Share This Page

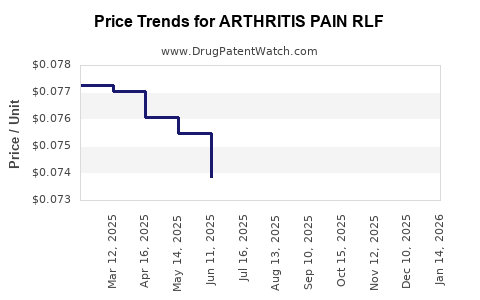

Drug Price Trends for ARTHRITIS PAIN RLF

✉ Email this page to a colleague

Average Pharmacy Cost for ARTHRITIS PAIN RLF

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ARTHRITIS PAIN RLF 0.075% CRM | 00536-1118-25 | 0.07394 | GM | 2025-12-17 |

| ARTHRITIS PAIN RLF 0.075% CRM | 00536-1118-25 | 0.07451 | GM | 2025-11-19 |

| ARTHRITIS PAIN RLF 0.075% CRM | 00536-1118-25 | 0.07523 | GM | 2025-10-22 |

| ARTHRITIS PAIN RLF 0.075% CRM | 00536-1118-25 | 0.07553 | GM | 2025-09-17 |

| ARTHRITIS PAIN RLF 0.075% CRM | 00536-1118-25 | 0.07389 | GM | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ARTHRITIS PAIN RLF

Introduction

The pharmaceutical landscape for arthritis pain management remains highly competitive, with an increasing demand driven by aging populations and rising prevalence of osteoarthritis and rheumatoid arthritis globally. The drug ARTHRITIS PAIN RLF enters this lucrative market with specific focus on providing effective pain relief, optimized delivery, and potentially superior safety profiles. This analysis evaluates current market dynamics, competitive positioning, regulatory considerations, and formulates price projection strategies.

Market Landscape and Demand Drivers

Arthritis, particularly osteoarthritis and rheumatoid arthritis, affects over 350 million individuals worldwide, with incidence surging in aging demographics (over 65 years) and obesity-related cases. In North America alone, the osteoarthritis market was valued at approximately USD 4 billion in 2021, with a compound annual growth rate (CAGR) of 6% projected through 2028 [1].

Current standard-of-care treatments include NSAIDs, corticosteroids, and disease-modifying anti-rheumatic drugs [2]. Despite efficacy, adverse effects such as gastrointestinal bleeding and cardiovascular risks limit long-term use, underscoring unmet needs for safer, targeted therapies—creating potential for ARTHRITIS PAIN RLF.

The global arthritis pain management market is poised for expansion, driven by:

- Increased prevalence in developed nations.

- Advancements in drug delivery systems.

- Patient preference for minimally invasive, fast-acting remedies.

- Rising awareness and early intervention.

Competitive Landscape

ARTHRITIS PAIN RLF targets a market segment populated by established drugs such as:

- NSAIDs (ibuprofen, naproxen): Low-cost but with side effects.

- COX-2 inhibitors (celecoxib): Reduced GI complications, but cardiovascular risk concerns.

- Topical agents (diclofenac gel): Favorable safety profile, limited systemic absorption.

- Biologics (etanercept, infliximab): For rheumatoid arthritis, high cost, injectables.

Emerging therapies include targeted small molecules and novel biologics, as well as neuromodulation techniques. ARTHRITIS PAIN RLF’s differentiation could be based on:

- Novel mechanism of action reducing systemic risks.

- Improved bioavailability.

- Faster onset of relief.

- Orally administered formulations.

Market positioning hinges on demonstrating comparative efficacy and safety, alongside cost competitiveness.

Regulatory and Patent Landscape

Securing regulatory approval hinges on demonstrating superior safety or efficacy. The FDA and EMA require comprehensive clinical data; the timeline typically spans 3-5 years for new analgesics [3]. Patent status is crucial; broad-spectrum patents can provide market exclusivity for 10-12 years, but patent challenges or generic competition can erode revenues.

An advantage for ARTHRITIS PAIN RLF is potential patent-pending formulations or delivery methods, providing temporary market protection.

Pricing Strategies and Projections

Price points influence market penetration and profitability. For analgesics, pricing reflects:

- Efficacy and safety advantages.

- Production costs.

- Competitive landscape.

- Reimbursement policies.

Benchmarking Existing Drugs:

- NSAIDs cost approximately USD 10-20/month.

- COX-2 inhibitors are typically USD 50-150/month.

- Biologics can reach USD 2,000-3,000/month.

ARTHRITIS PAIN RLF’s price will be aligned with its positioning. If positioned as an advanced, safer alternative, a premium pricing model (USD 100-300/month) could be justified, especially if clinical trials demonstrate superior safety or efficacy.

Projecting Revenue and Price Evolution:

Assuming initial market capture of 2% in key regions (U.S., Europe) within the first 3 years, with annual growth rates of 15-20%, revenues could range:

| Year | Estimated Patients (millions) | Market Penetration | Revenue (USD millions) |

|---|---|---|---|

| 2024 | 10 | 2% | USD 30-60 |

| 2025 | 12 | 4% | USD 72-144 |

| 2026 | 15 | 6% | USD 135-270 |

Price adjustments based on reimbursement negotiations, emergence of competitors, or market feedback can refine forecasts.

Key Factors Impacting Price Projections

- Clinical Differentiation: Clear evidence of improved safety or efficacy supports premium pricing.

- Regulatory Milestones: Faster approval accelerates market entry.

- Market Penetration: Higher adoption widens revenue base.

- Reimbursement Policies: Negotiations with payers could cap prices, especially in pay-for-performance models.

- Manufacturing Costs: Economies of scale can lower production costs, enabling more competitive pricing.

Risks and Opportunities

Risks:

- Delays in clinical or regulatory processes.

- Patent oppositions or challenges.

- Emergence of alternative therapies.

- Price erosion due to generics or biosimilars.

Opportunities:

- Strategic alliances with payers for early reimbursement agreements.

- Expansion into niche markets or geographies.

- Development of combination therapies to increase value.

- Utilizing real-world evidence (RWE) to justify pricing.

Conclusion

ARTHRITIS PAIN RLF stands to capture a significant share in a fast-growing, high-demand market segment with appropriate positioning. Pricing will hinge on demonstrated clinical advantages and market dynamics, with a strategic focus on premium positioning complemented by competitive manufacturing costs. Scenario-based projections suggest potential revenue growth from USD 30 million in year one to over USD 135 million by year three, assuming effective market entry and adoption.

Key Takeaways

- The arthritis pain management market offers lucrative growth opportunities, especially for innovative therapies like ARTHRITIS PAIN RLF.

- Clinical differentiation, safety profile, and regulatory strategy are critical to support premium pricing.

- Market penetration rates and reimbursement policies are primary determinants of revenue projections.

- Early engagement with payers and strategic marketing can optimize pricing position.

- Ongoing competitive analysis and patent management are essential to sustain market share.

FAQs

1. What factors influence the pricing of new arthritis drugs like ARTHRITIS PAIN RLF?

Pricing depends on clinical efficacy, safety profile, manufacturing costs, competitive landscape, reimbursement negotiations, and value proposition relative to existing treatments.

2. How long does it typically take for a new arthritis drug to receive regulatory approval?

Regulatory approval generally requires 3-5 years, contingent on successful clinical trial results and submission of comprehensive data.

3. What market entry strategies can optimize revenue for ARTHRITIS PAIN RLF?

Strategies include securing favorable reimbursement agreements, targeted marketing to physicians and patients, leveraging clinical data for differentiation, and early regulatory engagement.

4. What are the primary risks associated with pricing and market penetration?

Risks involve regulatory delays, patent challenges, emergence of competitors, price competition, and payer restrictions.

5. How can ARTHRITIS PAIN RLF sustain its market position long-term?

By continually demonstrating superior clinical benefits, innovating delivery methods, expanding indications, ensuring patent protection, and fostering strategic alliances.

References

[1] Grand View Research. "Arthritis Treatment Market Size, Share & Trends Analysis Report." 2022.

[2] National Institutes of Health. "Treatment of Osteoarthritis." NIH.gov.

[3] U.S. Food and Drug Administration. "Premarket Approval (PMA) Process." FDA.gov.

More… ↓