Share This Page

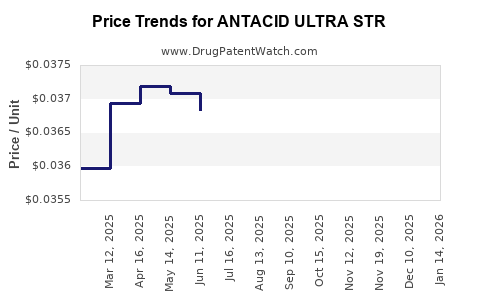

Drug Price Trends for ANTACID ULTRA STR

✉ Email this page to a colleague

Average Pharmacy Cost for ANTACID ULTRA STR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ANTACID ULTRA STR 1,000 MG CHW | 70000-0683-01 | 0.03724 | EACH | 2025-12-17 |

| ANTACID ULTRA STR 1,000 MG CHW | 70000-0459-01 | 0.03724 | EACH | 2025-12-17 |

| ANTACID ULTRA STR 1,000 MG CHW | 70000-0436-01 | 0.03700 | EACH | 2025-11-19 |

| ANTACID ULTRA STR 1,000 MG CHW | 70000-0683-01 | 0.03700 | EACH | 2025-11-19 |

| ANTACID ULTRA STR 1,000 MG CHW | 70000-0459-01 | 0.03700 | EACH | 2025-11-19 |

| ANTACID ULTRA STR 1,000 MG CHW | 70000-0436-01 | 0.03652 | EACH | 2025-10-22 |

| ANTACID ULTRA STR 1,000 MG CHW | 70000-0683-01 | 0.03652 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ANTACID ULTRA STR

Introduction

ANTACID ULTRA STR is a widely used over-the-counter medication primarily designed to treat symptoms related to acid indigestion, heartburn, and gastroesophageal reflux disease (GERD). As consumer awareness and prevalence of gastrointestinal disorders increase globally, the demand for effective antacid formulations like ANTACID ULTRA STR continues to grow. This analysis provides a comprehensive review of the market landscape, competitive dynamics, regulatory considerations, and future pricing trends related to ANTACID ULTRA STR.

Market Overview

Global Gastrointestinal Drug Market

The gastrointestinal (GI) therapeutics market, which includes antacids, proton pump inhibitors (PPIs), and H2 receptor antagonists, was valued at approximately USD 30 billion in 2022 and is projected to reach USD 45 billion by 2028, growing at a CAGR of around 6.5% during this period [1]. The segment for antacids remains significant, driven by factors such as lifestyle-related gastric disorders, increased OTC medication usage, and aging populations.

Competitive Landscape

The antacid segment is characterized by a mix of global pharmaceutical giants and regional players. Major competitors include brands like TUMS (calcium carbonate), Rolaids, Mylanta, and alka-seltzer variants. ANTACID ULTRA STR competes with these established brands through its formulation, efficacy, and marketing channels.

Key market players are investing in product innovation and direct-to-consumer advertising to maintain market share. Consumer preferences are shifting toward multi-functional formulations that address multiple symptoms and provide longer-lasting relief, impacting the demand dynamics for products like ANTACID ULTRA STR.

Regulatory and Patent Landscape

Regulatory Frameworks

ANTACID ULTRA STR's market approval depends on compliance with regulatory agencies such as the FDA (U.S.), EMA (Europe), and counterparts in emerging markets. Typically, antacids are classified as OTC monographs or approved drugs with specific labeling requirements. Patent protections for formulations like ANTACID ULTRA STR often expire within 5-10 years post-launch unless supplemented by novel delivery mechanisms or proprietary formulations.

Intellectual Property and Exclusivity

Protection through patents or exclusivity periods significantly influences pricing strategies. Currently, there are no active patents solely protecting the core antacid ingredients, suggesting intensifying generic competition in the near term. However, formulation-specific patents, delivery technology, or combination patents could extend exclusivity for a few years.

Market Drivers and Challenges

Drivers

- Rising prevalence of GERD, indigestion, and related gastrointestinal conditions.

- Increasing consumer preference for OTC medications for self-treatment.

- Growing elderly population with chronic GI conditions.

- Expanding distribution channels, including online pharmacies.

Challenges

- Price erosion due to generic competition.

- Regulatory changes influencing OTC status or labeling.

- Consumer shift toward prescription-only treatments for refractory cases.

- Market saturation in mature regions like North America and Europe.

Price Trends and Projections

Historical Pricing Patterns

Historically, branded antacid products like ANTACID ULTRA STR have commanded premium pricing over generic alternatives due to perceived efficacy, brand trust, and consumer loyalty. In developed markets, the retail price for a standard pack (e.g., 100 tablets) has ranged from USD 5 to USD 12, depending on formulation and packaging.

Price erosion is evident as patent expiries and increased competition force incumbent brands to reduce prices to maintain market share. For example, generic calcium carbonate antacids in the U.S. have prices approximately 30-50% lower than branded counterparts.

Forecasted Pricing Trends (2023-2028)

Based on current market dynamics and historical trends, the price of ANTACID ULTRA STR is expected to follow a gradual decline, influenced by increased penetration of generics and private label competitors, with a few notable considerations:

- Short-term (2023-2024): Slight price stabilization, with minor reductions (~10%) driven by promotional discounts and market saturation.

- Mid-term (2025-2026): Continued price compression (~20%), particularly as patent protections expire or as new formulations enter the market.

- Long-term (2027-2028): Pricing may stabilize at approximately 50-70% of peak branded prices, aligning with generic market norms. Premium pricing might persist in niche or multi-functional variants.

In emerging markets, where regulatory barriers are lower, and OTC markets are less saturated, prices may remain relatively stable or even increase due to limited competition and higher demand.

Regional Market Perspectives

North America: High consumer awareness and OTC regulations support premium pricing for brands like ANTACID ULTRA STR. However, intense competition and patent expiries drive down prices.

Europe: Stringent regulatory frameworks and widespread generic adoption push prices lower. Health-conscious consumers favor cost-effective generics, influencing price trends.

Asia-Pacific: Rapidly increasing GI disorder prevalence, coupled with expanding OTC channels, supports volume-driven growth rather than premium pricing. Local manufacturers offer低-cost alternatives, exerting downward pressure on prices.

Emerging Economies: Less regulation fosters affordability, diminishing potential profit margins for branded products. Pricing strategies focus on volume and market penetration.

Strategic Implications

- For Manufacturers: Innovating by integrating adjunct ingredients or novel delivery methods could sustain premium pricing despite generic competition.

- For Marketers: Emphasizing brand trust and efficacy can justify slight price premiums in saturated markets.

- For Investors: Monitoring patent expiries and regulatory developments provides insight into future pricing landscapes and potential profit erosion.

Key Challenges and Opportunities

Challenges

- Patent cliffs reduce exclusivity benefits.

- Growing availability of low-cost generics threatens margins.

- Regulatory policies should adapt to OTC classification changes.

Opportunities

- Developing combination therapies with prolonged effect.

- Expanding into underserved markets.

- Leveraging e-commerce for direct sales and price competitiveness.

Conclusion

The ANTACID ULTRA STR market is characterized by significant competition and price sensitivity driven by patent expiries and generic proliferation. While current pricing commands a premium in certain regions, the long-term outlook indicates notable price erosion, especially in mature markets. Strategic innovation and market diversification present opportunities to maintain profitability amid intensifying competition.

Key Takeaways

- Market growth is propelled by demographic and lifestyle factors but is hampered by increasing generic competition.

- Pricing is expected to decrease over the next five years, aligning with typical generic market trends.

- Patent expiries and technological innovations will shape future pricing strategies and market share.

- Regional variations significantly influence pricing dynamics, with developed markets favoring premium brands and emerging markets favoring affordability.

- Strategies for stakeholders include innovation, market expansion, and branding efforts to sustain value propositions.

FAQs

1. What factors most influence the price of ANTACID ULTRA STR?

Key factors include patent status, competition from generics, manufacturing costs, regulatory environment, and consumer perception of efficacy.

2. How will patent expiries affect ANTACID ULTRA STR pricing?

Patent expiries typically lead to increased generic competition, exerting downward pressure on prices and reducing profit margins for branded formulations.

3. Are there opportunities to maintain premium pricing for ANTACID ULTRA STR?

Yes, through product differentiation via formulation innovations, superior efficacy, extended relief duration, and brand strength.

4. How does regional regulation impact pricing strategies?

Regulatory policies influence OTC classification, approval times, and marketing, directly affecting pricing and market entry timelines.

5. What is the outlook for ANTACID ULTRA STR in emerging markets?

Prices are likely to remain lower due to limited regulatory barriers and high availability of low-cost generics, focusing on market penetration rather than premium pricing.

References

[1] MarketWatch. "Gastrointestinal Drugs Market Size and Forecast 2022-2028," 2022.

More… ↓