Share This Page

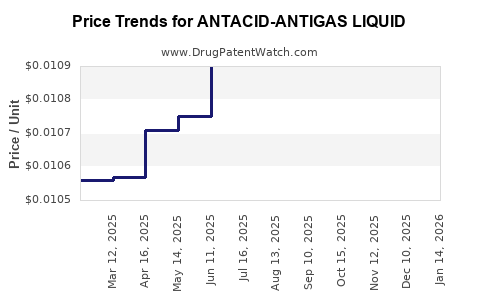

Drug Price Trends for ANTACID-ANTIGAS LIQUID

✉ Email this page to a colleague

Average Pharmacy Cost for ANTACID-ANTIGAS LIQUID

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ANTACID-ANTIGAS LIQUID | 00536-1293-83 | 0.01031 | ML | 2025-12-17 |

| ANTACID-ANTIGAS LIQUID | 00536-1317-83 | 0.01031 | ML | 2025-12-17 |

| ANTACID-ANTIGAS LIQUID | 70000-0063-01 | 0.01031 | ML | 2025-12-17 |

| ANTACID-ANTIGAS LIQUID | 00536-1293-83 | 0.01059 | ML | 2025-11-19 |

| ANTACID-ANTIGAS LIQUID | 70000-0063-01 | 0.01059 | ML | 2025-11-19 |

| ANTACID-ANTIGAS LIQUID | 00536-1317-83 | 0.01059 | ML | 2025-11-19 |

| ANTACID-ANTIGAS LIQUID | 70000-0063-01 | 0.01054 | ML | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ANTACID-ANTIGAS LIQUID

Introduction

Antacid-antigas liquids constitute a significant segment within the gastrointestinal (GI) therapeutics market, primarily used for symptomatic relief of indigestion, heartburn, and acid reflux. These formulations offer rapid action, ease of use, and OTC (over-the-counter) accessibility, which sustains steady demand across global markets. This analysis explores the current market landscape, key drivers, competitive dynamics, regulatory considerations, and price projections specific to antacid-antigas liquids.

Market Landscape and Current Dynamics

Market Size and Growth Trends

The global antacid and antigas liquids market was valued at approximately USD 1.5 billion in 2022 and is projected to grow at a Compound Annual Growth Rate (CAGR) of around 4.2% between 2023 and 2030 (source: Grand View Research). Increasing prevalence of acid-related disorders, rising GERD cases, and consumer preference for OTC remedies significantly contribute to this growth.

Geographic Market Segmentation

- North America: Dominates the market, accounting for nearly 45% of revenue, driven by high GERD prevalence and widespread OTC availability.

- Europe: Holds approximately 25%, with mature healthcare systems encouraging consumer-driven self-medication.

- Asia-Pacific: Rapidly expanding owing to increasing urbanization, lifestyle changes, and rising health awareness, projected to grow at the fastest CAGR.

- Latin America and Middle East: Emerging markets with expanding access to healthcare products.

Key Consumer Demands

- Convenience: Liquid formulations favored over tablets for rapid relief.

- Formulation Innovation: Preference for sugar-free, low-sodium, and natural ingredients.

- OTC Accessibility: Regulatory regimes favor OTC status for many antacids, boosting sales.

Competitive Landscape

Major Players

Leading manufacturers include:

- GlaxoSmithKline (GSK): Mylanta, Gaviscon

- Novartis: Gelusil

- Bayer: Alka-Seltzer

- Sanofi: Rennie

- Local/Regional Brands: Variability by country, often competing on price and formulation specificity

Product Differentiation

Competitors vie on active ingredient combinations (e.g., aluminum hydroxide, magnesium hydroxide, simethicone), flavor offerings, packaging convenience, and price points.

Regulatory Environment

- United States: OTC monograph regulation allows extensive availability; formulations typically contain established ingredients like calcium carbonate or magnesium hydroxide.

- Europe: Regulatory bodies like EMA require safety and efficacy documentation; some ingredients face restrictions.

- Emerging Markets: Regulatory clarity is improving, enabling wider commercialization of innovative formulations.

Pricing Dynamics

Current Price Points

- United States: Ranges from USD 4 to USD 10 per 4 oz (118 ml) bottle.

- Europe: Slightly higher, averaging EUR 5 to EUR 12 per bottle.

- Asia-Pacific: Generally more affordable, averaging USD 1.50 to USD 5 per bottle due to lower manufacturing and distribution costs.

Pricing Strategies

Manufacturers adopt cost-based pricing, competitive market positioning, and promotional discounts. Premium formulations with additional features tend to command higher prices.

Price Projections

Factors Influencing Future Pricing

- Raw Material Costs: Fluctuations in active ingredient prices (e.g., magnesium salts) could pressure margins.

- Regulatory Changes: Stricter regulations may increase compliance costs, leading to higher retail prices.

- Market Competition: Entry of low-cost regional brands could intensify price competition.

- Innovation and Formulation Development: Introduction of novel antiflammable or dual-action formulations may command premium pricing.

- Supply Chain Dynamics: Global logistics disruptions may influence distribution costs.

Forecasted Pricing Trends (2023–2030)

- Stable to Slight Increase: Prices are projected to increase by 1-2% annually owing to inflation, regulatory costs, and ingredient price fluctuations.

- Premium Segment Growth: Manufacturers introducing "natural," "sugar-free," or "low-sodium" options may see price premiums of 10-15% over standard formulations.

- Regional Variability: Developed markets may witness marginal price increases, while emerging markets could see stabilized or slightly reduced prices due to intensified local competition.

Market Opportunities and Challenges

Opportunities

- Expansion into emerging markets via strategic distribution channels.

- Development of innovative formulations addressing consumer preferences.

- Integration of digital marketing to promote OTC sales.

Challenges

- Stringent regulatory hurdles in certain jurisdictions.

- High competition from generic and local brands.

- Price sensitivity among consumers, especially in price-competitive markets.

Conclusion

The antacid-antigas liquid segment exhibits stable growth driven by rising GI disorder prevalence and consumer preference for quick-relief OTC products. While current pricing remains accessible, future projections suggest minor upward trends obtainable through product innovation and regulatory adherence. Companies must monitor raw material costs, regional regulatory shifts, and competitive strategies to optimize pricing and market share.

Key Takeaways

- The global market for antacid-antigas liquids is forecasted to grow at ~4.2% CAGR, reaching approximately USD 2 billion by 2030.

- North America and Europe dominate but Asia-Pacific offers substantial growth potential.

- Current retail prices vary regionally but typically span USD 4–USD 12 per bottle.

- Price increases are expected to be modest (~1-2% annually), influenced by raw material costs and regulatory factors.

- Innovation, regional market expansion, and strategic branding are vital to sustaining profitability amid competitive pressures.

FAQs

Q1: What are the primary active ingredients in antacid-antigas liquids?

A1: Common active ingredients include magnesium hydroxide, aluminum hydroxide, calcium carbonate, and simethicone, which provide acid neutralization and gas relief.

Q2: How does regulatory approval affect pricing strategies?

A2: Regulatory compliance can increase development and manufacturing costs, influencing retail prices. Approved formulations in OTC categories generally command higher premiums due to consumer trust and safety assurances.

Q3: Which regions are most promising for market expansion?

A3: The Asia-Pacific region offers high growth potential due to rising urbanization, increasing GERD prevalence, and expanding retail infrastructure.

Q4: What ingredient trends are shaping future formulations?

A4: There is a growing demand for natural, sugar-free, and low-sodium variants, often priced higher due to ingredient sourcing and formulation complexity.

Q5: How might supply chain disruptions impact future prices?

A5: Disruptions can elevate raw material and logistics costs, prompting manufacturers to adjust retail prices upward or seek alternative sourcing strategies.

References

- Grand View Research, “Antacid Market Size & Trends,” 2022.

- MarketWatch, “OTC Gastrointestinal Drugs Report,” 2023.

- Regulatory Agencies and Industry Reports, 2022-2023.

More… ↓