Last updated: July 27, 2025

rket Analysis and Price Projections for Anastrozole

Introduction

Anastrozole, marketed primarily under the trade name Arimidex, is a non-steroidal aromatase inhibitor indicated primarily for the treatment of hormone receptor-positive breast cancer in postmenopausal women. Since its approval by the FDA in 1995, Anastrozole has become a cornerstone in hormonal therapy, distinguished by its efficacy, safety profile, and widespread adoption. This article provides a comprehensive market analysis and price projection for Anastrozole, considering current trends, competitive landscape, regulatory environment, and potential future developments.

Market Overview

Global Market Size and Growth Trends

The global breast cancer therapeutics market, including Anastrozole, is experiencing robust growth. As of 2022, the market was valued at approximately USD 24 billion, with expectations to grow at a CAGR of around 4.5% through 2030 [1]. Anastrozole's market share within this segment remains significant due to its established efficacy and guideline recommendation by leading oncology associations. The increasing incidence of breast cancer, notably among aging populations worldwide, sustains demand.

Regional Market Dynamics

- North America: Dominates the market due to high breast cancer prevalence, advanced healthcare infrastructure, and high drug affordability. The US accounts for over 50% of the global market share within the aromatase inhibitor segment [2].

- Europe: Exhibits steady growth driven by increasing awareness and screening programs, with a significant uptake of Anastrozole in standard treatment protocols.

- Asia-Pacific: Represents a high-growth region owing to rising breast cancer incidence, improving healthcare access, and expanding pharmaceutical markets, despite considerable price-sensitive markets.

Competitive Landscape

Anastrozole's key competitors include other aromatase inhibitors like Letrozole (Femara) and Exemestane (Aromasin). While these agents offer similar mechanisms, Anastrozole's efficacy, safety profile, and clinical positioning sustain its market share. Generic versions have entered the market post patent expiry, intensifying price competition and accessibility.

Patent and Regulatory Environment

Patent Status and Generic Entry

The original patent for Anastrozole expired in the late 2000s, leading to a proliferation of generics worldwide. Generic formulations now dominate many markets, significantly driving down prices. Despite concerns about biosimilar or alternative medications, no biosimilar counterparts exist for Anastrozole, given its small-molecule classification.

Regulatory Approvals and Reimbursement

Anastrozole is broadly approved across major markets, with approvals steadily maintained and expanded. Reimbursement policies favor generics, encouraging their utilization over branded versions in many regions, contributing to declining overall drug prices.

Market Drivers

- Rising Incidence of Breast Cancer: The World Health Organization reports approximately 2.3 million new breast cancer cases globally in 2020 [3].

- Advancements in Hormonal Therapy Guidelines: Leading oncology societies, including ASCO and NCCN, recommend Anastrozole as first-line adjuvant therapy for hormone receptor-positive postmenopausal breast cancer.

- Generic Market Expansion: Widespread availability of cost-effective generics has broadened access, especially in developing nations.

- Aging Demographics: An increasing elderly population predisposes a higher prevalence of hormone receptor-positive breast cancer, augmenting demand.

Market Challenges

- Pricing Pressures: Governments and payers increasingly favor lower-cost generics, constraining margins on branded formulations.

- Competition: Entering biosimilar or novel therapies may influence market share dynamics.

- Side Effect Profiles: Adverse effects such as osteoporosis and cardiovascular risks can affect adherence, influencing overall therapeutic utilization.

Price Projections and Trends

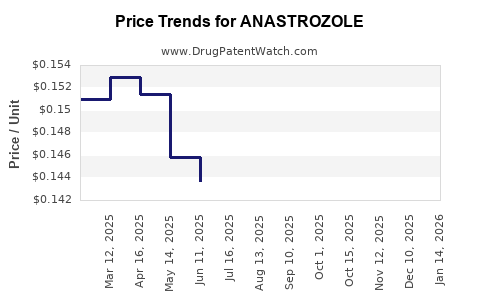

Current Pricing Landscape

- Brand-Name Anastrozole (Arimidex): In the US, a 30-tablet course (1 mg) typically costs around USD 400–500 without insurance, but prices vary based on pharmacy discounts and insurance plans.

- Generics: Prices for generic Anastrozole often range from USD 10–20 per month, reflecting a dramatic reduction of over 95% compared to brand-name versions [4].

Future Price Trends

Projections indicate continued price erosion of Anastrozole in coming years driven by factors such as increased generic competition, procurement efficiencies, and evolving reimbursement policies.

- Branded Drugs: Price declines of 10–15% annually are anticipated as market saturation and patent expiration-driven generics expand.

- Generics: Stable or slight reductions (~2–5%) expected, primarily due to supply chain efficiencies and increased competition.

- Potential Biosimilars or New Formulations: While unlikely given the chemical class, any introduction of innovative formulations (e.g., extended-release) could temporarily alter pricing dynamics but are less predictable.

Pricing in Developing Markets

In regions like India, China, and parts of Southeast Asia, generic Anastrozole is available at prices as low as USD 0.50 per tablet. These regions are expected to sustain low-cost options, maintaining price disparities from Western markets [5].

Market Outlook Summary

Overall, the cost of Anastrozole will likely decline over the next five years, stabilizing at a fraction of current branded prices, primarily driven by generic penetration and policy pressures for cost containment.

Implications for Industry Stakeholders

- Pharmaceutical Companies: Branded manufacturers must innovate or differentiate (e.g., new formulations, combination therapies) to sustain premium pricing. Generic manufacturers should capitalize on the low-cost market segments.

- Healthcare Providers: Emphasize the cost-effectiveness of generics to improve patient access and adherence.

- Regulators and Payers: Strive for policies that balance affordability with access to effective therapies, influencing market pricing structures.

Key Takeaways

- The Anastrozole market remains robust, driven by increasing breast cancer prevalence, guideline endorsements, and widespread generic availability.

- Price erosion will continue, especially in regions with high generic competition and supportive reimbursement policies.

- The drug’s market dynamics are susceptible to competitor entry, regulatory changes, and healthcare policy reforms.

- Stakeholders should anticipate stable to declining prices over the next five years, with value-based pricing becoming more prominent.

- Companies investing in innovative formulations or combination therapies may sustain higher margins amid intense price competition.

FAQs

1. What is the current market size for Anastrozole worldwide?

The global breast cancer therapeutics market, including Anastrozole, was valued at approximately USD 24 billion in 2022, with Anastrozole capturing a significant portion due to its widespread use, especially in North America and Europe.

2. How is the patent status affecting Anastrozole prices?

The expiry of Anastrozole's original patent in the late 2000s led to the proliferation of generic versions, sharply reducing its prices. The absence of biosimilars and new patent protections minimizes the potential for price hikes from brand-name manufacturers.

3. What are the main drivers of future price decline for Anastrozole?

The primary drivers include increasing generic competition, healthcare policy emphasis on cost containment, and the proliferation of low-cost markets. Price declines of 10–15% annually are anticipated in branded markets over the next five years.

4. Which regions are most impacted by price reductions?

Developed markets like the US and Europe are experiencing significant reductions due to generic competition and reimbursement policies, while emerging markets maintain low prices due to high generic penetration.

5. Will new formulations or therapies impact Anastrozole’s market share?

While innovative formulations or combination therapies could offer differentiation, no biosimilars or novel therapies are currently positioned to replace Anastrozole’s role significantly. Future developments remain uncertain and would require regulatory approval and market acceptance.

References

[1] MarketWatch. "Global Breast Cancer Therapeutics Market Size, Share & Trends." 2022.

[2] Deloitte. "Pharmaceutical Market Insights," 2022.

[3] WHO. "Cancer Facts & Figures 2020." World Health Organization.

[4] GoodRx. "Anastrozole Prices & Discounts." 2023.

[5] IQVIA. "Emerging Market Pharmaceutical Pricing Trends," 2022.