Last updated: July 27, 2025

Introduction

Aspirin, known chemically as acetylsalicylic acid, stands as one of the most historically significant and widely used over-the-counter (OTC) medications globally. Its applications span pain relief, anti-inflammatory treatment, antipyretic therapy, and cardiovascular prophylaxis. Despite the emergence of newer pharmacologic agents, aspirin’s entrenched positioning in both prescription and OTC markets ensures sustained demand. This report presents a detailed market analysis and price projection for aspirin, synthesizing historical data, current market dynamics, regulatory trends, and competitive forces to facilitate informed decision-making.

Market Overview

Global Market Size and Growth

The global aspirin market was valued at approximately USD 1.4 billion in 2022, exhibiting a CAGR of around 3.2% from 2018 to 2022. Factors fueling growth include aging populations, heightened cardiovascular disease awareness, and ongoing demand for OTC analgesics [1]. The Asia-Pacific region leads market expansion, driven by emerging economies and increased healthcare access.

Market Segmentation

- By Formulation: Tablets (most prevalent), chewable, effervescent, powders.

- By Application: Pain relief (minor aches), cardiovascular prophylaxis, anti-inflammatory therapy, antipyretic, and other uses.

- By Distribution Channel: Pharmacy shelves, drug stores, online platforms, hospitals, clinics.

Key Markets and Demographics

- North America: Largest market share due to high prevalence of cardiovascular diseases and widespread OTC availability.

- Europe: Significant due to aging population and stringent regulatory environment.

- Asia-Pacific: Fastest-growing segment owing to increased healthcare expenditure and urbanization.

Competitive Landscape

Major players include Bayer, Johnson & Johnson, Sanofi, and private label manufacturers. Bayer’s iconic “Aspirin” brand dominates, especially in OTC segments.

Regulatory Environment

Regulatory agencies—like the U.S. Food and Drug Administration (FDA) and European Medicines Agency (EMA)—continue to regulate aspirin as an OTC drug, with ongoing evaluations of safety profiles, especially concerning bleeding risks and dosing guidelines. Recent trends indicate increased scrutiny over low-dose aspirin for primary prevention, potentially impacting market volume [2].

Market Dynamics and Drivers

- Aging Population: Rising prevalence of cardiovascular diseases sustains long-term demand.

- Preventive Healthcare: Growing emphasis on prophylactic use enhances sales, especially in developed markets.

- OTC Accessibility: Ease of purchase boosts consumer usage but also encounters regulatory pushback on safety concerns.

- Research and Development: Innovations in formulation (e.g., gastro-resistant coating) may extend product lifecycle and open new market segments.

Market Challenges

- Safety Concerns: Bleeding risks and gastrointestinal side effects restrict certain patient groups, prompting regulatory warnings.

- Competition from Alternative Analgesics: Nonsteroidal anti-inflammatory drugs (NSAIDs) and new aging-related therapies may divert some demand.

- Pricing Pressure: Price erosion due to generic competition and store-brand proliferation.

Price Trends and Projections

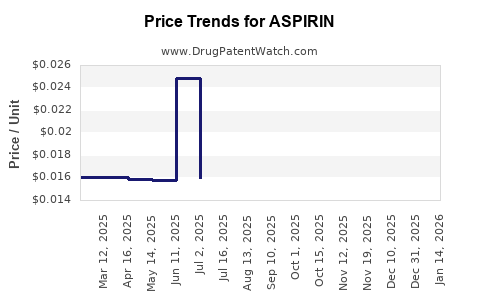

Historical Price Analysis

Over the past decade, aspirin prices have declined markedly, driven by genericization, OTC sales, and increased competition. Typical retail costs for a standard bottle (100 tablets of 325 mg) ranged between USD 4–8 in the U.S. market prior to 2020, with generics priced as low as USD 2–4 per bottle in recent years.

Current Pricing Landscape

- Brand-name Aspirin: Approximately USD 6–10 per 100-tablet bottle.

- Generics and Private Labels: USD 2–4 per 100 tablets, representing >60% market share.

- Online Retailers: Often cheaper, with bulk purchase discounts reducing per-unit price further.

Projection Methodology

Price projections incorporate factors like raw material costs (e.g., salicylic acid precursors), manufacturing costs, regulatory environment, market competition, and inflation. Based on prevailing trends, a moderate decline in costs (2–3% annually) and increasing generic market penetration suggest an overall downward price trajectory.

Projected Price Range (2023–2028)

| Year |

Expected Price Range per 100 Tablets (USD) |

Notes |

| 2023 |

USD 2.50 – 4.50 |

Current trends continue |

| 2024 |

USD 2.40 – 4.30 |

Slight raw material cost reductions |

| 2025 |

USD 2.30 – 4.20 |

Increased generic competition |

| 2026 |

USD 2.20 – 4.00 |

Market saturation effects |

| 2027 |

USD 2.10 – 3.85 |

Regulatory influences |

| 2028 |

USD 2.00 – 3.75 |

Potential price stabilization |

Note: These projections assume stable raw material prices, no disruptive regulatory changes, and continued generic market dominance.

Market Opportunities and Forecasts

- Emerging Markets: High growth potential due to expanding healthcare infrastructure.

- Combination Therapies: Future formulations combining aspirin with other agents could command premium pricing.

- Preventive Use Optimization: Education campaigns may expand indication scope, bolstering volume despite price pressure.

Conclusion

The aspirin market remains resilient amid evolving healthcare landscapes, driven chiefly by aging demographics and preventive healthcare initiatives. Price projections indicate a gradual decline attributable to robust generic competition and commoditization, but overall market stability persists due to steady demand.

Key Takeaways

- The global aspirin market is projected to grow modestly through 2028, predominantly fueled by emerging markets.

- Prices are expected to decline gradually, with generic formulations dominating and pushing retail prices downward.

- Regulatory scrutiny, especially regarding safety and indication updates, may influence future market dynamics and pricing.

- Innovation in formulations and combination therapies represent potential growth avenues.

- Market resilience hinges on demographic trends, regulatory environments, and the capacity to adapt to safety concerns and competition.

FAQs

1. What are the main factors influencing aspirin pricing?

Primarily, manufacturing costs, raw material prices, competitive dynamics (especially generics), regulatory policies, and consumer demand shape aspirin prices. Increased competition with store brands and online retail channels exerts downward pressure.

2. How might regulatory changes impact the aspirin market?

Enhanced safety regulations, such as restrictions on use for primary cardiovascular prevention, may reduce demand, influencing pricing and market size. Conversely, approval of new formulations or indications could create pricing premiums.

3. What are the growth prospects in emerging markets?

Emerging markets offer significant opportunities due to expanding healthcare access, increasing awareness, and rising prevalence of cardiovascular diseases, potentially offsetting mature-market saturation.

4. Will the price of aspirin rebound in the future?

Given market sustainability and high production efficiency, significant price rebounds are unlikely. Prices may plateau or decline slightly due to ongoing genericization but are not expected to increase substantially barring new therapeutic innovations or regulatory shifts.

5. Are there upcoming innovations that could affect aspirin's market?

Research into combination therapies, sustained-release formulations, and new delivery mechanisms could offer expansion opportunities and sustain market relevance, though widespread adoption will depend on clinical efficacy and regulatory approval.

References

[1] Market Research Future. (2022). Global Aspirin Market Report.

[2] FDA. (2022). Aspirin and Cardiovascular Prevention: Safety and Regulatory Updates.