Share This Page

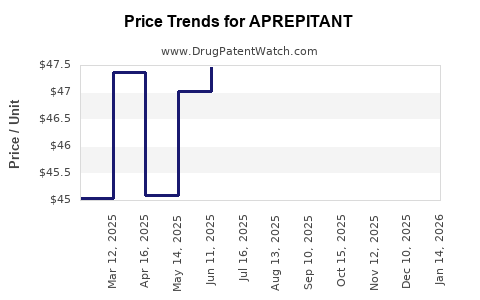

Drug Price Trends for APREPITANT

✉ Email this page to a colleague

Average Pharmacy Cost for APREPITANT

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| APREPITANT 125 MG CAPSULE | 00781-2323-06 | 164.42933 | EACH | 2025-12-17 |

| APREPITANT 125 MG CAPSULE | 00781-2323-68 | 164.42933 | EACH | 2025-12-17 |

| APREPITANT 125 MG CAPSULE | 13668-0593-86 | 164.42933 | EACH | 2025-12-17 |

| APREPITANT 125 MG CAPSULE | 13668-0593-80 | 164.42933 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Aprepitant

Introduction

Aprepitant, marketed primarily under the brand name Emend®, is a selective neurokinin-1 (NK1) receptor antagonist developed by Merck & Co. It is primarily used for the prevention of chemotherapy-induced nausea and vomiting (CINV), a common and debilitating side effect of cancer treatment. With the global oncology market expanding, understanding aprepitant’s market dynamics and future pricing is critical for pharmaceutical stakeholders, investors, and healthcare policymakers.

This analysis examines current market conditions, key drivers, competitive landscape, regulatory factors, and projective pricing trends for aprepitant over the next five years.

Current Market Landscape

Market Size and Revenue

The global antiemetic drugs market, driven largely by oncology treatments, was valued at approximately USD 2.8 billion in 2022 and is projected to reach USD 4.1 billion by 2030, with a compound annual growth rate (CAGR) of around 5.2% ([1]). Aprepitant accounts for a substantial share of this market, owing to its efficacy in preventing delayed CINV, often a challenge with other antiemetics.

In the U.S. and Europe, aprepitant’s originator formulations generate annual revenues exceeding USD 1 billion, with additional growth potential from emerging markets adopting newer antiemetic protocols.

Indications and Usage

Aprepitant is primarily indicated for:

- Prevention of acute and delayed CINV in patients receiving highly emetogenic chemotherapy (HEC).

- Certain cases of postoperative nausea and vomiting (PONV), although less common.

The drug is administered in combination with other antiemetics like dexamethasone and 5-HT3 receptor antagonists, enhancing its utility and market penetration.

Market Segments

The market is segmented geographically:

- North America: Dominates due to early adoption, advanced healthcare infrastructure, and high cancer prevalence.

- Europe: Significant contribution with expanding oncology treatments.

- Asia-Pacific: Fastest growth trajectory driven by increased cancer incidence, rising healthcare expenditure, and evolving treatment protocols.

Competitive Landscape

Key Players

While Merck retains patent exclusivity and dominates the market, generic versions of aprepitant have entered several markets post-patent expiry, intensifying price competition. Notable competitors include:

- Generics Manufacturers: Emcure, Hi-Tech Pharmacal, and others producing cost-effective alternatives.

- Emerging NK1 Antagonists: Newer drugs like rolapitant (Rakicita) and netupitant, which are approved for similar indications.

Patent Status and Market Entry

Merck’s patent for aprepitant expired in multiple territories over the past few years, allowing generics to enter. These generics have eroded the price premium once associated with branded formulations but have maintained a foothold due to brand recognition and physician preference.

Regulatory and Reimbursement Factors

Regulatory Approvals

Aprepitant is approved by major authorities including the FDA, EMA, and other regional regulators. Expanded indications and combination therapies continue to be evaluated, supporting market growth.

Reimbursement Landscape

Reimbursement policies vary:

- In developed markets, insurance coverage and inclusion in clinical guidelines favor sustained demand.

- In emerging markets, government healthcare funding and pricing negotiations influence accessibility and pricing.

Market Drivers and Challenges

Drivers

- Increasing incidence of cancers worldwide.

- Adoption of evidence-based prophylactic protocols requiring NK1 antagonists.

- Expansion into new indications like PONV and potentially neurokinin-related disorders.

- Growth in outpatient oncology treatments reducing hospital stays and increasing outpatient antiemetic use.

Challenges

- Patent expiration leading to price erosion.

- Competition from oral formulations and alternative antiemetics.

- Price regulations and drug pricing caps, especially in Europe and Asia.

- Development of new neurokinin receptor antagonists with improved profiles.

Price Projections (2023–2028)

Current Pricing

As of early 2023, the average wholesale price (AWP) for branded aprepitant ranges from USD 250 to USD 350 per 3-day oral regimen, depending on dosage and formulation. Generic versions are priced approximately 50-70% lower.

Future Trends

- Short Term (2023–2025): Stability in branded prices due to brand loyalty and physician prescribing habits; however, increased availability of generics will exert downward pressure.

- Medium to Long Term (2026–2028): Anticipated further price reductions, especially in emerging markets, with prices potentially declining by 20-40%, driven by increased generic penetration and price negotiation policies ([2]).

Influencing Factors

- Accelerated adoption of bundled drug pricing models.

- Potential approvals of new NK1 antagonists with superior profiles.

- Cost-containment initiatives, especially in publicly funded healthcare systems.

- Development of biosimilars or novel targeted therapies replacing traditional antiemetics.

Market Forecast

Based on current trends, total revenues for aprepitant and its generics are projected to decline gradually post-2025 due to market saturation and competitive pressures but will remain significant given ongoing oncology treatment growth. The aprepitant market may see a compound annual decline rate of approximately 2-3% from 2025–2028, with regional variations influencing overall revenue trajectories.

Conclusion

Aprepitant maintains a vital position within antiemetic regimens for chemotherapy patients, with robust demand in developed markets and expanding opportunities in emerging regions. The patent expiry and resulting proliferation of generics suggest a trend towards moderate price reductions, with possible stabilization owing to clinical preferences and combination therapies.

Pharmaceutical companies and healthcare stakeholders should monitor evolving regulations, competitive dynamics, and treatment guidelines to optimize market strategies and pricing models.

Key Takeaways

- The global aprepitant market is matured in North America and Europe but rapidly expanding in Asia-Pacific.

- Patent expiries have introduced generics, exerting downward pressure on prices, especially in low- and middle-income countries.

- Future price reductions of 20-40% are anticipated by 2028 due to increased generic competition and pricing regulations.

- Market growth remains driven by the rising global cancer burden and adherence to antiemetic guidelines, despite competitive challenges.

- Strategic segmentation—focusing on emerging markets and combination therapy regimens—can optimize revenue streams amid declining branded prices.

FAQs

1. Will aprepitant's price increase due to new indications?

No. While new indications can expand TAM, pricing trends are more influenced by generic competition and market saturation that typically exert downward pressure.

2. How will patent expiries affect future revenue?

Patent expiries facilitate generic entry, significantly reducing prices and margins for branded formulations, leading to projected revenue declines of around 20-40% over the next five years.

3. Are there emerging alternatives to aprepitant?

Yes. Drugs like rolapitant and netupitant offer similar efficacy with different dosing regimens, providing market alternatives that may influence pricing dynamics.

4. How does regional regulation impact aprepitant pricing?

In regions with strict price controls and reimbursement policies, prices tend to be lower. Conversely, less regulated markets may see higher or stable prices due to supply and demand dynamics.

5. What is the outlook for aprepitant in the PONV market?

While approved for PONV, aprepitant’s role is limited compared to other antiemetics, but expanding indications could create niche growth opportunities.

References

[1] Market Research Future, "Anti-Emetic Drugs Market — Forecast to 2030," 2022.

[2] IQVIA, "Global Oncology and Supportive Care Market Trends," 2022.

More… ↓