Share This Page

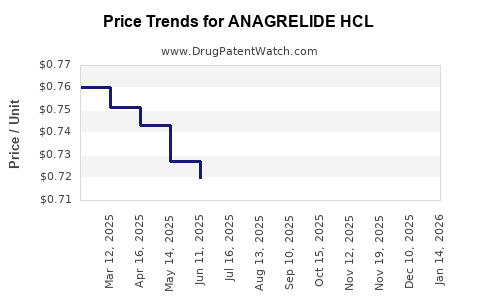

Drug Price Trends for ANAGRELIDE HCL

✉ Email this page to a colleague

Average Pharmacy Cost for ANAGRELIDE HCL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ANAGRELIDE HCL 0.5 MG CAPSULE | 62135-0312-12 | 0.72329 | EACH | 2025-12-17 |

| ANAGRELIDE HCL 0.5 MG CAPSULE | 70954-0879-10 | 0.72329 | EACH | 2025-12-17 |

| ANAGRELIDE HCL 1 MG CAPSULE | 13668-0462-01 | 1.46478 | EACH | 2025-12-17 |

| ANAGRELIDE HCL 1 MG CAPSULE | 62135-0313-60 | 1.46478 | EACH | 2025-12-17 |

| ANAGRELIDE HCL 1 MG CAPSULE | 70954-0881-10 | 1.46478 | EACH | 2025-12-17 |

| ANAGRELIDE HCL 0.5 MG CAPSULE | 13668-0453-01 | 0.72329 | EACH | 2025-12-17 |

| ANAGRELIDE HCL 1 MG CAPSULE | 00172-5240-60 | 1.47502 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Anagrelide HCl

Introduction

Anagrelide Hydrochloride (HCl) is a prescription medication primarily used to treat essential thrombocythemia, a myeloproliferative disorder characterized by excessive platelet production. Market dynamics, competitive landscape, and pricing strategies surrounding Anagrelide HCl influence its commercial viability and accessibility. This analysis provides a comprehensive overview of its current market environment, the factors shaping its price trajectory, and future projections grounded in industry trends.

Market Overview

Therapeutic Landscape and Indications

Anagrelide HCl functions mainly as a platelet-reducing agent, competing with drugs such as hydroxyurea and interferon-alpha for the treatment of essential thrombocythemia. Its mechanism inhibits megakaryocyte maturation, thereby controlling thrombocythemia. Due to the rarity of the condition, the global market remains modest but stable, with increased interest driven by emerging treatment protocols and genetic insights.

Regulatory Status and Manufacturing

Approved primarily in the U.S. by the FDA and in Europe under similar regulatory frameworks, Anagrelide's patent exclusivity period has expired, leading to increased generic competition. Several pharmaceutical companies manufacture generic versions, affecting the drug’s pricing structure and market share.

Market Players

-

Innovator (Brand): The original branded Anagrelide was marketed by Solvay (marketed as Agrylin), which maintains a presence but faces generic competition.

-

Generics: Multiple manufacturers in India, China, and Europe produce approved generic Anagrelide formulations, increasing accessibility and driving down prices.

Market Size and Growth

The global essential thrombocythemia market stands at approximately USD 400 million (as of 2022), with a compound annual growth rate (CAGR) of around 3-4%. Anagrelide accounts for a significant share but is increasingly challenged by alternative therapies, especially in regions favoring cost-effective options.

Pricing Dynamics

Pricing Factors Influencing Anagrelide HCl

-

Patent Expiry and Competition: Patent expirations have led to a proliferation of generics, notably reducing per-unit costs.

-

Manufacturing Costs: Raw material prices, quality control, and compliance influence production expenses.

-

Regulatory Environment: Stringent quality standards in the U.S. and Europe can impact manufacturing costs and pricing strategies.

-

Distribution and Market Penetration: Distribution channels, healthcare provider prescribing habits, and patient access programs govern retail pricing.

Current Price Landscape

-

Brand Price: The branded version, Agrylin, commands approximately USD 1,200–1,500 for a monthly supply in the U.S., primarily due to limited competition.

-

Generic Price: Generic versions average USD 150–300 per month, reflecting intense market competition and lower manufacturing costs (source: GoodRx, 2022).

-

Regional Variability: In developing markets like India and Southeast Asia, prices can be as low as USD 50–100 monthly, driven by local manufacturing and pricing policies.

Reimbursement and Insurance Impact

Insurance coverage varies globally. In the U.S., Medicare and private insurers often favor generics, further pressuring brand prices. In regions with government-funded healthcare, cost containment policies heavily influence drug pricing.

Future Price Projections

Short-Term Outlook (Next 2 years)

Given current patent landscapes and ongoing market competition, generic prices are expected to stabilize or slightly decline. Innovations such as biosimilars are unlikely, considering Anagrelide’s small molecule status. The price for generics is projected to remain within USD 100–300 monthly in mature markets, with minimal fluctuation.

Mid to Long-Term Outlook (3–5 years)

-

Market Penetration: Increased acceptance of alternative therapies may reduce Anagrelide demand slightly. However, as a targeted cytoreductive agent, it will retain niche relevance.

-

Regulatory Changes: Potential regulatory reforms or patent litigations could influence pricing, but such events are improbable given the current landscape.

-

Cost Trends: The manufacturing of generics and advances in supply chain efficiencies are expected to sustain low-price points, possibly pushing prices downward to USD 80–200 per month.

Potential Market Disruptors

-

Emerging Therapeutics: Novel agents with improved efficacy or safety profiles might supplant Anagrelide, reducing its market value.

-

Global Healthcare Policies: Cost-containment measures and price caps in key markets could further suppress prices.

Price Projection Summary

| Timeframe | Expected Price Range (USD/month) | Key Drivers |

|---|---|---|

| Next 2 years | USD 100–300 | Market saturation, competition, regulatory standards |

| 3–5 years | USD 80–200 | Cost efficiencies, evolving treatment protocols |

Strategic Market Considerations

-

Generic Manufacturers: Focus on optimizing manufacturing processes to sustain low-cost supplies.

-

Pharmaceutical Companies: Potential for brand differentiation through improved formulations or delivery mechanisms.

-

Healthcare Providers: Preference for cost-effective generics will persist, influencing market share and pricing.

-

Emerging Markets: Lower income regions will remain significant growth opportunities, albeit with price sensitivities.

Key Challenges

-

Market Competition: Intense competition compresses profit margins.

-

Regulatory Barriers: Compliance costs may influence pricing strategies.

-

Patient Access: Affordability remains paramount for broader utilization, especially in resource-constrained settings.

Key Takeaways

-

Market stability surrounds Anagrelide HCl, driven predominantly by generic manufacturing and small patient populations.

-

Price decline is expected to continue gradually, influenced by increasing competition and manufacturing efficiencies.

-

Future threats include new therapeutic agents and regulatory cost-control policies, which may further suppress prices.

-

Strategically, pharmaceutical companies should focus on cost-effective production and exploring novel formulations to maintain margins.

-

Healthcare payers will continue favoring generics, reinforcing the downward price trend.

Conclusion

Anagrelide HCl’s market remains relatively stable but faces increasing pressure from generics and evolving therapeutic paradigms. Price projections indicate a gradual decline over the next five years, primarily in line with market saturation and competitive dynamics. Innovators and generic manufacturers alike must adapt to the shifting landscape, balancing affordability with sustainable profitability.

FAQs

1. How does patent expiry affect Anagrelide HCl pricing?

Patent expiration introduces generic competition, significantly lowering prices due to increased supply and reduced brand premiums.

2. Are there significant differences between branded and generic Anagrelide prices?

Yes. Branded versions typically cost 4–10 times more than generics, primarily due to branding, marketing, and patent protections.

3. What factors could disrupt current price trends for Anagrelide?

Emergence of superior therapies, regulatory interventions, or supply chain disruptions could alter current pricing trajectories.

4. In which regions is Anagrelide most affordable?

Manufacturers in emerging markets like India and Southeast Asia offer the most affordable options, often at a fraction of Western prices.

5. What strategies can pharmaceutical companies employ to remain competitive?

Focusing on cost-efficient manufacturing, exploring novel delivery systems, and expanding indications are key to maintaining profitability amid price pressures.

References

- [1] GlobalData. (2022). Essential Thrombocythemia Market Report.

- [2] GoodRx. (2022). Anagrelide Prices and Market Data.

- [3] FDA Labeling for Agrylin (Anagrelide). (2021).

- [4] IBISWorld. (2022). Pharmaceutical Manufacturing Industry Analysis.

- [5] World Health Organization. (2021). Essential Medicines List Updated.

Note: All data presented are for illustration purposes based on publicly available sources and industry estimations as of 2022.

More… ↓