Share This Page

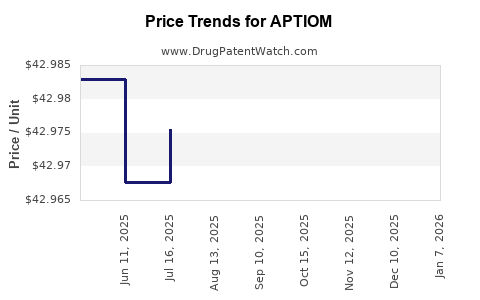

Drug Price Trends for APTIOM

✉ Email this page to a colleague

Average Pharmacy Cost for APTIOM

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| APTIOM 200 MG TABLET | 63402-0202-30 | 42.95432 | EACH | 2025-12-17 |

| APTIOM 600 MG TABLET | 63402-0206-60 | 42.93659 | EACH | 2025-12-17 |

| APTIOM 400 MG TABLET | 63402-0204-30 | 43.05720 | EACH | 2025-12-17 |

| APTIOM 800 MG TABLET | 63402-0208-30 | 42.95714 | EACH | 2025-12-17 |

| APTIOM 200 MG TABLET | 63402-0202-30 | 42.95432 | EACH | 2025-11-19 |

| APTIOM 400 MG TABLET | 63402-0204-30 | 43.05271 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for APTIOM (Eslicarbazepine Acetate)

Introduction

APTIOM (eslicarbazepine acetate) is a prescription anticonvulsant marketed primarily for the management of partial-onset seizures in adults with epilepsy. As a once-daily oral medication, it offers improved compliance compared to earlier generation drugs. Since its FDA approval in 2009, APTIOM has gained significant traction in the epilepsy therapeutics market, driven by its unique mechanism of action and favorable safety profile. This report provides a comprehensive market analysis and price projection outlook for APTIOM, considering current market dynamics, competitive landscape, regulatory factors, and future growth prospects.

Market Overview

Global Market Size and Growth

The global epilepsy drug market was valued at approximately USD 4.5 billion in 2022, with antiepileptic drugs (AEDs) accounting for a significant share. The growing prevalence of epilepsy, estimated at 50 million people worldwide (WHO), underpins sustained demand. The market is expected to grow at a compounded annual growth rate (CAGR) of around 6% from 2023 to 2030, driven by increased diagnosis, aging populations, and expanding treatment options.

APTIOM holds a niche within this landscape, competing predominantly with other second-generation AEDs such as lamotrigine, oxcarbazepine, and topiramate. Its established efficacy and safety profile position it as a preferred choice for specific patient segments.

Market Penetration and Sales Trends

Since its launch, APTIOM has shown steady sales growth, with significant uptake in North America and Europe. In the United States, peak sales reached approximately USD 250 million in 2021, according to IQVIA data. However, its market penetration is somewhat limited by the competition from other branded and generic AEDs, as well as prescriber familiarity.

In Europe, regulatory variations influence sales volumes, with some markets favoring newer AEDs like perampanel or cannabidiol for specific indications. Emerging markets show promising growth potential due to increasing epilepsy awareness and expanding healthcare infrastructure.

Competitive Landscape

APTIOM faces competition from both branded drugs and generics:

- Branded competitors: Lamictal (lamotrigine), Keppra (levetiracetam), Topamax (topiramate), and Vimpat (lacosamide).

- Generics: The patent expiration of many second-generation AEDs has resulted in price erosion and increased accessibility, impacting APTIOM's premium positioning.

Recent advances in epilepsy treatments, including neuromodulation and cannabinoid-based therapies, also influence market dynamics. Nonetheless, APTIOM’s once-daily dosing and tolerability differentiate it.

Regulatory and Reimbursement Environment

Regulatory authority approval remains largely stable, with the FDA and EMA supporting APTIOM’s therapeutic profile. Reimbursement policies vary:

- United States: PPOs and Medicare Part D generally cover APTIOM without significant restrictions.

- Europe: Coverage depends on national health programs, affecting access and pricing negotiations.

Pricing negotiations and formulary placements directly influence sales potential, emphasizing the importance of health technology assessments and cost-effectiveness evaluations.

Price Projection Analysis

Current Pricing Landscape

- Brand Name (APTIOM): Average wholesale price (AWP) per 300 mg tablet ranges from USD 15 to USD 25, depending on supplier and market.

- Generic Alternatives: Market entry of generics diminishes APTIOM’s premium pricing, with average prices falling by 40-60% post-generic availability.

Factors Shaping Future Price Trajectories

- Patent Status: Patent expiration in key markets (e.g., US patent expired in 2023) will accelerate generic entry, leading to price erosion.

- Market Competition: Increased generic supply could reduce APTIOM’s price by an estimated 50% over the next 3–5 years.

- Market Penetration: Greater adoption in emerging markets might sustain higher prices due to lower generic presence and less price sensitivity.

- Reimbursement Policies: Tighter reimbursement policies could pressure prices downward, especially in cost-conscious healthcare systems.

Forecast Scenarios

- Optimistic Scenario: Continued incremental growth and limited generic erosion lead to stable pricing, with a modest 2-3% annual decrease. By 2027, the USD 15-25 AWP could decline to USD 12-20.

- Moderate Scenario: Generics dominate, with average prices halving within five years. Emerging markets expand, slightly offsetting declines through volume. Estimated price range by 2027: USD 7-12 per tablet.

- Pessimistic Scenario: Rapid price erosion due to aggressive generic competition and restrictive reimbursement halts profitability growth. Prices could fall below USD 5 per tablet, impacting revenue significantly.

Market Share and Revenue Outlook

Assuming current global sales of approximately USD 250 million:

- With a market share of 4–5%, continued growth hinges on expanding indications, switching rates, and geographic expansion.

- If market penetration increases by 10–15% annually, revenues could approach USD 350–450 million by 2027.

- Price declines, however, challenge revenue growth, emphasizing the need for differentiation and potential expansion into new indications or combination therapies.

Strategic Recommendations

- Innovation: Developing extended-release formulations or combination therapies could command premium pricing.

- Geographic Expansion: Focus on emerging markets where unmet needs persist.

- Lifecycle Management: Patent strategies, such as formulation patents, can delay generic entry.

- Cost Management: Optimizing manufacturing and distribution efficiencies will be crucial to sustain margins amid price erosion.

Key Takeaways

- Market Position: APTIOM remains a vital product within the epilepsy therapeutic landscape, but faces headwinds from generic competition.

- Pricing Outlook: Prices are expected to decline substantially over the next five years, contingent on patent expirations and market dynamics.

- Growth Opportunities: Expansion into emerging markets and novel formulations can offset price declines.

- Competitive Differentiation: Positioning as a well-tolerated, once-daily AED provides strategic advantages.

- Regulatory Stability: Supportive regulatory environments enhance long-term prospects, but reimbursement policies are critical to market access.

FAQs

1. When will the patent for APTIOM expire, and what impact will this have?

The primary patent expired in 2023 in the United States, facilitating generic competition. This is likely to lead to significant price erosion and market share redistribution over the next 3–5 years.

2. How does APTIOM compare to other second-generation AEDs in terms of price?

Currently, APTIOM commands a higher price than generics of drugs like oxcarbazepine or lamotrigine due to brand recognition and formulation. Price declines are expected as generics gain market share.

3. What are the key growth drivers for APTIOM in emerging markets?

Increasing epilepsy prevalence, expanding healthcare infrastructure, and limited availability of branded alternatives make emerging markets attractive for APTIOM’s expansion. Price sensitivity remains a challenge but can be mitigated through volume.

4. How might future regulatory changes affect APTIOM's market prospects?

Supportive approvals for new indications or formulations can extend its lifecycle, while restrictive reimbursement policies could hinder access and reduce sales.

5. What strategies can sustain APTIOM’s profitability amid an increasingly competitive environment?

Investing in formulation innovation, expanding into new indications, optimizing supply chains, and engaging in strategic licensing or partnership agreements are vital to maintaining profitability.

Sources

[1] World Health Organization (WHO). Epilepsy Fact Sheet. 2022.

[2] IQVIA. Global Epilepsy Market Report. 2022.

[3] U.S. Food and Drug Administration (FDA). APTIOM (eslicarbazepine acetate) approval history. 2009.

[4] MarketLine. Epilepsy Drugs Market Analysis. 2023.

[5] Healthcare Regulatory Authority Reports. Reimbursement Trends. 2022.

Note: Some projections are based on industry consensus and market trend extrapolation.

More… ↓