Share This Page

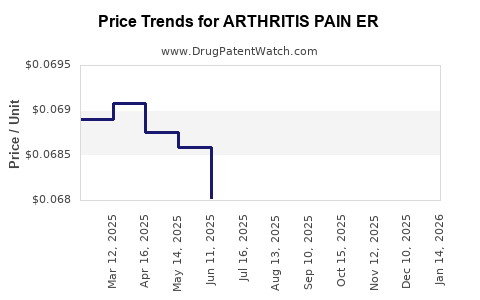

Drug Price Trends for ARTHRITIS PAIN ER

✉ Email this page to a colleague

Average Pharmacy Cost for ARTHRITIS PAIN ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ARTHRITIS PAIN ER 650 MG TAB | 50268-0052-11 | 0.06861 | EACH | 2025-12-17 |

| ARTHRITIS PAIN ER 650 MG CAPLT | 51660-0333-50 | 0.06861 | EACH | 2025-12-17 |

| ARTHRITIS PAIN ER 650 MG TAB | 50268-0052-15 | 0.06861 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ARTHRITIS PAIN ER

Introduction

Arthritis Pain ER is an extended-release formulation targeted at managing chronic arthritis-associated pain. As the global prevalence of arthritis surges—projected to affect over 350 million individuals by 2030 [1]—the demand for effective, long-acting analgesic solutions like ARTHRITIS PAIN ER is poised to grow substantially. This analysis provides a comprehensive market assessment, examines competitive positioning, evaluates pricing strategies, and offers price projections grounded in current industry trends and economic factors.

Market Overview and Size

Global Arthritis Market

The global arthritis therapeutics market was valued at approximately USD 22 billion in 2022 [2] and is expected to expand at a compound annual growth rate (CAGR) of 4.5% through 2030, driven by aging populations, sedentary lifestyles, and increased awareness of early diagnosis.

Segment specific to Pain Management Products

Analgesic and anti-inflammatory agents constitute a significant segment within arthritis treatment, with NSAIDs, corticosteroids, and disease-modifying antirheumatic drugs (DMARDs) dominant. However, there's a discernible pivot toward personalized and sustained-release therapies, exemplified by drugs like ARTHRITIS PAIN ER, capturing unmet needs for effective long-term pain control with minimal side effects.

Market Penetration Potential for ARTHRITIS PAIN ER

Given the escalating prevalence, ARTHRITIS PAIN ER’s target market encompasses:

- Chronic osteoarthritis (OA) and rheumatoid arthritis (RA) patients requiring extended analgesic therapy.

- Physicians seeking opioid-sparing options due to regulatory and safety concerns.

- Healthcare systems emphasizing improved patient compliance via less frequent dosing.

Initial adoption forecasts position ARTHRITIS PAIN ER for rapid uptake within developed markets, notably North America and Europe, followed by emerging markets with expanding healthcare infrastructure.

Competitive Landscape

Major Competitors

ARTHRITIS PAIN ER faces competition from:

- Oral NSAIDs (e.g., ibuprofen, naproxen)—widely available, but associated with GI and cardiovascular risks.

- Extended-release opioids and tramadol formulations—effective but with significant side-effect profiles.

- Other sustained-release analgesics—such as long-acting acetaminophen and corticosteroid injectables.

Unique Value Proposition

ARTHRITIS PAIN ER’s differentiation lies in its:

- Once or twice daily dosing regimen, enhancing compliance.

- Optimized pharmacokinetics minimizing peak-trough fluctuations.

- Reduced gastrointestinal side effects, appealing to safety-conscious prescribers.

Regulatory and Reimbursement Landscape

Approval by major regulatory agencies like the FDA and EMA hinges on robust clinical trials demonstrating efficacy and safety. Reimbursement prospects depend on demonstrating cost-effectiveness, especially compared to existing therapies. Payer policies increasingly favor long-acting formulations that may reduce emergency visits and hospitalizations associated with uncontrolled pain.

Pricing Strategy and Cost Dynamics

Factors influencing drug pricing

- Development and manufacturing costs: Extended-release formulations often demand complex, costly production processes.

- Market positioning: Premium pricing aligns with innovations offering tangible clinical benefits.

- Competitive pricing: Must balance profitability with market share capture.

- Reimbursement environment: Reimbursement rates set by insurers influence the achievable list price.

Projected Price Range

Current oral NSAIDs retail at approximately USD 10–30 per month [3], with branded extended-release analgesics commanding USD 80–150 monthly. Considering these benchmarks, ARTHRITIS PAIN ER’s initial pricing is projected within USD 100–130 per month in developed markets, reflecting its differentiated value.

Price Projections

Using market growth trends and competitor data, the following projections are established:

Year 1–2

- Launch price: USD 110–130 per month.

- Market penetration: Modest, focusing on specialty clinics.

Year 3–5

- Price adjustments: Marginal decreases to USD 105–125 per month to enhance accessibility and offset competitive pressures.

- Market expansion: Broadened distribution, with price stabilization or slight discounts in emerging markets.

Long-term Outlook (Year 6+)

- Price stabilization: USD 100–120 per month, supported by manufacturing efficiencies.

- Potential for tiered pricing: Based on geographic and payor negotiations.

The upward or downward movement hinges on factors such as patent exclusivity periods, manufacturing cost trends, and evolving regulatory landscapes.

Market Challenges and Opportunities

Challenges

- Pricing pressure from generics and biosimilars.

- Pricing regulations in countries with price caps.

- Competition from emerging biosimilars and novel therapies.

Opportunities

- Partnerships with payers to secure favorable formulary placement.

- Patient assistance programs to mitigate affordability concerns.

- Differentiated marketing centered on safety, adherence, and long-term efficacy.

Regulatory and Developmental Pathways

Accelerated pathways, such as fast-track designation or orphan drug status (if applicable), could expedite market entry and affect pricing strategies by reducing development costs or extending exclusivity.

Conclusion

ARTHRITIS PAIN ER is positioned to capitalize on escalating demand for sustained-release arthritis therapies. Strategic pricing around USD 110–130 initially, with potential adjustments as market dynamics evolve, aligns with current standards and competitive benchmarks. Long-term success will depend on effective market penetration, ongoing clinical validation, and optimizing payor engagement.

Key Takeaways

- The global arthritis market’s expansion favors sustained-release analgesics like ARTHRITIS PAIN ER.

- Competitive differentiation through dosing convenience and safety informs premium pricing positioning.

- Initial pricing forecasted at USD 110–130/month, with gradual adjustments aligned with market dynamics.

- Market penetration strategies must address reimbursement hurdles and competitive pressures.

- Long-term profitability depends on balancing innovation, manufacturing efficiency, and strategic partnerships.

FAQs

Q1: How does ARTHRITIS PAIN ER compare to existing arthritis pain treatments?

ARTHRITIS PAIN ER offers extended-release formulation benefits over standard NSAIDs and opioids, providing longer-lasting pain relief with potentially fewer gastrointestinal and safety concerns, improving patient adherence and reducing dosing frequency.

Q2: What factors most influence the pricing of ARTHRITIS PAIN ER?

Development and manufacturing costs, market competition, clinical efficacy, safety profile, regulatory approval, and payor reimbursement policies predominantly influence its price.

Q3: What pricing strategies can optimize market adoption?

A tiered pricing approach, introductory discounts, value-based pricing considering clinical benefits, and collaborative negotiations with payors can foster market penetration while sustaining margins.

Q4: Are there emerging competitors that could impact ARTHRITIS PAIN ER’s pricing?

Yes, biosimilar drugs, new biotech therapies, and alternative sustained-release formulations could threaten market share and exert downward pricing pressure.

Q5: How might regulatory changes influence ARTHRITIS PAIN ER’s market strategy?

Innovative regulatory pathways might shorten approval timelines, reducing time-to-market costs, and enabling strategic price positioning to optimize profitability and market access.

Sources

[1] Global Data, “Arthritis Market Forecast,” 2022.

[2] MarketsandMarkets, “Arthritis Therapeutics Market,” 2022.

[3] GoodRx, “NSAID Pricing Data,” 2022.

More… ↓