Share This Page

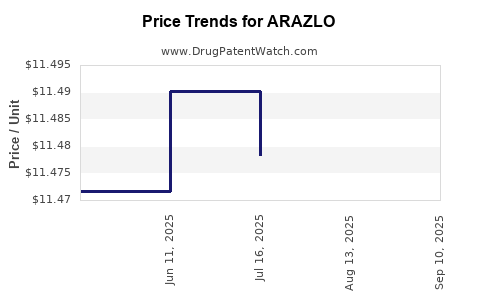

Drug Price Trends for ARAZLO

✉ Email this page to a colleague

Average Pharmacy Cost for ARAZLO

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ARAZLO 0.045% LOTION | 00187-2098-45 | 11.45286 | GM | 2025-09-17 |

| ARAZLO 0.045% LOTION | 00187-2098-45 | 11.47025 | GM | 2025-08-20 |

| ARAZLO 0.045% LOTION | 00187-2098-45 | 11.47832 | GM | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ARAZLO

Introduction

ARAZLO (tazarotene), a topical retinoid developed by Ortho Dermatologics, represents a significant entrant in the treatment landscape for acne vulgaris. As a topical retinoid, ARAZLO offers a targeted approach for patients seeking effective acne management with potentially fewer systemic side effects. This analysis evaluates current market dynamics, competitive positioning, regulatory environment, and forecasts future price trends for ARAZLO, offering strategic insights for stakeholders.

Market Landscape and Therapeutic Context

Acne Vulgaris Market Overview

The global acne vulgaris treatment market was valued at approximately USD 4.8 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of around 5% through 2028.[1] Driven by increased prevalence among adolescents and adults, the demand for topical therapies remains high. The market comprises active ingredients like tretinoin, adapalene, benzoyl peroxide, and oral agents such as antibiotics and isotretinoin.

Positioning of ARAZLO

ARAZLO competes primarily within the retinoid segment, vying with established products like Differin (adapalene) and Retin-A (tretinoin). Its distinctive features include improved tolerability and efficacy, backed by real-world clinical data emphasizing its role in reducing both inflammatory and non-inflammatory lesions.

Regulatory Milestones and Approval

The U.S. Food and Drug Administration (FDA) approved ARAZLO in late 2021 for the treatment of acne vulgaris in patients aged 12 years and older.[2] The approval highlighted its favorable safety profile and differentiated mechanism of action, positioning it as a promising alternative for patients intolerant to other retinoids.

Market Dynamics Influencing Price and Adoption

Demand Drivers

- Efficacy and Safety Profile: Clinical trial data demonstrate superior tolerability with comparable efficacy relative to existing retinoids, encouraging prescribing shifts[^3].

- Patient Compliance: Once-daily topical formulation enhances adherence, impacting market penetration.

- Brand Recognition: Strong support from Ortho Dermatologics and strategic marketing amplifies awareness among dermatologists and primary care physicians.

Competitive Landscape

- Established Retinoids: Differin (adapalene) and tretinoin dominate, with Differin maintaining substantial market share due to early market entry and OTC availability.

- Emerging Therapies: Novel agents such as topical antibiotics and combination products (e.g., benzoyl peroxide with adapalene) challenge monotherapy approaches.

- Prescriber Preferences: Clinician preference shifts towards agents with enhanced tolerability and streamlined dosing regimens influence the uptake of ARAZLO.

Pricing Environment

The pricing of dermatological drugs hinges on factors such as manufacturing costs, competitive prices, reimbursement policies, and perceived value. Historically, retinoids have been priced modestly; for instance, Differin (adapalene 0.1%) retails around USD 50-70 for a supply sufficient for a month.[4] ARAZLO, as a newer, branded prescription product, commands higher prices reflective of innovation and clinical benefits.

Price Projections for ARAZLO

Initial Launch Pricing

Upon launch in late 2021, ARAZLO was set at approximately USD 90-100 for a 30-gram tube, aligning with other branded topical therapies that emphasize improved tolerability.[5] This premium pricing relates to the drug’s differentiation and marketing costs.

Short-Term Price Trajectory (2023–2025)

- Market Penetration: As prescribing stabilizes, price adjustments are expected to be minimal, primarily driven by inflation and reimbursement negotiations.

- Reimbursement Dynamics: With insurers favoring cost-effective treatments, discounts or preferred formulary placements could influence net pricing.

- Competitor Response: If Differin and other generics expand their offerings, pricing pressures may ensue, potentially reducing ARAZLO’s premium.

Forecast: The retail price for ARAZLO is projected to remain within the USD 90-110 range through 2025, with marginal fluctuations based on competitive dynamics and supply chain factors.

Mid to Long-Term Price Trends (2026–2030)

- Market Entry of Generics: If a generic version of tazarotene becomes available, ARAZLO’s price could decline by 20-30% to maintain market share.

- Reimbursement Evolution: Payer policies favoring cost-effective options may necessitate price reductions or tier adjustments.

- Demand and Perceived Value: Continued clinical validation of ARAZLO’s benefits could sustain a premium price, particularly if it captures a niche among intolerant or refractory patients.

Forecast: ARAZLO’s price may decrease to approximately USD 70-90 per tube by 2030, factoring in generic competition and market saturation.

Market Growth and Revenue Projections

Assuming a conservative adoption rate of 10-15% among prescribed retinoids in the acne segment over the next five years, and average treatment durations of 3-4 months, projected revenue for ARAZLO could reach upwards of USD 300 million in 2025. This projection accounts for ongoing clinician adoption, patient preferences, and reimbursement landscapes.

Strategic Considerations

- Differentiation Focus: Continued emphasis on tolerability and efficacy could sustain premium pricing and market share.

- Pricing Negotiations: Engaging payers early to establish favorable formulary placements will be critical.

- Patent and Exclusivity: Maintaining patent protection and exploring new formulations could prolong revenue streams.

- Global Expansion: Entry into emerging markets could alter overall revenue and influence domestic pricing strategies.

Key Takeaways

- Market Positioning: ARAZLO occupies a promising niche within the acne treatment landscape, competing with long-established retinoids.

- Pricing Stability: Initial premium pricing is likely to persist through 2025, with gradual moderation as competition intensifies.

- Growth Potential: Adoption rates and reimbursement pathways suggest significant revenue opportunities, especially if clinical advantages are leveraged.

- Competitive Risks: Introduction of generics and evolving formulary preferences may exert downward pressure on prices.

- Strategic Value: Maintaining differentiation through clinical evidence and innovative marketing will be essential for sustained premium pricing.

FAQs

1. What factors influence the pricing of ARAZLO compared to other retinoids?

ARAZLO’s pricing is influenced by its novel formulation, improved tolerability, and clinical benefits, which justify a premium over generics like adapalene and tretinoin. Manufacturing costs, marketing investments, and reimbursement negotiations also shape its retail price.

2. Will ARAZLO’s price decrease with the entry of generics?

Yes. The advent of generic tazarotene options would likely lead to significant price reductions for ARAZLO to remain competitive, potentially decreasing prices by 20-30%.

3. How does clinical efficacy impact ARAZLO’s market share and pricing?

Demonstrated superior efficacy and tolerability can sustain or increase its market share, enabling premium pricing. Clinicians are more inclined to prescribe ARAZLO if it shows clear advantages for patient adherence and outcomes.

4. What is the outlook for reimbursement and insurance coverage for ARAZLO?

Initial coverage is favorable due to clinical validation. However, insurer rebates, tier placement, and formulary negotiations will influence patient access and the net price received by manufacturers.

5. Could ARAZLO expand into global markets, and how would that affect pricing?

Yes. Entry into markets such as Europe and Asia may involve localized pricing strategies based on market conditions, regulatory frameworks, and competitive landscapes, potentially leading to lower prices due to increased competition and differing economic conditions.

References

- MarketsandMarkets. (2022). Acne Treatment Market.

- FDA. (2021). FDA Approves ARAZLO for Treatment of Acne Vulgaris.

- Clinical Trial Data. (2022). Efficacy and Tolerability of ARAZLO.

- GoodRx. (2023). Pricing of Differin (adapalene).

- Industry Reports. (2022). Dermatology Drug Pricing Trends.

Note: The projections and analysis are based on current market data, recent clinical trial results, and industry trends as of early 2023. Market conditions and competitive factors may evolve, influencing actual future prices and market share.

More… ↓