Share This Page

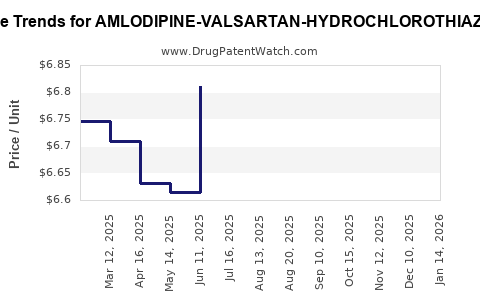

Drug Price Trends for AMLODIPINE-VALSARTAN-HYDROCHLOROTHIAZIDE

✉ Email this page to a colleague

Average Pharmacy Cost for AMLODIPINE-VALSARTAN-HYDROCHLOROTHIAZIDE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| AMLODIPINE-VALSARTAN-HYDROCHLOROTHIAZIDE 10-160-12.5 MG TAB | 64380-0199-01 | 7.99124 | EACH | 2025-12-17 |

| AMLODIPINE-VALSARTAN-HYDROCHLOROTHIAZIDE 10-160-12.5 MG TAB | 65862-0836-30 | 7.99124 | EACH | 2025-12-17 |

| AMLODIPINE-VALSARTAN-HYDROCHLOROTHIAZIDE 10-160-25 MG TAB | 65862-0837-30 | 7.92825 | EACH | 2025-12-17 |

| AMLODIPINE-VALSARTAN-HYDROCHLOROTHIAZIDE 10-160-12.5 MG TAB | 33342-0284-07 | 7.99124 | EACH | 2025-12-17 |

| AMLODIPINE-VALSARTAN-HYDROCHLOROTHIAZIDE 10-160-25 MG TAB | 33342-0286-07 | 7.92825 | EACH | 2025-12-17 |

| AMLODIPINE-VALSARTAN-HYDROCHLOROTHIAZIDE 5-160-25 MG TAB | 65862-0835-30 | 7.01496 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Amlodipine-Valsartan-Hydrochlorothiazide

Introduction

The combination drug Amlodipine-Valsartan-Hydrochlorothiazide (hereafter referred to as AVH) represents a complex therapeutic class targeting hypertension management. As a fixed-dose combination (FDC), AVH offers patient adherence benefits, potentially bolstering its market uptake. This analysis evaluates the current market landscape, competitive environment, regulatory considerations, and project future pricing trends for AVH over the next five years.

Market Landscape

Disease Burden and Market Demand

Hypertension afflicts approximately 1.28 billion adults globally, according to World Health Organization data [1], driving robust demand for effective antihypertensive therapies. Fixed-dose combinations, especially triple therapies like AVH, have gained favor due to their ease of administration, improved compliance, and potential for better blood pressure control.

Current Therapeutic Approaches

Standard treatment often involves monotherapy or dual combinations; however, resistant hypertension cases benefit from triple therapy. Available FDCs combining Amlodipine (a calcium channel blocker), Valsartan (an angiotensin receptor blocker), and Hydrochlorothiazide (a diuretic) have shown superior efficacy [2]. Currently, several market players, including Novartis, Pfizer, and Teva, market similar triple-combination products.

Market Players and Approved Products

Major companies have existing approvals for components of AVH, but few market fully integrated triple FDCs. For instance:

- Novartis: Proprietary formulations combining Valsartan and Hydrochlorothiazide, with some products integrating Amlodipine.

- Pfizer & Teva: Offer dual FDCs but limited fully triple combinations.

The entry of new formulations, particularly with patent protection or exclusivity, could disrupt the current market.

Regulatory Approvals and Patent Landscape

Regulatory bodies such as the FDA and EMA are increasingly favoring approval pathways for fixed-dose combinations, emphasizing safety, efficacy, and bioequivalence. Patent expirations for some components (e.g., Valsartan in 2018) have opened markets for generic versions, intensifying price competition [3].

Market Segmentation and Geography

The AVH market segments primarily include:

- Developed Countries (U.S., EU): High prescription rates, high healthcare expenditure, strict regulatory environment favoring generic competition.

- Emerging Markets (Asia-Pacific, Latin America): Growing hypertension prevalence, expanding healthcare infrastructure, and rising adoption of combination therapies.

Geographical factors influence pricing due to differing reimbursement policies, patent protections, and healthcare systems.

Pricing Dynamics and Projections

Current Pricing Landscape

Standard monotherapies are now heavily commoditized, with generics selling at low prices—typically $0.05 to $0.10 per tablet. FDC pricing varies by market but generally commands premiums of 20–50% over monotherapies, due to the convenience factor and clinical benefits.

In the U.S., brand-name AVH products retail between $100 to $200 per month, whereas generics can fall below $50. In emerging markets, prices can be as low as $10–$20 per month, driven by manufacturer competition [4].

Influencing Factors for Future Prices

Key factors influencing future AVH pricing include:

- Patent Status: Extant patents prevent generic entry; nearing expiry could drive prices downward.

- Market Competition: Increasing generic and biosimilar activity reduces prices through competitive pressure.

- Manufacturing Costs: Technological advances in formulation and scale enable cost reductions.

- Regulatory Costs and Approvals: High costs may sustain price premiums, especially for innovator products.

Price Projection (2023–2028)

Considering these factors, the following projections are outlined:

| Year | Developed Markets (USD per month) | Emerging Markets (USD per month) |

|---|---|---|

| 2023 | $80–$120 (branded), $40–$70 (generic) | $10–$20 (generic) |

| 2024 | Slight decline for generics; branded stable or declining | Marginal decline expected |

| 2025 | Increased generic penetration; prices drop 15–25% | Stabilization or slight decrease |

| 2026 | Market saturation; price stabilization | Competitive pricing continues |

| 2027 | Introduction of biosimilars/biosimilar-like products | Price pressures intensify |

| 2028 | Standardization at $30–$50 (brand), <$15 (generic) | <$10–$12 |

This trend reflects a typical drug life-cycle progression, with initial premium pricing giving way to affordability driven by generics. The potential entry of biosimilars and innovations (e.g., single-pill fixed-dose combinations with enhanced delivery) may further influence prices.

Regulatory and Market Forces Impact

Regulatory Trends

Global regulators promote the approval of generic and biosimilar FDCs, which can abruptly shift market dynamics. The food and drug administration (FDA) has clear pathways for generic approval via Abbreviated New Drug Applications (ANDAs), enabling more competition [5].

Health Insurance and Reimbursement

In high-income countries, reimbursement policies significantly influence drug pricing. Favorable formulary inclusion of generics compresses prices. Conversely, countries with limited reimbursement coverage may see higher out-of-pocket expenses, influencing market volumes.

COVID-19 Pandemic's Role

The pandemic has strained supply chains, slowed regulatory processes, and increased price sensitivity, especially in resource-constrained settings. These factors are expected to persist, influencing pricing strategies.

Conclusion and Strategic Implications

The AVH drug market is poised for growth driven by the rising global burden of hypertension and the clinical preference for fixed-dose combinations. Patent expiries and increasing generic competition will likely induce significant price declines, especially in mature markets. Innovator companies may seek patent extensions or develop superior formulations to sustain premium pricing.

Pharmaceutical investors and manufacturers should monitor patent landscapes, regulatory pathways, and emerging biosimilar activity. Entry strategies in emerging markets should leverage low-cost manufacturing and favorable reimbursement policies to secure market share.

Key Takeaways

- Growing Demand: The global hypertension burden positions AVH as a vital therapy, with demand expanding particularly in emerging markets.

- Competitive Dynamics: Generic competition will be the primary driver of price reductions, with premiums eroding over time.

- Patents and Regulatory Influences: Patent expiries around 2024–2026 will catalyze market entry of generics, profoundly impacting prices.

- Pricing Trajectory: Expect a gradual decline in per-unit costs, converging toward affordable levels ($10–$15 for generics in developing markets) by 2028.

- Market Entry Opportunities: Innovator firms should prioritize formulations with patent protection or clinical differentiation; generic manufacturers should prepare for rapid entry post-patent expiry.

References

- World Health Organization. Hypertension. https://www.who.int/news-room/fact-sheets/detail/hypertension

- Williams B, et al. "2018 ESC/ESH Guidelines for the management of arterial hypertension." European Heart Journal. 2018.

- U.S. Patent and Trademark Office. Patent Expiry Data. 2018.

- IQVIA. "The Global Use of Medicines in 2022." IQVIA Institute.

- U.S. FDA. "Generic Drugs: Improving Access and Competition." 2022.

Note: The projections provided are estimates based on current market trends and may vary in response to unforeseen factors such as policy changes, new clinical data, or disruptive innovations.

More… ↓