Share This Page

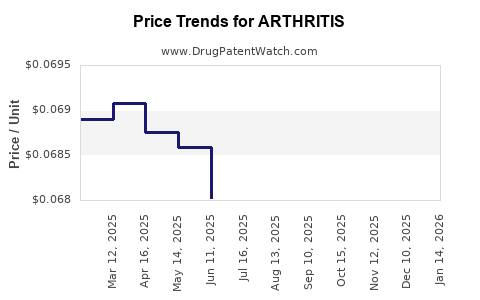

Drug Price Trends for ARTHRITIS

✉ Email this page to a colleague

Average Pharmacy Cost for ARTHRITIS

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ARTHRITIS PAIN RLF 0.075% CRM | 00536-1118-25 | 0.07394 | GM | 2025-12-17 |

| ARTHRITIS PAIN ER 650 MG CAPLT | 51660-0333-01 | 0.06861 | EACH | 2025-12-17 |

| ARTHRITIS PAIN ER 650 MG CAPLT | 51660-0333-50 | 0.06861 | EACH | 2025-12-17 |

| ARTHRITIS PAIN ER 650 MG TAB | 50268-0052-15 | 0.06861 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Arthritis Drugs

Introduction

Arthritis drugs represent a significant segment within the global pharmaceutical landscape, driven by the increasing prevalence of arthritis worldwide. As the population ages, the demand for effective treatments continues to surge, compelling pharmaceutical companies to innovate and strategize accordingly. This analysis explores current market dynamics, key therapeutic agents, competitive landscape, regulatory factors, and future price projections for arthritis medications.

Global Market Overview

The global arthritis market was valued at approximately USD 44.2 billion in 2022 and is projected to reach USD 72.5 billion by 2030, growing at a Compound Annual Growth Rate (CAGR) of approximately 6.2% (2023-2030) [1]. This growth reflects demographic shifts, increased awareness, and expanding treatment options. Rheumatoid arthritis (RA) and osteoarthritis (OA) constitute the primary disease subtypes, with RA constituting a significant portion of market revenue due to its severity and chronic nature.

Key Therapeutic Agents and Innovation Trends

Current treatment paradigms incorporate nonsteroidal anti-inflammatory drugs (NSAIDs), corticosteroids, disease-modifying antirheumatic drugs (DMARDs), biologics, and targeted synthetic DMARDs. Notably:

- Biologics and Biosimilars: Biological agents such as adalimumab, etanercept, and infliximab dominate the market but face increasing competition from biosimilars, which offer cost advantages and expanded access.

- Targeted Synthetic DMARDs: Janus kinase (JAK) inhibitors, including tofacitinib and baricitinib, are gaining popularity due to their oral administration and efficacy.

- Novel Innovations: Ongoing research targets disease-modifying pathways, with promising candidates in clinical trials focusing on precision medicine approaches.

Market Drivers and Challenges

Drivers:

- Aging Population: Globally, the elderly demographic (65+) is increasing, directly correlating with higher arthritis prevalence [2].

- Lifestyle Factors: Obesity and sedentary lifestyles augment osteoarthritis risk.

- Advancements in Biologics: Enhanced efficacy and safety profiles propel adoption.

- Regulatory Incentives: Policies encouraging biosimilar entry foster market competitiveness.

Challenges:

- High Cost of Biologics: Leading to affordability concerns and pressure to reduce prices.

- Patent Expirations: Patent cliffs for key biologics stimulate biosimilar proliferation but also introduce pricing volatility.

- Regulatory Hurdles: Variability in approval processes across regions complicates market entry strategies.

Price Dynamics and Projections

Current Pricing Landscape

- Biologics: Retail prices for biologic treatments for arthritis typically range from USD 15,000 to USD 30,000 annually per patient in developed markets (e.g., US, Europe) [3].

- Biosimilars: Introduction of biosimilars has reduced biosimilar biologic prices by approximately 20-30%, with some estimates suggesting prices as low as USD 10,000 annually [4].

- Oral Agents: JAK inhibitors generally cost between USD 30,000 to USD 35,000 annually but offer potentially better patient adherence.

Price Trends and Future Projections (2023-2030)

-

Decline in Brand-Name Biologic Prices: As biosimilar penetration increases, the prices of original biologics are projected to drop by 15-25% by 2025 and up to 35% by 2030. For instance, ongoing patent expirations for adalimumab (Humira) in key markets are expected to halve its price [5].

-

Biosimilar Market Expansion: Biosimilar volumes are expected to account for over 50% of biologic sales by 2028, further intensifying price competition [6].

-

Oral and Small Molecule Drugs: The unit price of JAK inhibitors may see modest reductions (~10-15%) as generics enter the market post-patent expiration, but their convenience and efficacy sustain high pricing.

-

Regional Variations: Pricing will remain more opaque in emerging markets due to lower healthcare spending and regulatory differences, but growth in affordable biologic versions and government negotiations will influence prices.

-

Pricing in Biosimilar-Driven Markets: The increasing availability of biosimilars will drive overall arthritis therapy costs downward, with some projections indicating a potential 20-30% reduction in global treatment costs by 2030.

Market Opportunities and Strategic Considerations

- Market Entry of Biosimilars: Early registration and harmonization with regulatory standards are critical for gaining market share.

- Cost-Effective Innovation: Developing truly differentiated, affordable therapies will be essential as pricing pressures intensify.

- Regional Expansion: Emerging markets present substantial growth opportunities, notably China and India, where arthritis prevalence is rising and affordability constraints persist.

- Digital Therapeutics: Integration of digital health tools may influence treatment access and adherence, indirectly affecting pricing models.

Regulatory and Policy Impact

Policy changes, including patent litigation, government price negotiations (e.g., US Medicaid, European price caps), and incentives for biosimilar uptake, will significantly influence future prices.

Conclusion

The arthritis therapeutic market is poised for continued growth, driven by demographic shifts and innovation. Price trends will be markedly influenced by biosimilar adoption, patent expirations, and regional policy environments. While biologics will retain premium pricing due to their proven efficacy, market pressures and new entrants will likely reduce overall treatment costs, improving accessibility but squeezing profit margins for innovators.

Key Takeaways

- The global arthritis market is expected to grow at a CAGR of over 6% through 2030, driven primarily by aging populations and treatment innovations.

- Biologics dominate current pricing structures but face steep competition from biosimilars, leading to significant price reductions.

- Biosimilar proliferation will contribute to a 20-30% decrease in global therapy costs by 2030.

- Oral and targeted synthetic drugs, though initially expensive, may experience modest price reductions, especially post-patent expiry.

- Emerging markets will become increasingly vital for market expansion, although price sensitivity remains high.

FAQs

1. How are biosimilars affecting the arthritis drug market?

Biosimilars are drastically reducing key biologic therapy prices, increasing treatment affordability, and driving market competition, which compels originator companies to offer more competitive pricing and innovate more cost-effective solutions.

2. What are the key factors driving down treatment costs?

Patent expirations, biosimilar entry, regulatory reforms favoring cost containment, and increased regional competition are primary factors leading to decreased prices.

3. Will innovative biologics maintain premium prices?

Yes, especially those with superior efficacy, safety, or convenience profiles. However, even innovative biologics will face downward pricing pressure as biosimilars gain market share and healthcare systems seek cost savings.

4. What regional differences impact arthritis drug pricing?

Developed markets typically feature higher prices due to regulatory standards and higher healthcare spending, whereas emerging economies benefit from lower prices, improved by biosimilar adoption and government negotiations.

5. What is the outlook for orphan biologics or personalized therapies?

These therapies will likely command premium prices due to their tailored nature and limited patient populations, but their market share will be constrained by high development costs and regulatory hurdles.

Sources:

[1] Fortune Business Insights. "Arthritis Drugs Market Size, Share & Industry Analysis." 2022.

[2] World Health Organization. "Global Data on Arthritis and Its Burden." 2022.

[3] IQVIA. "Pharmaceutical Pricing Trends." 2023.

[4] Deloitte. "Biosimilars and Their Impact on Pricing." 2022.

[5] European Medicines Agency. "Patent Status and Market Entry of Biosimilars." 2023.

[6] EvaluatePharma. "Global Biosimilars Market Outlook." 2023.

More… ↓