Last updated: July 28, 2025

Introduction

ASMANEX TWISTHALER, containing the active ingredient mometasone furoate, is an inhaled corticosteroid primarily prescribed for the maintenance treatment of asthma. Approved by the FDA in 2003, it quickly gained a foothold in respiratory therapeutics due to its efficacy, targeted delivery, and relatively favorable safety profile. As the global respiratory drug market evolves—driven by rising asthma prevalence, technological innovations, and competitive dynamics—the positioning and pricing trajectory of ASMANEX TWISTHALER warrant comprehensive analysis.

Market Landscape for Inhaled Corticosteroids

Global Respiratory and Asthma Market Overview

The global asthma therapeutics market is projected to reach USD 24.2 billion by 2028, expanding at a compound annual growth rate (CAGR) of around 4% from 2021 to 2028, according to Grand View Research. The increase is fueled by factors including urbanization, pollution, higher diagnosis rates, and advancements in inhaler technology.

Inhaled corticosteroids (ICS), such as mometasone furoate, dominate the maintenance therapy segment, accounting for nearly 50% of the total asthma treatment market share. Their efficacy in reducing airway inflammation positions them as first-line or adjunct therapies, consequently sustaining steady demand.

Competitive Position and Key Players

ASMANEX TWISTHALER's primary competitors include Fluticasone Furoate (e.g., Flonase, Arnuity Ellipta), Beclomethasone dipropionate, Budesonide (e.g., Pulmicort), and combination products such as Symbicort (budesonide/formoterol). The competitive edge of ASMANEX lies in its favorable safety profile and patented delivery system, offering high bioavailability with minimal systemic absorption.

Major pharmaceutical players like Merck (product owner), Teva Pharmaceuticals, and Teva-supported generics contribute to a competitive environment, with market shares influenced by efficacy, safety, device convenience, and pricing.

Regulatory and Patent Considerations

Merck's patent for mometasone furoate inhalers expired in the U.S. in 2022, opening pathways for generic competitors. This patent expiration could lead to downward pricing pressure and increased market penetration by generics, impacting the branded product’s market share and price points.

Market Dynamics Impacting Price Trends

Demand Drivers

- Rising Asthma Prevalence: The WHO estimates over 262 million people globally suffer from asthma, with increasing prevalence in Asia-Pacific and Latin America, broadening the patient base.

- Enhanced Patient Compliance: The TwistHaler device mode offers ease of use, contributing to better adherence and consistent medication intake.

- Expanding Insurance Coverage: In developed markets, insurance reimbursement stimulates access, supporting sustained demand.

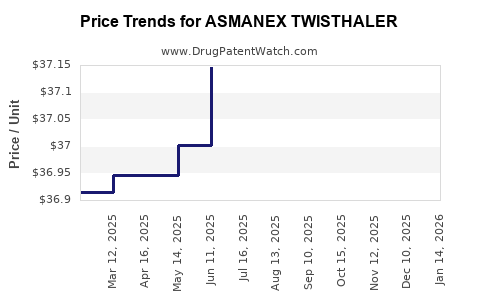

Price Trends and Historical Data

Historically, branded inhalers like ASMANEX TWISTHALER commanded premium pricing—approximate retail prices in the U.S. ranged between USD 300-400 for a 120-dose inhaler (approximately one-month supply), depending on pharmacy and insurance status.

Following patent expiration, the advent of generics has led to a significant reduction in prices—by up to 50–70%—with generic mometasone inhalers available at USD 100-150 per inhaler. This trend underscores price sensitivity among consumers and payors, promoting cost-conscious prescribing behaviors.

Regulatory Impact on Pricing

The launch of generic versions post-patent expiry has introduced price competition, pressing down the average selling price (ASP). GoodRx and other pharmacy benefit managers now list generic mometasone furoate inhalers with substantial discounts, affecting former premium price points of the branded product.

Moreover, potential regulatory hurdles related to inhaler device innovation, such as new delivery mechanisms or formulations, could influence future pricing strategies.

Forecasted Pricing Trajectory for ASMANEX TWISTHALER

Based on market trends, patent expirations, and competitors’ pricing strategies, the following projections emerge:

Short-Term (1–2 Years)

- Post-Patent Landscape: The expiration of Merck’s patent in 2022 is anticipated to lead to price erosion.

- Pricing Range: The retail price of ASMANEX TWISTHALER is expected to decrease by approximately 20%–30%, aligning with the generic price trends observed elsewhere.

- Market Share: The branded product may experience a decline in market share unless supported by unique formulations or device improvements.

Medium to Long-Term (3–5 Years)

- Market Consolidation and Differentiation: Merck's strategic responses, such as patent extension through formulation patents or device innovations, may stabilize or increase prices.

- Potential Premium Positioning: If new formulations or delivery systems gain regulatory approval, the company could command higher prices, offsetting generic competition.

- Price Range: Expect prices to stabilize around USD 150-200 per inhaler, assuming moderate generic competition and maintained brand loyalty.

Influence of Emerging Markets

In emerging economies, where brand equity, limited insurance coverage, and supply chain factors dominate, prices may remain relatively higher or more stable, offering potential premium margins for the brand.

Implications for Stakeholders

Pharmaceutical Companies

Brand owners should consider innovation strategies, such as improved delivery devices or combination therapies, to maintain pricing power. Alternatively, embracing generic partnerships or licensing could mitigate revenue losses.

Payors and Patients

Price reductions driven by generics improve access but may also impact medication adherence if perceived affordability leads to variations in product quality or availability.

Regulators

Regulatory frameworks encouraging innovation or market competition will influence future pricing dynamics.

Key Takeaways

- The expiration of Merck's patent for ASMANEX TWISTHALER in 2022 has initiated significant price compression driven by generic competition.

- Short-term forecasts indicate a 20–30% price decline, with stabilization around USD 150-200 per inhaler depending on market and regulatory dynamics.

- Long-term pricing hinges on innovation, regulatory strategies, and market penetration of generics.

- Manufacturers should focus on device differentiation and formulation innovations to preserve or enhance pricing power amid a competitive landscape.

- Stakeholders should monitor evolving regulatory policies and market entry of generics worldwide, which could further influence reflects and accessibility.

FAQs

1. What factors primarily influence the current pricing of ASMANEX TWISTHALER?

Patent status, generic competition, market demand, insurance coverage, and manufacturer pricing strategies significantly impact its price.

2. How has patent expiration affected the cost of mometasone inhalers?

Patent expiry has introduced generics, leading to substantial price reductions—up to 50–70%—making inhalers more accessible.

3. Are there any upcoming regulatory changes that could alter the pricing landscape?

Potential patent extensions, formulation approvals, or device innovations could influence future prices, either stabilizing or increasing them.

4. What strategies can Merck adopt to maintain profitability post-patent expiry?

Investing in device improvements, combination therapies, and patent-extending formulations, alongside strategic partnerships, can help retain market positioning.

5. How does the global prevalence of asthma affect the market for ASMANEX TWISTHALER?

Increasing asthma prevalence, especially in underserved regions, sustains or boosts demand, but price sensitivity and reimbursement policies vary across markets.

Sources:

[1] Grand View Research, “Asthma Drugs Market Size & Trends | Industry Report 2021-2028”

[2] U.S. Food and Drug Administration, “ANDA Approval and Patent Information for Mometasone Furoate Inhalers”

[3] IQVIA, “Global Respiratory Therapeutics Market Data” (2022)

[4] Pharma Intelligence, “Market Outlook for Inhaled Corticosteroids Post-Patent Expiration”