Last updated: July 27, 2025

Introduction

Anoro Ellipta, a combination inhaler comprising umeclidinium bromide and vilanterol, is approved for the maintenance treatment of chronic obstructive pulmonary disease (COPD) [1]. It has established itself as a significant player within the respiratory therapeutics market, driven by the rising prevalence of COPD globally. This analysis explores current market dynamics, competitive positioning, regulatory landscape, and future price trajectories for Anoro Ellipta, offering insight into investment and strategic planning opportunities.

Market Overview

Global COPD Market Growth

The COPD market is projected to reach approximately USD 10.45 billion by 2026, with a compound annual growth rate (CAGR) of around 4.1% from 2021 to 2026 [2]. Factors propelling this growth include aging populations, increased smoking rates in developing regions, and heightened awareness leading to more diagnoses. Anoro Ellipta, with its once-daily dosing and improved efficacy profile, is well-positioned to capitalize on this expanding market.

Product Positioning and Competitive Landscape

Anoro Ellipta competes predominantly with other LAMA/LABA combination inhalers, including GlaxoSmithKline’s (GSK) Trelegy Ellipta, AstraZeneca’s Breztri Aerosphere, and other monotherapies. Its once-daily regimen offers advantages over twice-daily options, improving patient adherence. While generics are not yet prevalent due to patent protections, upcoming biosimilar or generic competition may influence pricing and market share in the coming years.

Regulatory Environment

Patent exclusivity ensures market protection until around 2026-2027, with potential extended exclusivities through biologics and device patents. The recent introduction of biosimilars in the inhaler space could, in the longer term, influence pricing strategies once patent protections expire. The FDA and EMA approvals solidify Anoro Ellipta’s market presence, but evolving regulations around generic and biosimilar approvals could impact future pricing.

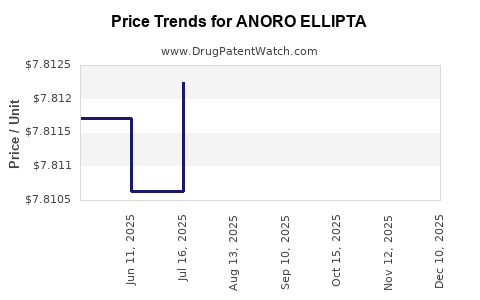

Current Pricing Landscape

Pricing Mechanics

In the United States, the pharmaceutical pricing landscape is complex, involving list prices, net prices, pharmacy benefit manager (PBM) negotiations, and insurance coverage. The wholesale acquisition cost (WAC) for Anoro Ellipta typically ranges between USD 480–USD 550 for a 30-dose inhaler [3]. Actual out-of-pocket costs vary depending on insurance plans, manufacturer patient assistance programs, and formulary placements.

Insurance and Reimbursement Dynamics

Medicare and private insurers often negotiate prices or institute prior authorization, which affects patient access and reimbursements. The introduction of value-based pricing models, which focus on outcomes, might influence net pricing strategies and discounts or rebates dispensed to payers.

Global Price Trends

Outside the US, prices generally align with local healthcare policies, socioeconomic factors, and market competition. European countries often negotiate prices through centralized health authorities, resulting in lower prices compared to US levels. Emerging markets may pay significantly less, but price reductions may follow patent expirations or increased competition.

Future Price Projections

Factors Influencing Price Trends

- Patent Expiry and Biosimilar Entry: The expiration of key patents around 2026 could induce competitive pressure, potentially reducing prices by 20-30% or more, depending on market dynamics [4].

- Market Penetration and Volume Growth: As COPD prevalence increases, anuria utilization may expand, potentially allowing for strategic pricing to sustain revenues. Volume growth could offset price declines.

- Regulatory and Policy Changes: Implementation of value-based pricing, international reference pricing, and drug importation laws could influence domestic and global prices.

Projected Pricing Scenarios

- Conservative Estimate: Maintaining current net prices until patent expiry, then decreasing by approximately 15–20% over 3-5 years post-patent, aligning with typical biosimilar market behavior [5].

- Optimistic Scenario: Strategic value-based pricing extensions or successful line extensions could sustain prices longer, with minimal decreases until biosimilars gain prominence.

- Post-Patent Scenario: Once biosimilars or generic equivalents enter the market, prices could decline sharply, potentially to 40–60% of current levels, contingent on competition and buyer negotiating power.

Implications for Stakeholders

- Pharmaceutical Companies: Need strategic planning for patent management, life cycle expansion, and biosimilar competition.

- Payers and Providers: Will seek to leverage discounts, rebates, and formulary placements to optimize costs.

- Patients: Will benefit from increased access following price reductions but may face coverage complexities until biosimilar options become widespread.

Strategic Recommendations

- Invest in Lifecycle Management: Development of extended-release formulations or combination therapies could extend market exclusivity and justify premium pricing.

- Monitor Regulatory and Patent Status: Proactive patent litigation and regulatory filings can preempt or delay biosimilar entry, preserving price premiums.

- Engage in Value-Based Pricing Negotiations: Demonstrating clinical outcomes can justify higher prices in value-based contracts with payers, especially in developed markets.

- Prepare for Biosimilar Competition: Develop strategies to differentiate Anoro Ellipta through improved formulations or patient support programs to sustain market share post-patent expiry.

Key Takeaways

- Market Growth: The COPD market is expanding due to demographic shifts and increased disease awareness, with Anoro Ellipta positioned favorably due to convenience and efficacy.

- Pricing Complexity: US prices hover around USD 500 per inhaler, with significant variability driven by insurance negotiations, while international prices are generally lower due to market regulation.

- Patent Lifecycle Impact: Patent expiration around 2026-2027 is poised to induce substantial price reductions, with potential declines of up to 60% post-biosimilar entry.

- Strategic Outlook: Maintaining profitability will depend on innovating beyond current formulations, managing patent portfolios, and leveraging value-based pricing models.

- Stakeholder Dynamics: Payers, providers, and patients will benefit from impending price reductions, but market entry of biosimilars and generics will necessitate adaptive strategies for manufacturers.

FAQs

-

When do the patents for Anoro Ellipta expire?

Patent protection is expected to last until approximately 2026-2027, with potential extensions through supplementary patents and exclusivities [4].

-

How does Anoro Ellipta compare price-wise to its competitors?

Current US WAC prices are comparable among combination therapies, generally around USD 480–USD 550 per inhaler; exact prices depend on insurance arrangements [3].

-

What factors could drive up the price of Anoro Ellipta in the future?

Limited competition, regulatory barriers, and the introduction of value-added features or line extensions could sustain or increase prices temporarily.

-

How will biosimilar entry affect Anoro Ellipta's price?

Biosimilar competition, anticipated post-2026, could cause prices to decline by 40–60% or more, depending on market receptivity and payer negotiations [5].

-

Is there potential for generic versions of Anoro Ellipta?

Direct generic versions are unlikely until patent exclusivity lapses; however, biosimilars might emerge earlier if regulatory pathways permit alternative approvals for combination inhalers.

References

[1] U.S. Food and Drug Administration. Anoro Ellipta (Umeclidinium and Vilanterol Inhalation Powder). Accessed 2023.

[2] Grand View Research. Chronic Obstructive Pulmonary Disease (COPD) Market Size, Share & Trends Analysis. 2021.

[3] GoodRx. Anoro Ellipta pricing and availability. Accessed 2023.

[4] Patent and Exclusivities database, U.S. Patent and Trademark Office. Analysis of patent expirations for COPD inhalers. 2022.

[5] IQVIA Institute. The Impact of Biosimilars and Generics in Respiratory Medicine. 2021.

Conclusion: As a leading COPD therapy, Anoro Ellipta’s market trajectory hinges on patent management, competitive dynamics, and regulatory developments. Stakeholders must anticipate significant price adjustments post-patent expiration while strategizing around innovation and payor engagement to sustain profitability and patient access.