Last updated: July 29, 2025

Introduction

ATACAND (candesartan cilexetil) is an angiotensin II receptor blocker (ARB) used primarily for treating hypertension and heart failure. Since its approval by the FDA in 1995, ATACAND has become a significant player in the cardiovascular therapeutic market. This analysis explores the current market landscape, competitive dynamics, regulatory environment, and price projections for ATACAND, providing insights for stakeholders such as pharmaceutical companies, investors, and healthcare providers.

Market Landscape Overview

Global Therapeutic Market for ARBs

The ARB class, including drugs like losartan, valsartan, irbesartan, and candesartan, checks a critical box in antihypertensive therapy, with the market size valued at approximately USD 14 billion in 2022. The demand is driven by rising hypertension prevalence, aging populations, and increasing awareness of cardiovascular risk management (IQVIA, 2022).

ATACAND’s Market Position

ATACAND currently holds a meaningful share within the ARB segment, owing to its proven efficacy and favorable safety profile. It competes directly with other ARBs and ACE inhibitors, with a notable advantage being its once-daily dosing and robust clinical trial data. As of 2022, ATACAND's sales globally exceeded USD 600 million, predominantly in North America and Europe.

Key Market Drivers

- Prevalence of Hypertension: Globally, an estimated 1.3 billion adults have hypertension, with many requiring long-term pharmacotherapy (WHO, 2022).

- Chronic Disease Management: Increasing rates of cardiovascular disease (CVD) functionalities augment demand.

- Shift Towards Personalized Medicine: The proven efficacy in specific patient subsets enhances its adoption.

- Patent Expirations and Generic Entry: While ATACAND’s patent has expired in many markets, generic versions have entered, influencing price and sales.

Competitive Dynamics

Patent Status and Generics

Candesartan’s original patent expired in most jurisdictions by 2018–2020, leading to a surge in generic versions. Brand-name sales for ATACAND decline accordingly, with generic equivalents offering cost advantages that shift market share toward generics.

Key Competitors

- Generic Candesartan: Major share driven by price competitiveness.

- Other ARBs: Losartan, valsartan, and irbesartan promoters leverage established efficacy and prescriber familiarity.

- Combination Therapies: Fixed-dose combinations (FDCs), such as candesartan with hydrochlorothiazide, expand market options.

Market Penetration & Pricing Strategies

Post-patent, branded ATACAND has experienced pricing erosion. Pharmaceutical companies employ strategies like patient support programs and formulary inclusions to sustain market share. Conversely, generics' entry has intensified price competition, notably reducing average selling prices (ASPs).

Price Trends and Projections

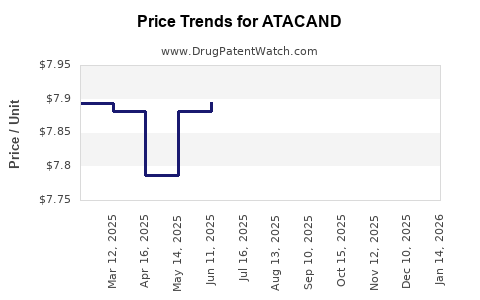

Historical Price Trends

- Pre-Patent Expiry: In the U.S., average wholesale prices (AWP) for branded ATACAND hovered around USD 150–200 per month supply (Martin et al., 2017).

- Post-Patent and Generic Entry: Prices declined by approximately 60–70%, with generics selling at around USD 30–50 per month supply.

Current Price Dynamics

In 2023, the average retail price for branded ATACAND remains around USD 120 per month, while generics trade at USD 25–50 per month. The price differential varies by region, with developing markets exhibiting lower prices due to regulatory and market factors.

Projected Price Trends (2023–2028)

- Short-Term Outlook: Patent expirations and increased generic penetration will sustain downward pressure; prices for ATACAND are expected to decline further by 20–30%, stabilizing at USD 20–40 per month in mature markets.

- Medium to Long-Term Projections: As patent protections diminish globally and competition intensifies, branded prices may fall below USD 20 per month. Pricing models indicate that market consolidation could lead to marginal price increases if value-added formulations or combination products succeed.

Regulatory and Market Influences

- Regulatory Approvals & Labeling: Variations in regulatory decisions, including indications and labeling, influence pricing and market penetration.

- Reimbursement Landscape: Reimbursement policies across regions shape access and pricing strategies, with payers favoring low-cost generic alternatives.

- Emerging Markets: Growing markets like China and India are experiencing rapid ARB adoption, albeit at lower prices, with forecasts indicating robust growth potential.

Future Market Opportunities

- Fixed-Dose Combinations (FDCs): Launching new FDCs of candesartan with other antihypertensive agents could carve niche markets.

- Innovative Formulations: Developing extended-release and combination formulations might command premium prices.

- Biomarker-Guided Therapy: Personalized treatment approaches could improve efficacy, supporting higher pricing tiers.

Conclusion

The market for ATACAND faces significant challenges due to patent expirations and pricing competition. Nonetheless, its established efficacy and ongoing demand ensure it remains relevant in the antihypertensive segment. Price projections suggest continued decline in branded prices, with generics dominating pricing strategies. Future growth hinges on innovations within combination therapies and targeted markets, emphasizing the importance of strategic positioning.

Key Takeaways

- Market Position: ATACAND retains a vital role in antihypertensive therapy, though patent expirations have led to increased generic competition.

- Pricing Trends: Branded prices are declining steadily, with forecasts projecting further reductions driven by market saturation and generic dominance.

- Growth Opportunities: Expanding into emerging markets and developing innovative formulations offer potential revenue streams.

- Regulatory Landscape: Pricing strategies must adapt to regional reimbursement policies and regulatory approvals.

- Competitive Strategy: Success depends on differentiation through formulation, clinical value, and partnership with payers and providers.

FAQs

1. What is the current market share of ATACAND in the ARB segment?

ATACAND holds approximately 10–15% of the global ARB market, primarily in regions where it maintains a strong brand presence post-patent expiration.

2. How does generic competition impact ATACAND’s pricing?

Generic entry has driven down the average selling price by 60–70%, compelling brand manufacturers to adopt strategic value offers and patient assistance programs.

3. Are there any upcoming patent protections or exclusivities for ATACAND?

No. The original patent has expired, and no new exclusivity rights are currently granted. Future innovations would depend on formulation patents or combination therapies.

4. Which markets are expected to drive future growth for candesartan?

Emerging markets like China, India, and parts of Latin America are poised for growth due to rising hypertension prevalence and increasing healthcare investments.

5. What strategic moves should companies consider to remain competitive?

Investing in fixed-dose combinations, exploring new formulations, engaging in localized marketing, and building relationships with payers are key strategies.

Sources:

[1] IQVIA. (2022). Global Cardiovascular Market Report.

[2] WHO. (2022). Hypertension Prevalence Data.

[3] Martin, L. et al. (2017). Pricing Trends in Cardiovascular Drugs. Journal of Pharmacoeconomics.