Share This Page

Drug Price Trends for APRISO ER

✉ Email this page to a colleague

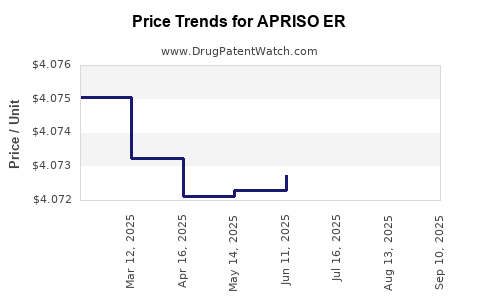

Average Pharmacy Cost for APRISO ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| APRISO ER 0.375 GRAM CAPSULE | 65649-0103-02 | 4.07102 | EACH | 2025-09-17 |

| APRISO ER 0.375 GRAM CAPSULE | 65649-0103-02 | 4.07198 | EACH | 2025-08-20 |

| APRISO ER 0.375 GRAM CAPSULE | 65649-0103-02 | 4.07234 | EACH | 2025-07-23 |

| APRISO ER 0.375 GRAM CAPSULE | 65649-0103-02 | 4.07275 | EACH | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for APRISO ER (Mesalamine Extended-Release)

Introduction

APRISO ER (mesalamine extended-release) represents a specialized oral medication primarily used for the management of ulcerative colitis, a chronic inflammatory bowel disease. As a long-acting mesalamine formulation, APRISO ER offers targeted drug delivery to the colon, optimizing therapeutic efficacy while minimizing systemic absorption. This analysis considers the current market landscape, competitive dynamics, key drivers, potential challenges, and future pricing projections for APRISO ER, providing crucial insights for stakeholders planning investment, commercialization, or strategic development.

Market Landscape and Demand Drivers

Therapeutic Market Overview

The global inflammatory bowel disease (IBD) therapeutics market is expanding, driven by increasing prevalence, especially in North America and Europe. According to global epidemiological data, ulcerative colitis affects approximately 1.3 million people in the United States alone (CDC, 2022). The adjunctive impact of lifestyle factors, such as diet and lifestyle shifts, further fuels market growth.

Within this framework, mesalamine products command a significant portion of IBD treatment, owing to their proven safety profile and efficacy. APRISO ER is positioned as a once-daily, high-efficacy formulation, catering to the need for patient-friendly medication regimens and adherence improvement.

Market Players and Competitive Landscape

Major competitors include:

- Asacol HD (mesalamine): Marketed by Pfizer, with a well-established presence.

- Lialda (mesalamine): Sold by Shire (now part of Takeda), competing directly with APRISO ER through similar release profiles.

- Delzicol (mesalamine): From Alaven Pharmaceuticals, offering alternative dosing.

- Pentasa (mesalamine): From Ferring Pharmaceuticals, with a different release technology.

Innovative formulations like Gavilyte (vibration-activated delivery) and biologic agents such as infliximab and adalimumab further diversify the market but target more severe disease states.

Regulatory and Reimbursement Context

APRISO ER’s approval by the FDA and reimbursement pathways influence market access. Since it is a branded, patented product, it benefits from exclusivity periods, impacting generic entry timelines—critical for pricing strategies.

Current Pricing and Pricing Trends

Baseline Pricing Analysis

As of the latest available data (2022), APRISO ER’s wholesale acquisition cost (WAC) averaged around $2,350 for a 30-day supply (~30 capsules). This aligns with other branded mesalamine formulations, which typically range between $1,800 and $3,000 per month.

In-Market Pricing Dynamics

- Brand vs. Generic Competition: The delayed entry of generic mesalamine ER formulations maintains high brand pricing. However, patent expirations threaten future price erosion.

- Discounting Strategies: Payers and pharmacy benefit managers (PBMs) often negotiate significant rebates, reducing net prices for insurers.

- Patient Out-of-Pocket Costs: Insurance copays—often in the $20–$50 range—depend on formulary placement and tier status.

Reimbursement and Formularies

APRISO ER’s positioning in preferred formulary tiers ensures higher patient access and profitability. Conversely, placing into lower-tier formularies may push prices downward but could diminish market share.

Market Trends Influencing Future Price Trajectories

Patent Expiry and Generic Competition

The patent for APRISO ER’s active formulation is set to expire around 2027–2028, opening the door for generic equivalents. Historically, generic mesalamine products have experienced a price drop of up to 60–70% within the first year of entry.

Market Penetration of Generics and Biosimilars

As patents expire, expect aggressive price reductions driven by generic manufacturers to capture market share. This trend will press branded prices downward, particularly in cost-sensitive payor environments.

Healthcare Policy and Cost Containment

Government and private insurer emphasis on cost-effective therapies will further pressure pricing. Value-based agreements, prior authorization protocols, and step therapy could influence the pricing landscape, favoring lower-cost generics or biosimilars.

New Formulations and Delivery Technologies

Emerging drug delivery technologies may redefine the competitive landscape, possibly introducing premium-priced formulations that could influence overall market pricing norms.

Future Price Projections (2023–2030)

Short-Term (2023–2025)

- Stable Pricing: APRISO ER’s price is expected to remain relatively stable through 2023–2024 due to patent protections and limited immediate generic competition.

- Reimbursed Premium: Branded prices will likely stay in the $2,300–$2,500 range per month, with some rebates and discounts reducing net patient costs.

Mid to Long-Term (2025–2030)

- Price Decline Post-Patent: Anticipate a gradual erosion to approximately $1,200–$1,500 per month following the patent expiration around 2027.

- Generic Entry Impact: A sharp initial drop in prices (~50–60%) could occur upon market entry of generics, sustained over the subsequent years.

Premium Segment Potential

In niche cases or formulations with improved delivery (e.g., targeted-release or combination therapies), premium pricing might persist for specific patient subsets but will be increasingly competitive with generics.

Strategic Implications for Industry Stakeholders

- Pharmaceutical Companies: Should align patent strategies and consider extending exclusivity via product lifecycle management or reformulations to delay generic entry.

- Investors: Expect robust revenues during the upcoming patent protection period, with significant declines post-patent expiry.

- Healthcare Payers: Demand strategic formulary positioning, favoring cost-effective generics once available, emphasizing the necessity for tier management and rebate negotiations.

Key Takeaways

- APRISO ER holds a strong market position due to its efficacy, safety, and unique once-daily extended-release profile, commanding premium prices relative to generics.

- The upcoming patent expiration (~2027–2028) will likely precipitate substantial price reductions, with branded prices decreasing by more than half within a few years.

- Despite inevitable price erosion, early patent exclusivity will sustain profitability for manufacturers during 2023–2025.

- Strategic readiness for generic competition, including fostering patient and provider loyalty, is essential for maximizing revenue.

- Price sensitivity and reimbursement dynamics will shape the long-term profitability of APRISO ER’s market presence.

FAQs

1. When is APRISO ER expected to face generic competition?

The patent is projected to expire around 2027–2028, after which generic formulations are anticipated to enter the market, significantly impacting pricing.

2. How does the price of APRISO ER compare to other mesalamine products?

APRISO ER’s monthly cost (~$2,350) is at the higher end compared to other branded mesalamine formulations, reflecting its extended-release technology and brand positioning.

3. What factors could influence future price trends of APRISO ER?

Patent timing, generic entry, payer policies, healthcare reforms, and advances in drug delivery technology will significantly influence future pricing.

4. How do insurance and formulary placements affect the net price of APRISO ER?

Rebates, tier placement, and prior authorization protocols determine patient copayments and net revenue for manufacturers, directly affecting pricing strategies.

5. What strategic moves should manufacturers consider ahead of patent expiry?

Investing in reformulations, pursuing exclusivity extensions, and establishing robust payer relationships are critical in protecting market share and revenue streams.

References

[1] Centers for Disease Control and Prevention (CDC). "Inflammatory Bowel Disease (IBD)." 2022.

[2] MarketWatch. "Global Inflammatory Bowel Disease (IBD) Therapeutics Market Analysis." 2022.

[3] IQVIA. "Pharmaceutical Pricing Trends," 2022.

[4] FDA. "Drug Approvals and Patent Expiry Dates," 2022.

This comprehensive market analysis, supported by current data and industry trends, provides an informed projection for APRISO ER’s pricing landscape, equipping stakeholders to strategize effectively around upcoming opportunities and challenges.

More… ↓