Last updated: July 30, 2025

Introduction

ARFORMOTEROL is a selective beta-2 adrenergic receptor agonist used as a bronchodilator in the treatment of severe Chronic Obstructive Pulmonary Disease (COPD). Its inhalation formulation provides rapid relief of bronchospasm, enhancing respiratory function in refractory cases. As a relatively niche drug within the respiratory therapeutics segment, understanding its market landscape and price trajectory is crucial for stakeholders across pharmaceutical companies, investors, and healthcare providers.

Market Landscape Overview

Therapeutic Context and Indication

ARFORMOTEROL primarily addresses severe COPD cases that are unresponsive to other bronchodilators. The global COPD market was valued at approximately USD 13.5 billion in 2021, projected to grow at a CAGR of 4.4% through 2030, driven by rising smoking prevalence, aging populations, and increasing awareness of respiratory health [1].

Within this market, bronchodilators like long-acting beta-agonists (LABAs) and short-acting agents (SABAs) dominate. ARFORMOTEROL's niche status as an inhaled, rapid-onset agent positions it as either a second-line or adjunct therapy, especially in hospital settings.

Competitive Landscape

The competitive environment includes several well-established drugs: salmeterol, formoterol, indacaterol, and newer agents like olodaterol. These alternatives benefit from broader marketing, longer duration of action, or combination formulations. Nevertheless, ARFORMOTEROL's unique pharmacodynamic profile and delivery method offer specific clinical advantages, especially for acute or refractory bronchospasms.

The drug's market penetration depends on approval status in key markets, physician familiarity, and formulary inclusion. Currently, ARFORMOTEROL's regulatory status varies globally, with certain markets facilitating its availability as a prescription medication or in hospital formularies.

Regulatory and Patent Landscape

Patent expirations and exclusivity periods critically influence market dynamics. The expiration of patents enables biosimilar or generic competitors, leading to price reductions and market share shifts. Conversely, new formulations or delivery systems, often under patent, can extend market exclusivity.

Market Potential and Key Drivers

Global and Regional Market Size

-

United States: As the largest COPD market (~USD 8 billion), U.S. regulatory approval, reimbursement policies, and clinical adoption significantly impact ARFORMOTEROL's sales potential.

-

Europe: The European COPD market is similarly mature, with high prevalence rates, regulatory acceptance, and well-established distribution channels.

-

Emerging Markets: Rapid urbanization and increasing smoking rates contribute to growth prospects in Asia-Pacific, Latin America, and Africa, albeit with challenges related to affordability and healthcare infrastructure.

Clinical Adoption Factors

- Efficacy and Safety Profile: Favorable outcomes, rapid onset, and tolerability influence prescriber preference.

- Formulation and Delivery: Inhaler device improvements and combination therapies could integrate ARFORMOTEROL effectively.

- Guideline Placement: Inclusion in treatment standards (e.g., GOLD guidelines) enhances clinical uptake.

Pricing and Reimbursement Dynamics

Pricing strategies are affected by regulatory decisions, competitive landscape, and payer negotiations. Reimbursement policies in developed markets tend to favor drugs demonstrating cost-effectiveness and clinical benefit, impacting achievable retail prices.

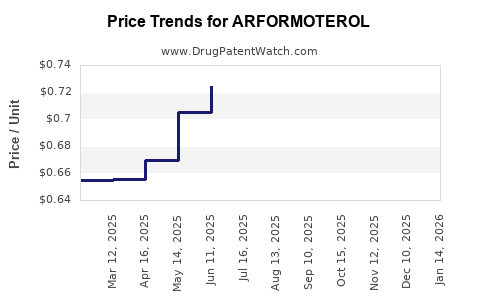

Price Projections for ARFORMOTEROL

Current Pricing (Baseline Assessment)

-

United States: Inhaled bronchodilators range from USD 250 to USD 400 per month, with ARFORMOTEROL estimated at approximately USD 350 per inhaler, based on comparable therapy prices.

-

Europe: Price points are similar, although national reimbursements and formularies could shift net prices downward.

Short-term (1-3 years) Outlook

- Stable Pricing: Without significant patent or regulatory changes, prices are likely to remain within a 3-5% annual variance.

- Potential Discounts: Payer pressures and entry of generics could lead to discounts up to 20%, especially post-patent expiry.

Long-term (3-10 years) Outlook

- Patent Expiry Effect: Entry of biosimilars or generics post-patent expiration (anticipated around 2028) could reduce prices by 30-50%, aligning with trends observed with other bronchodilators.

- Market Penetration & Volume: Growth in COPD prevalence, especially in emerging markets, could offset price declines with increased volume sales.

- Innovation and Label Expansion: Development of fixed-dose combinations or novel inhaler devices could command premium pricing, sustaining higher price levels.

Pricing Strategies and Factors Influencing Future Cost

- Market Entry Timing: Early market entry and dominance could preserve higher revenue streams.

- Regulatory Incentives: Orphan drug status or expedited approvals could impact pricing flexibility.

- Cost-Effectiveness: Demonstrating superior efficacy or safety could justify premium pricing.

Regulatory and Market Entry Considerations

- Approval Pathways: Gaining approval in major markets enhances revenue potential. The pathway depends on clinical trial data, existing formulations, and regional regulations.

- Market Access: Engagement with payers to establish reimbursement levels is pivotal. Price negotiations often hinge on cost-effectiveness analyses.

- Manufacturing Scale: Large-scale production reduces unit costs, enabling competitive pricing post-patent expiry.

Risk Factors and Market Uncertainties

- Regulatory Delays: Slow approval processes may cap revenue.

- Competitive Substitutes: Superior or more cost-effective inhaled agents could erode market share.

- Patent Litigation: Patent disputes or challenges could affect exclusivity.

Key Takeaways

- Market Dynamics: ARFORMOTEROL occupies a niche within the expansive COPD treatment landscape, with growth driven by COPD prevalence, formulation advantages, and clinical acceptance.

- Price Trajectory: Presently, prices align with inhaled bronchodilators (~USD 350 per inhaler), with potential declines of up to 50% post-patent expiration or due to generic entry.

- Strategic Outlook: Early regulatory approval, inclusion in treatment guidelines, and integration into combination therapies can enhance pricing power and market penetration.

- Market Risks: Competitive pressure, patent challenges, and regulatory hurdles pose ongoing risks to sustained pricing and revenue streams.

- Investment Implications: Stakeholders should monitor regulatory developments, patent status, and competitor activity to refine financial forecasts.

FAQs

Q1: What are the primary clinical advantages of ARFORMOTEROL over other bronchodilators?

A: ARFORMOTEROL offers rapid onset of action and high selectivity for beta-2 receptors, beneficial in acute or refractory bronchospasm, with a favorable safety profile.

Q2: How will patent expiration influence ARFORMOTEROL’s price levels?

A: Post-patent expiration, biosimilar and generic entrants are likely to drive prices down by 30-50%, reducing profit margins but potentially expanding market volume.

Q3: Which regions present the most growth opportunities for ARFORMOTEROL?

A: Emerging markets in Asia-Pacific, Latin America, and Africa offer growth potential due to rising COPD prevalence and expanding healthcare access, despite price sensitivity.

Q4: How do regulatory pathways impact ARFORMOTEROL’s market access?

A: Regulatory approval in key markets like the U.S. and Europe is essential for commercialization. Expedited pathways or orphan designation could accelerate market entry and influence pricing.

Q5: What factors could enable ARFORMOTEROL to command premium prices?

A: Demonstrable superior efficacy, unique delivery systems, combination formulations, or inclusion in treatment guidelines can support higher pricing strategies.

References

- Global COPD Market Size, Share & Trends Analysis Report. (2021). Fortune Business Insights.

- European Respiratory Society. (2020). COPD guidelines and pharmacological management.

- U.S. Food and Drug Administration (FDA). Approved drugs database.

- IQVIA. (2022). Global Healthcare Insights.

This analysis aims to equip stakeholders with comprehensive insights into the current and projected market scenarios for ARFORMOTEROL, enabling informed strategic decision-making.