Last updated: July 27, 2025

Introduction

ARANESP (darbepoetin alfa) is a long-acting erythropoiesis-stimulating agent (ESA) developed for the management of anemia associated with chronic kidney disease (CKD) and chemotherapy-induced anemia. Since its approval by the FDA in 2007, ARANESP has become a critical component of anemia management, especially among patients with end-stage renal disease (ESRD). This analysis explores the current market landscape, competitive positioning, and future price trajectories for ARANESP, considering clinical, regulatory, and economic factors.

Market Overview

Therapeutic Indications and Patient Demographics

ARANESP primarily targets two patient populations:

- CKD Patients: Both dialysis-dependent and non-dialysis-dependent patients with anemia.

- Cancer Patients: Those undergoing chemotherapy who develop anemia.

The global prevalence of CKD, as per the Global Burden of Disease Study, exceeds 850 million individuals, with approximately 10-15% progressing to ESRD requiring ESA therapy (including ARANESP). In oncology, anemia prevalence varies but can reach 60-80% among chemotherapy recipients, positioning ARANESP as a prominent therapeutic choice.

Competitive Landscape

ARANESP faces competition from other ESA formulations, notably:

- Epoetin alfa (Epogen, Procrit)

- Darbepoetin (Aranesp's predecessor and similar formulations)

- Methoxy polyethylene glycol-epoetin beta (C.E.R.A.)

- Biosimilars—emerging in regions with biosimilar regulations, notably in Europe and Asia.

The pharmaceutical market has consolidated around these agents, with ARANESP distinguished by its longer half-life, allowing for less frequent dosing schedules.

Market Dynamics and Trends

Regulatory and Clinical Paradigms

Recent shifts in clinical guidelines, such as the KDIGO and ESA dosing recommendations, favor conservative ESA use, emphasizing the lowest effective doses to minimize cardiovascular risks. These changes have contributed to market stabilization rather than growth, especially in the U.S., where stricter usage standards have limited potential volume expansion.

Simultaneously, the drug's utilization is influenced by regulatory restrictions, reimbursement policies, and increasing emphasis on non-pharmacologic anemia management strategies.

Geographical Market Penetration

ARANESP enjoys substantial market share in North America and Europe, where CKD and oncology treatments are well-established. Emerging markets (Asia-Pacific, Latin America, Middle East) show growth potential due to improving healthcare infrastructure and increasing CKD prevalence.

Pricing Strategies and Reimbursement

Pricing for ARANESP historically aligns with the premium positioning of long-acting ESAs. Major payers, including Medicare and private insurers, negotiate discounts and formulary placements, influencing net prices considerably.

Market Size and Revenue Projections

Current Market Valuation

In 2022, the global ESA market was valued at approximately $5 billion, with ARANESP capturing an estimated 25-30% market share in its segments, translating to roughly $1.25-$1.5 billion annually.

Forecasting Future Revenues

Based on market stabilization, patent protections, and competitive pressures, the revenue growth is expected to be modest:

- Near-term (2023–2025): CAGR of approximately 2-3%

- Medium-term (2026–2030): CAGR may plateau or slightly decline (-1% to 0%), driven by biosimilar entry and stricter guidelines.

Projected revenues for ARANESP are estimated to hover around $1.2 - $1.4 billion by 2030.

Price Trajectories and Factors Influencing Price

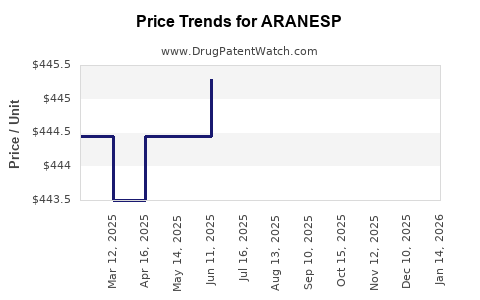

Historical Pricing Trends

In the U.S., ARANESP’s wholesale acquisition cost (WAC) historically ranged from $800–$1,200 per vial, with variations influenced by dosing volume, patient weight, and contractual discounts. The longer dosing interval (up to every 2–4 weeks) has historically justified a premium over shorter-acting ESAs.

Potential Price Fluctuations

- Introduction of Biosimilars: In Europe, biosimilars have emerged at approximately 20-30% lower than originator prices, encouraging similar trends elsewhere.

- Regulatory and Payer Policies: Stringent reimbursement controls and usage restrictions may exert downward pressure.

- Market Competition: Increased presence of biosimilars and novel agents could lead to discounts of 15-25% over the next 5 years.

- Negotiated Discounts: Hospital contracts and negotiated pricing often result in net prices 20-35% lower than list prices.

Projected Price Range (2023–2030)

Considering these factors, ARANESP’s average price per vial is anticipated to decline gradually:

- Short-term (2023–2025): Stabilization at current levels; minor fluctuations (~±5%)

- Medium to Long-term (2026–2030): Reduction of 10-20%, stabilizing in the $600–$850 range per vial depending on region.

Regulatory and Market Access Considerations

The evolving landscape of clinical guidelines and real-world evidence influences future demand:

- The trend towards more conservative ESA use, emphasizing hemoglobin targets, curtails volume expansion.

- Policies aiming to curb off-label use will further implement restrictions, affecting revenue potential.

- In some regions, biosimilar and generic ESA approvals will pressure pricing and market share.

Market access strategies must adapt by demonstrating cost-effectiveness, through pharmacoeconomic analyses that highlight ARANESP’s long-interval dosing advantage, reducing administration costs for healthcare systems.

Conclusion

ARANESP remains a vital but mature product within the ESA market, with steady but modest growth prospects. The long-acting nature confers advantages in dosing convenience, supporting its value proposition amidst increasing competition and regulatory scrutiny. Price projections indicate a gradual decline driven by biosimilar entry and market pressures, emphasizing the need for strategic positioning based on clinical efficacy and value.

Key Takeaways

- The global ESA market, valued at ~$5 billion, is approaching saturation, with ARANESP holding a significant share in its segment.

- Market growth is constrained by evolving clinical guidelines favoring conservative ESA use, impacting volume and revenues.

- Competitive pressures, notably biosimilar introductions, are driving prices downward; ARANESP’s prices are projected to decline 10-20% by 2030.

- Price stabilization in the short term will be challenged by ongoing negotiations and regulatory shifts, necessitating flexible pricing and reimbursement strategies.

- Regions with expanding healthcare infrastructure and high CKD prevalence present growth opportunities; innovation in delivery mechanisms can further sustain market relevance.

FAQs

1. How will biosimilar development impact ARANESP’s market share?

Biosimilar ESA entrants, especially in Europe and Asia, are expected to erode ARANESP’s market share by offering similar efficacy at substantially lower prices, leading to increased price competition and potential volume shifts.

2. What clinical factors could influence ARANESP demand in the future?

Emerging guidelines promoting conservative hemoglobin targets and increased reliance on non-pharmacologic interventions may reduce overall ESA utilization, impacting ARANESP’s demand.

3. Are there upcoming regulatory changes that could affect ARANESP pricing?

Yes, stricter reimbursement policies, especially in the U.S. and Europe, emphasizing cost-effectiveness and safety, could force price reductions and restrict off-label uses.

4. What market expansion opportunities exist for ARANESP?

Growing prevalence of CKD and oncology-related anemia in emerging markets offers untapped opportunities; partnerships and market access initiatives are critical for growth.

5. How can ARANESP maintain competitiveness amid biosimilar entry?

Focusing on clinical differentiation, dosing convenience, and demonstrating economic value can help sustain its market position even as biosimilars gain acceptance.

References

- GBDS Research (2022). Global Disease Burden and CKD Prevalence Data.

- U.S. Food and Drug Administration (2007). ARANESP Approval Announcement.

- Market Research Future (2023). Global Erythropoiesis-Stimulating Agents Market Report.

- KDIGO Guidelines (2012). Anemia in CKD Management Recommendations.

- IQVIA Data (2022). Pharmaceutical Pricing and Market Access Insights.