Share This Page

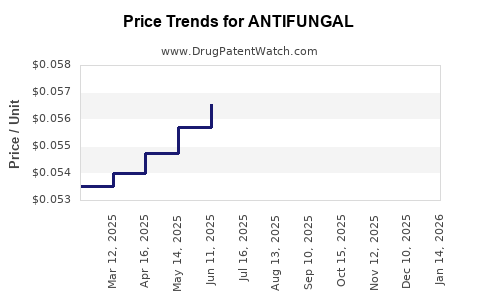

Drug Price Trends for ANTIFUNGAL

✉ Email this page to a colleague

Average Pharmacy Cost for ANTIFUNGAL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ANTIFUNGAL 1% TOPICAL CREAM | 00536-1272-22 | 0.06078 | GM | 2025-12-17 |

| ANTIFUNGAL 1% TOPICAL CREAM | 68001-0475-47 | 0.08280 | GM | 2025-12-17 |

| ANTIFUNGAL 1% TOPICAL CREAM | 68001-0475-45 | 0.19865 | GM | 2025-12-17 |

| ANTIFUNGAL 2% POWDER | 70000-0323-01 | 0.05621 | GM | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Antifungal Drugs

Introduction

The global antifungal market has experienced substantial growth driven by rising incidences of fungal infections, expanding therapeutic indications, and innovations in drug development. As a critical segment within the broader infectious disease pharmacology sector, antifungal medications address a range of conditions—from superficial skin infections to life-threatening systemic mycoses. This comprehensive analysis explores current market dynamics, competitive landscape, regulatory environment, and projected pricing trends for antifungal drugs through 2030.

Market Overview

Global Market Size and Growth Trajectory

The global antifungal market was valued at approximately USD 13.7 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of about 5.8% through 2030, reaching nearly USD 24.7 billion. This growth is fueled by an increasing prevalence of immunocompromised populations—particularly cancer patients, transplant recipients, and individuals with HIV/AIDS—as well as aging populations and rising diabetes incidence.

Therapeutic Segments and Key Indications

Antifungal agents are categorized primarily into three classes:

- Polyenes (e.g., Amphotericin B, nystatin)

- Azoles (e.g., fluconazole, voriconazole)

- Echinocandins (e.g., caspofungin, micafungin)

Emerging classes and novel agents such as tetracyclic compounds and antivirulence drugs are gradually reshaping treatment paradigms. The predominant indications include invasive aspergillosis, candidemia, cryptococcosis, and superficial infections like dermatophytosis.

Regional Market Dynamics

North America currently dominates the antifungal market (>40%) due to high healthcare expenditure, advanced diagnostic infrastructure, and substantial R&D investments. Europe follows closely, with emerging markets like Asia-Pacific poised for accelerated growth owing to increasing healthcare access and infectious disease burden.

Competitive Landscape

Key players include Pfizer, Merck & Co., Basilea Pharmaceutica, Gilead Sciences, and Scynexis. Patent expirations for several first-generation agents, such as fluconazole, catalyzed generic entry, intensifying price competition. Innovative drugs with novel mechanisms—like ibrexafungerp and rezafungin—are penetrating markets with competitive pricing strategies tailored to maximize adoption.

Regulatory and Reimbursement Environment

Regulatory agencies, including the FDA and EMA, have streamlined approval pathways for antifungals addressing unmet needs, especially for resistant strains. Reimbursement policies vary globally, with developed countries providing extensive coverage, thereby influencing market prices.

Pricing Dynamics and Projections

Current Pricing Landscape

Drug prices vary considerably:

- Brand-name antifungals: USD 50–200 per vial/course

- Generics: USD 10–50 per vial/course

- Liposomal formulations: 2–4x the cost of standard formulations due to enhanced efficacy and safety profiles

In the hospital setting, the high-cost liposomal amphotericin B remains a preferred choice for invasive infections, with prices stabilizing around USD 100–150 per vial.

Factors Influencing Price Trends

Multiple factors impact future pricing:

- Patent expirations: Increased generic competition will continue to drive prices downward.

- Development of biosimilars: Entering the market with competitive pricing.

- Regulatory incentives: Fast-track approvals may accelerate access, influencing supply and pricing.

- Market demand: Rising infection rates and expanding indications bolster premium pricing for novel agents.

- Manufacturing advancements: Cost reductions through improved synthesis and manufacturing efficiencies.

Price Projections through 2030

Based on current trends, antifungal drug prices are expected to decline marginally (CAGR of -2% to -3%) for established drugs owing to generic and biosimilar entry. Conversely, innovative therapies with novel mechanisms or superior safety profiles could command premium pricing—potentially 15–25% higher than current standards—especially if they address resistant strains or offer outpatient convenience.

Specifically:

- Generic azoles (e.g., fluconazole): Projected to decline from USD 10–50 to USD 5–30 per course.

- Brand-name echinocandins: Prices likely to stabilize around USD 200–300 per vial, with modest decreases expected.

- Novel agents: Anticipated to command USD 300–500 per treatment course upon approval, reflecting their efficacy and patent exclusivity.

Market Entry Impact on Pricing

Entry of biosimilars and generics will exert downward pressure, while orphan indications for rare fungal infections may sustain higher prices due to limited competition. Furthermore, the adoption of combination therapies and personalized treatment approaches may influence overall treatment costs but potentially improve cost-effectiveness.

Implications for Stakeholders

- Pharmaceutical companies should anticipate declining revenues from established agents post-patent expiry, focusing R&D on novel agents or combination therapies.

- Healthcare providers and payers should leverage cost-effective generic alternatives where appropriate, balancing efficacy and affordability.

- Investors may find lucrative opportunities in innovative antifungal startups with proprietary compounds addressing resistant strains.

Regulatory and Policy Considerations

Regulators will likely prioritize approving drugs with enhanced safety or activity against resistant fungi, impacting pricing strategies and market competition. Reimbursement policies favoring cost-effective therapies may further compress pricing margins for older agents while rewarding innovation.

Key Takeaways

- The antifungal market is poised for steady growth driven by rising fungal infection burdens and therapeutic innovations.

- Price declines for generics will challenge revenue streams for established drugs, whereas novel agents will command premium prices due to unmet need.

- Regional disparities influence pricing, with North America leading in affordability and access; emerging markets may see delayed price reductions.

- Strategic focus on R&D, including biosimilars and combination therapies, will shape future pricing and market share.

- Stakeholders should continuously monitor regulatory trends and epidemiological shifts to optimize pricing and market positioning.

FAQs

1. What factors are most likely to influence antifungal drug prices over the next decade?

Patent expirations, market competition from generics and biosimilars, regulatory approvals of novel agents, development of resistance patterns, and healthcare policy reforms are primary drivers that will shape antifungal pricing.

2. How will the emergence of antifungal resistance impact drug pricing?

Increased resistance elevates demand for new, more effective therapies, often commanding higher prices. Conversely, resistance to existing drugs can lead to price stabilization or increases if new treatments are scarce.

3. Are biosimilars expected to significantly reduce antifungal drug prices?

Yes. Biosimilars entering the market typically reduce costs by 20–40%, fostering affordability and wider access to essential antifungals, especially for expensive formulations like echinocandins.

4. How does regional variability affect antifungal drug pricing?

Healthcare infrastructure, reimbursement policies, and market competition vary globally, affecting drug prices. North America and Europe often have higher prices compared to emerging markets, where cost considerations heavily influence procurement.

5. What innovation trends are expected to influence future antifungal market prices?

Development of agents targeting resistant fungi, oral formulations with outpatient applicability, and combination therapies will likely maintain premium pricing, particularly for drugs addressing unmet clinical needs.

References

[1] MarketsandMarkets. "Antifungal Drugs Market by Type, Application, and Region – Global Forecast to 2030." 2022.

[2] GlobalData Healthcare. "Fungal Infection and Antifungal Market Insights." 2022.

[3] FDA and EMA Drug Approval Databases.

[4] World Health Organization. "Fungal Infections: Overview." 2021.

[5] IQVIA Institute. "Prescription Market Trends and Forecasts." 2022.

More… ↓