical Trends

- Pre-Patent Expiry: Brand-name Lipitor commanded prices upwards of USD 200 per month.

- Post-Patent: Generic pricing plummeted to USD 10–20 per month, a reduction of over 90% (see Table 1).

- Current Prices: In mature markets like the US, average costs for generics hover around USD 10–15 per month[4].

Factors Influencing Future Prices

- Market Saturation: With most prescriptions being generically supplied, further price reductions may plateau.

- Regulatory Policies: Policies promoting biosimilars and generics can lead to additional discounts.

- Volume Growth: High volume offsets per-unit price decreases, sustaining revenue streams for manufacturers.

- New Entrants and Price Competition: Continuous entry of low-cost generics keeps prices at historically low levels.

Future Price Projections

Given current parameters, at least a 10–20% price decline is expected over the next five years, primarily driven by heightened competition and healthcare policies targeting drug affordability. In emerging markets, prices could stabilize or slightly decline further due to increased market penetration and local manufacturing.

- In Developed Markets (US/Europe): Average generic prices are projected to stabilize around USD 8–12 per month by 2028, considering inflation and regulatory cost pressures.

- In Emerging Markets: Prices could decline from USD 5–10 to USD 3–8, depending on local policies and market dynamics.

Regulatory and Policy Impact

Regulatory agencies such as the FDA and EMA play a pivotal role by streamlining generic approval processes, which, in turn, facilitate price reductions. The increasing acceptance of biosimilars for biologic lipid-lowering therapies could influence perceptions around cost and safety, indirectly affecting atorvastatin's market price.

Government initiatives in cost containment, including price caps and reimbursement policies, will be central to shaping future prices. Countries like Canada and Australia have implemented strict price negotiation strategies, which likely will influence global trends.

Market Outlook Summary

While the volume of atorvastatin prescriptions remains robust, especially due to its established safety profile, the price landscape faces downward pressure. Price decreases are expected to plateau as the market reaches saturation, but the overall revenue generated from high-volume generics remains substantial for manufacturers.

Key Takeaways

- The atorvastatin market is highly saturated with generics, leading to significant price reductions post-2011 patent expiry.

- In mature markets, prices for generic atorvastatin are projected to decline modestly by 10–20% over the next five years.

- Emerging economies will likely experience continued price decreases following increased local production and policy reforms, expanding access.

- The segment's outlook remains stable due to high clinical demand, though it faces on-going competition from novel lipid-lowering agents.

- Policy-driven reforms and potential biosimilar entries could exert additional downward pressure on pricing in the future.

FAQs

1. How has the patent expiry of Lipitor influenced the global atorvastatin market?

Patent expiry in 2011 triggered a surge of generic atorvastatin offerings, drastically reducing prices and expanding access worldwide. It shifted market share from brand-name Lipitor to a multitude of generics, intensifying price competition and lowering profit margins for manufacturers.

2. What are the key factors affecting atorvastatin pricing in the next decade?

Major factors include market saturation, regulatory policies promoting generics and biosimilars, competitive entry, healthcare reimbursement strategies, and advances in alternative therapies like PCSK9 inhibitors.

3. How do emerging markets impact the global atorvastatin price landscape?

Emerging markets, characterized by increased local production and evolving policies, witness continued downward price trends, improving affordability and expanding treatment coverage.

4. Are there upcoming threats that could disrupt current pricing trends?

Yes, the development and adoption of more potent biologic agents and novel lipid-lowering therapies may shift prescribing patterns, potentially reducing atorvastatin's market share and influencing prices.

5. What strategies can manufacturers adopt to remain competitive?

Manufacturers should focus on cost-efficient production, diversify portfolios with value-added formulations, engage in strategic partnerships, and adapt to regional regulatory environments to sustain margins amidst price pressures.

References

[1] MarketWatch. “Global Lipid-Lowering Drugs Market Analysis, 2022-2030.”

[2] IQVIA, “Global Pharmaceutical Market Trends, 2023.”

[3] World Health Organization. “Cardiovascular Diseases (CVDs).”

[4] GoodRx. “Atorvastatin Price Trends and Variations.”