Last updated: July 28, 2025

Introduction

Artificial tears are among the most widely used ophthalmic products for dry eye disease, a condition affecting millions worldwide. The global market for artificial tears reflects growing prevalence, expanding treatment options, and increasing healthcare awareness. This analysis explores the current market landscape, key drivers, competitive environment, regulatory influences, and future price projections for artificial tears, providing critical insights for stakeholders like pharmaceutical companies, investors, healthcare providers, and policymakers.

Market Overview

Global Market Size and Growth Trajectory

The artificial tears market has witnessed consistent growth driven by escalating incidences of dry eye syndrome, an aging population, and increased screen time. According to industry reports, the global ophthalmic drugs market—including artificial tears—was valued at approximately US$6.5 billion in 2022 and is projected to reach around US$10 billion by 2030, growing at a CAGR of roughly 5.8%.[1]

Key Players and Competitive Landscape

Major participants include Allergan (acquired by AbbVie), Novartis, Bausch + Lomb, Santen Pharmaceutical, and Akorn. These companies differentiate through formulation innovations, preservative-free options, and packaging technologies. Generic and private-label brands also contribute significantly to price competition, especially in developing regions.

Segment Breakdown

The market segments primarily by composition:

- Preservative-Free Artificial Tears: Preferred for chronic use; command higher prices.

- Preserved Artificial Tears: Lower cost, widely available.

- Specialty Formulations: Targeted for severe dry eye, often with additional active ingredients.

Distribution Channels

Distribution spans ophthalmic clinics, pharmacies, online retail, and direct-to-consumer channels. The rise of e-commerce is notably impacting accessibility and pricing strategies.

Market Drivers

Prevalence of Dry Eye Disease

Dry eye affects an estimated 5-30% of adults globally, with higher prevalence among older adults and contact lens wearers.[2] Factors like environmental stressors and increased digital device use exacerbate incidence rates.

Aging Population

Globally aging demographics amplify demand, as dry eye is common among those over 50.

Technological Innovations

Advancements such as preservative-free multi-dose bottles, sustained-release formulations, and combination therapies have expanded products’ efficacy and patient compliance, enabling premium pricing.

Rising Healthcare Awareness

Educational campaigns and improved diagnostic techniques lead to increased diagnosis, fueling market growth.

Regulatory Environment

Regulatory bodies like the FDA (U.S.) and EMA (Europe) typically categorize artificial tears as over-the-counter (OTC) products, simplifying access and fostering market penetration. However, newer formulations with novel delivery systems or active ingredients may require stringent approval processes, impacting development timelines and pricing.

Pricing Landscape

Current Price Range

- Generics and Private Labels: US$4–$10 per 10 mL bottle.

- Brand-Name Products: US$12–$25 per 10 mL, with some specialty formulations exceeding this range.

- Preservative-Free Options: Typically priced 20-50% higher due to manufacturing complexities.

Factors Influencing Pricing

- Formulation Complexity: Preservative-free or multi-dose systems hike production costs.

- Brand Premium: Established brands maintain higher pricing through brand loyalty and perceived efficacy.

- Market Region: Developed markets like North America and Europe feature higher prices compared to Asia and Latin America.

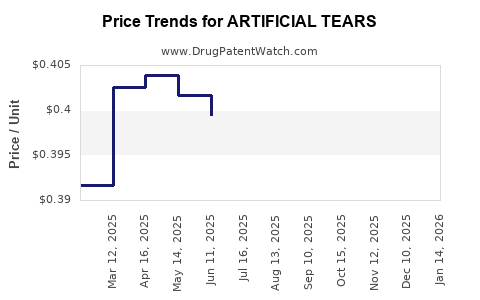

Pricing Trends

The global shift toward preservative-free products and innovative delivery mechanisms is pushing prices upward. Conversely, market commoditization, especially in emerging regions, exerts downward pressure on prices.

Future Price Projections (2023–2030)

Considering current growth dynamics, technological advancements, and regulatory influences, artificial tears prices are expected to follow these trajectories:

Short-Term (2023–2025)

- Stability with Moderate Increases: Existing brands will likely see upward pressure due to inflation, ingredient costs, and innovation premiums (~3–5% annual increase).

- Introduction of Premium Formulations: New, high-cost preservative-free or sustained-release formulations will command prices 30–50% higher than current average.

Medium to Long-Term (2026–2030)

- Market Saturation and Economies of Scale: Price reductions expected in commoditized segments, especially in regions with aggressive generic proliferation (~2–4% annual decline).

- Premium Segment Growth: Continued innovation sustains higher price points, with targeted niche products possibly exceeding US$30 per 10 mL.

- Emerging Markets: Price reductions driven by local manufacturing, competition, and cost sensitivities could lower prices by 10–20% from current levels.

Impact of Digital and Telehealth Platforms

Increased online availability may foster pricing elasticity, enabling competitive discounts and bundling options, especially for bulk purchases or subscription models.

Key Market Trends Influencing Pricing

- Innovation-Driven Premiums: Bi-layered, sustained-release, and preservative-free formulations sustain higher pricing.

- Patent Expirations: Generic entry post-patent expiry leads to price erosion, especially in developed markets.

- Distribution Expansion: Online channels and direct-to-consumer models lower retail markup, potentially reducing consumer prices.

- Regulatory Approvals: Novel formulations needing regulatory clearance may temporarily inflate prices due to high R&D and approval costs.

Implications for Stakeholders

- Pharmaceutical Companies: Need to balance innovation investments with market saturation risks.

- Investors: Opportunities in premium formulations and emerging markets could yield higher returns.

- Healthcare Providers: Understanding price trends helps optimize procurement and patient care strategies.

- Policymakers: Monitoring pricing trends ensures affordability and equitable access, particularly in low-income regions.

Conclusion

The artificial tears market positioning is shaped by increasing dry eye prevalence, technological advancements, and shifting healthcare dynamics. While prices for standard products are anticipated to stabilize or decline slightly due to commoditization, innovation-driven premium products will sustain higher pricing levels, with projected increases over the next few years. Stakeholders must adapt to evolving consumer preferences, regulatory landscapes, and regional economic factors to optimize market performance and patient outcomes.

Key Takeaways

- The global artificial tears market is projected to grow at a CAGR of approximately 5.8% through 2030, driven by demographic and technological factors.

- Prices vary significantly across regions and formulations, with premium, preservative-free products commanding higher premiums.

- Innovation and regulatory trends will influence future pricing, creating opportunities for high-end formulations and challenges for mass-market products.

- Expected trends suggest stability or slight price decreases in commoditized segments, while premium formulations will maintain or increase prices.

- Digital retail expansion and evolving regulatory frameworks will continue to impact pricing strategies and market competitiveness.

FAQs

1. What factors primarily influence the pricing of artificial tears?

Formulation complexity (preservative-free, sustained-release), brand reputation, regional economic conditions, distribution channels, and regulatory approvals significantly influence pricing.

2. How will technological innovations impact future prices?

Innovations such as preservative-free multi-dose bottles and sustained-release systems typically command higher prices due to higher manufacturing costs but can reduce prices through increased competition over time.

3. Are generic artificial tears significantly cheaper than brand-name versions?

Yes, generics and private-label brands generally cost 30–50% less than branded products, especially in mature markets, though quality perceptions can influence consumer choice.

4. How might emerging markets affect global pricing trends?

Emerging markets often experience lower prices due to localized manufacturing, heightened competition, and cost sensitivities, which can exert downward pressure on global average prices.

5. What is the outlook for premium, innovative formulations over the next decade?

Premium formulations are expected to maintain or increase their price premiums due to ongoing innovation and demand from patients with severe dry eye, supporting higher profit margins for manufacturers focusing on these segments.

Sources:

[1] MarketWatch, "Global Ophthalmic Drugs Market," 2022.

[2] American Academy of Ophthalmology, "Dry Eye Disease," 2022.