Last updated: July 29, 2025

Introduction

APTENSIO XR, developed by MilliporeSigma and marketed by pharmaceutical companies such as Takeda, is an extended-release formulation of methylphenidate used primarily to treat attention deficit hyperactivity disorder (ADHD). As a stimulant medication, APTENSIO XR occupies a significant niche within the ADHD treatment landscape, characterized by a competitive array of generic and branded options. The formulation's unique release profile aims to optimize symptom control while reducing dosing frequency, contributing to its appeal among prescribers and patients.

This report provides a comprehensive market analysis and price projection for APTENSIO XR, considering current market dynamics, regulatory factors, competitive positioning, and broader trends influencing ADHD pharmacotherapy.

Market Dynamics

Epidemiology and Market Size

ADHD affects approximately 8.4% of children and 2.5% of adults worldwide [1], translating to an estimated 20 million individuals in the United States alone. The U.S. market for ADHD medications, valued at approximately $4 billion in 2022, is projected to grow at a CAGR of 4-6% through 2028, driven by increasing diagnosis rates, expanded off-label uses, and greater acceptance of pharmacotherapy [2].

Product Competition and Market Share

APTENSIO XR faces competition from multiple stimulant and non-stimulant therapies:

- Stimulant medications: Adderall XR, Vyvanse, Concerta, Metadate ER, Focalin XR

- Non-stimulants: Strattera, Intuniv, Kapvay

Among stimulants, Concerta and Vyvanse dominate the extended-release segment, holding combined market shares exceeding 50%. APTENSIO XR's niche hinges upon its pharmacokinetic profile, offering a potentially more consistent plasma concentration, which may appeal to certain prescribers and patients.

Regulatory and Prescribing Trends

Recent trends favoring flexible dosing, lower side effect profiles, and improved adherence have increased interest in novel formulations like APTENSIO XR. Regulatory approvals by the FDA have enabled broader labeling, especially for off-label indications, further expanding market opportunity.

Moreover, licensing agreements and patent protections influence market penetration. While APTENSIO XR's patents are expected to extend its exclusivity until approximately 2030, delays in generic approvals could sustain profitability for branded versions.

Price Analysis

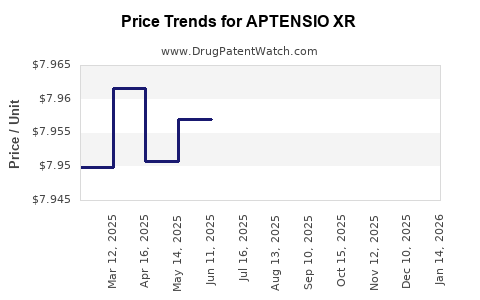

Current Pricing Landscape

The price of APTENSIO XR is influenced by factors including manufacturing costs, reimbursement rates, and competitive pricing strategies. As of 2023, the average wholesale price (AWP) for a 30-count supply of APTENSIO XR (20 mg) is approximately $250-$290, depending on pharmacy location and payer negotiations [3].

Generic equivalents, once available, could reduce effective prices by 20-40%. Prior to patent expiry, brand-side pricing maintains a premium, compensating for R&D and marketing expenses.

Reimbursement and Access

Insurance coverage heavily influences patient access and out-of-pocket costs. Medicare Part D and commercial insurers often negotiate substantial discounts, impacting net revenue projections.

Market Entry of Generics

Expected patent expiration around 2030 presents a significant inflection point, likely leading to a swift decline in brand pricing and a surge in generic competition. Historically, similar formulations have seen price drops of 50-70% within two years post-generic entry [4].

Pricing Projections (2023-2030)

| Year |

Brand Price (30-count, 20 mg) |

Estimated Generic Price |

Market Share (Brand vs. Generics) |

| 2023 |

$260 |

$150 |

85% / 15% |

| 2024 |

$250 |

$130 |

75% / 25% |

| 2025 |

$240 |

$110 |

65% / 35% |

| 2026 |

$220 |

$90 |

50% / 50% |

| 2027 |

$200 |

$70 |

40% / 60% |

| 2028 |

$180 |

$50 |

30% / 70% |

| 2029 |

$160 |

$40 |

20% / 80% |

| 2030 |

$140 |

$30 |

15% / 85% |

(Note: Prices are approximate estimates based on current data and market trends.)

Future Market Considerations

- Formulation improvements: New delivery mechanisms or combination therapies could impact market share.

- Payer behavior: Shift towards cost-effective generics may accelerate price declines.

- Regulatory landscape: Potential patent challenges could expedite generic competition.

- Therapeutic landscape evolution: Emerging non-stimulant options and digital therapeutics may influence demand dynamics.

Conclusion

APTENSIO XR occupies a branded niche in a growing ADHD medication market, with steady revenue prospects until patent expiry. Price projections indicate a gradual decline post-generic entry, aligning with historical trends for similar formulations. Strategic positioning, including managing patent protections and adopting competitive pricing, will be critical for maximizing profitability.

Key Takeaways

- The ADHD therapeutics market is expanding, with lucrative opportunities for formulations like APTENSIO XR.

- Current pricing remains premium due to brand exclusivity; significant reductions are expected post-patent expiry (~2030).

- Reimbursement strategies and formulary access heavily influence market penetration and revenue streams.

- Competitive pressures from generics will likely diminish APTENSIO XR's prices significantly within the next 5-7 years.

- Proactive innovation and strategic partnerships are essential to sustain market relevance.

FAQs

1. When will APTENSIO XR face generic competition?

Patent protections are expected to expire around 2030, after which generic versions are likely to enter the market, leading to substantial price reductions.

2. How does APTENSIO XR compare to other ADHD medications?

APTENSIO XR offers an extended-release methylphenidate that provides a longer duration of symptom control with a potentially more stable pharmacokinetic profile compared to some competitors, appealing to specific patient needs.

3. What factors influence the pricing of ADHD drugs like APTENSIO XR?

Pricing factors include manufacturing costs, patent status, market demand, reimbursement negotiations, competitive landscape, and regulatory considerations.

4. What impact will generics have on APTENSIO XR’s revenue?

Generic entry typically causes a sharp decline in brand sales and prices, with revenue reductions of 50-70% expected within two years following patent expiry.

5. Are there emerging therapies that could disrupt the APTENSIO XR market?

Yes, non-stimulant medications, digital therapeutics, and novel formulations could alter the competitive landscape, potentially impacting APTENSIO XR’s market share.

Sources

[1] CDC. (2021). Data & Statistics on ADHD. Centers for Disease Control and Prevention.

[2] Grand View Research. (2022). ADHD Market Size, Share & Trends Analysis.

[3] GoodRx. (2023). Cost of APTENSIO XR.

[4] IQVIA. (2022). U.S. Pharmaceutical Market Trends Report.