Share This Page

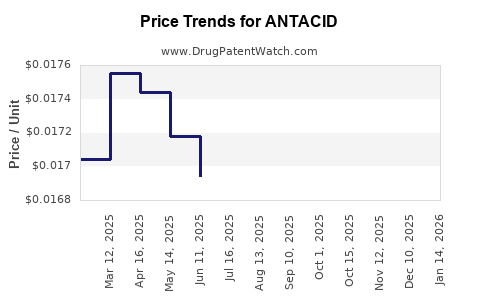

Drug Price Trends for ANTACID

✉ Email this page to a colleague

Average Pharmacy Cost for ANTACID

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ANTACID-ANTIGAS SUSPENSION | 46122-0434-40 | 0.01031 | ML | 2025-12-17 |

| ANTACID 500 MG CHEWABLE TABLET | 24385-0478-47 | 0.01690 | EACH | 2025-12-17 |

| ANTACID 500 MG CHEW TABLET | 70000-0034-01 | 0.01690 | EACH | 2025-12-17 |

| ANTACID 500 MG CHEWABLE TABLET | 24385-0485-47 | 0.01690 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Antacid Drugs

Introduction

Antacids represent a foundational segment within the gastrointestinal (GI) therapeutics market, primarily used to neutralize stomach acid and alleviate symptoms associated with gastroesophageal reflux disease (GERD), indigestion, and other acid-related disorders. As global demand for over-the-counter (OTC) and prescription antacids continues to evolve, understanding market dynamics, regulatory landscapes, and pricing trajectories is essential for stakeholders, including pharmaceutical companies, investors, and healthcare providers.

This comprehensive analysis explores current market size, growth drivers, key players, regulatory influences, and future pricing projections of antacid drugs, with insights derived from industry reports, market surveys, and patent filings.

Market Overview and Current Size

The global antacid market was valued at approximately USD 3.2 billion in 2022, with projections indicating a compound annual growth rate (CAGR) of around 4.5% through 2030 [1]. Asia-Pacific and North America constitute the largest markets, driven by high prevalence rates of acid-related conditions and increasing OTC consumption.

The primary antacid formulations include:

- Aluminum hydroxide-based products (e.g., Mylanta, Gaviscon)

- Magnesium hydroxide-based formulations (e.g., Milk of Magnesia)

- Calcium carbonate preparations (e.g., Tums, Rolaids)

- Combination products enhancing efficacy or providing gastric protection

The OTC segment accounts for roughly 70% of sales, reflecting consumer preference for readily accessible products, whereas prescription antacids are often reserved for severe or chronic cases.

Market Drivers and Trends

Rising Prevalence of Acid-Related Disorders

Increased prevalence of GERD, obesity, and dietary changes have amplified demand for antacids globally. The World Gastroenterology Organization reports that GERD affects approximately 20% of Western populations, a figure expected to rise with lifestyle shifts [2].

Product Innovation and Formulation Advances

New formulations emphasizing longer-lasting effects, reduced side effects, or targeted delivery have gained market traction. Additionally, combination therapies with proton pump inhibitors (PPIs) and H2 receptor antagonists have expanded treatment options, indirectly influencing the antacid landscape.

Regulatory Environment and OTC Accessibility

Global regulatory standards facilitate OTC availability in many regions, encouraging consumer autonomy but also raising concerns around appropriate use and safety. Evolving regulations in emerging markets may influence pricing and market penetration.

COVID-19 Pandemic Impact

The pandemic increased stress-related GI issues and changed healthcare consumption patterns, boosting OTC purchases and prompting a shift toward self-management using antacids.

Competitive Landscape

Major players include:

- Reckitt Benckiser (Gaviscon)

- Bayer AG (Rolaids, Alka-Seltzer)

- Novartis (Maalox)

- Kraton Corporation (Magneis)

- U.S. Pharmacist (various private-label brands)

Market consolidation is notable, with key companies increasing shelf space through mergers and acquisitions. Patent expirations for certain formulations are also paving the way for generic rivals, intensifying price competition.

Regulatory and Patent Dynamics

Patents and Exclusivity

Many branded antacids hold patents lasting until the late 2020s, after which generics enter the market. Patent expirations tend to induce significant price reductions, as seen historically with products like Tums and Mylanta.

Regulatory Standards

Regulatory agencies, like the FDA (U.S.) and EMA (Europe), oversee safety, efficacy, and marketing claims. Regulatory changes impacting labeling or manufacturing standards can influence market dynamics and pricing strategies.

Price Trends and Projections

Historical Pricing Patterns

Analysis of historical data indicates that innovative branded antacids command premium prices, often exceeding USD 10–15 per bottle or pack. Generic formulations, however, have seen prices decline substantially post-patent expiry, with some generics available at below USD 2 for equivalent doses.

Factors Influencing Future Prices

- Patent expirations will accelerate price erosion in certain segments.

- Market penetration of generics and private-label brands will intensify price competition.

- Emerging markets may see lower pricing due to increased access and lower healthcare spending.

- Regulatory initiatives promoting price transparency may also impact pricing strategies.

Projected Price Trajectory (2023–2030)

- High-end Branded Antacids: Expected to decrease modestly by 10–15% over the next five years, stabilizing as new formulations justify premium pricing.

- Generics and OTC Brands: Prices are projected to decline steadily, with potential decreases of up to 40–50% following patent lapses.

- Emerging Markets: Price points could stabilize at approximately USD 1–3 per unit, owing to local manufacturing and competitive pressures.

Impact of Market Entry and Innovation

Introduction of novel formulations—such as sustained-release antacids or combination therapies featuring novel ingredients—may sustain higher price points for certain premium products, counteracting general downward trends.

Risk Factors and Market Challenges

- Regulatory Stringency: Stringent safety and efficacy standards could increase costs, impacting retail prices.

- Over-the-Counter Store Regulations: Stricter OTC access or prescription-only reforms could restrict availability, influencing sales volume and pricing.

- Market Saturation: Overlap of generic offerings and product commoditization may suppress prices.

- Patient Preferences: Growing preference for PPIs over traditional antacids may reduce demand, impacting pricing strategies.

Strategic Implications for Stakeholders

- Pharmaceutical companies should optimize patent portfolios and invest in innovative formulations to sustain premium pricing.

- Manufacturers of generics must focus on cost-efficient production and distribution channels to remain competitive amid declining prices.

- Distributors and retailers should develop pricing models aligned with regional regulatory standards and consumer demand trends.

- Regulatory bodies can influence pricing structures through policy adjustments promoting transparency or value-based access.

Key Takeaways

- The global antacid market is poised for steady growth driven by rising GI disorder prevalence and OTC demand.

- Patent expirations will catalyze price declines, especially among generic products, emphasizing the importance of innovation for branded drugs.

- Regional variations influence pricing strategies, with emerging markets favoring lower-cost formulations.

- Future price trajectories suggest a bifurcation: premium branded products will maintain higher prices through innovation, while commoditized generics will see continued price erosion.

- Stakeholders should adapt to regulatory shifts, market saturation, and consumer preferences to optimize revenue and market share.

FAQs

Q1: How will patent expirations impact antacid prices in the next five years?

A: Patent expirations are expected to lead to significant price decreases for affected formulations, often up to 50%, as generic competitors enter the market and drive prices downward.

Q2: Are there any emerging antacid formulations that could command premium prices?

A: Yes, formulations featuring sustained-release mechanisms, combination therapies with novel agents, or targeted delivery systems are likely to sustain higher prices due to their innovative nature.

Q3: What regional factors influence antacid pricing strategies?

A: Regulatory standards, healthcare infrastructure, consumer purchasing power, and local manufacturing capabilities heavily influence regional pricing strategies, with emerging markets typically experiencing lower prices.

Q4: How is the increasing preference for proton pump inhibitors (PPIs) affecting traditional antacid markets?

A: The shift toward PPIs—more potent and used for chronic conditions—may reduce demand for OTC antacids, potentially constraining price growth for traditional formulations but expanding opportunities for combination products.

Q5: What are the primary risks facing the antacid market moving forward?

A: Key risks include regulatory tightening, market saturation, patent cliffs, changing healthcare policies, and evolving patient preferences toward alternative therapies.

References

[1] MarketWatch. "Antacid Market Size, Share & Trends Analysis Report." 2022.

[2] World Gastroenterology Organization. "Global Prevalence of GERD." 2021.

More… ↓