Share This Page

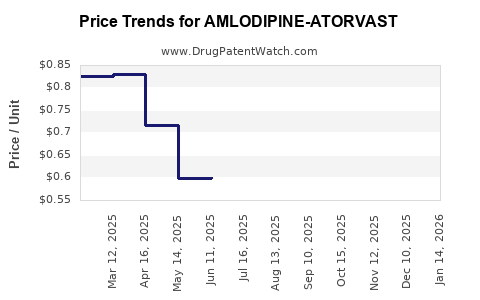

Drug Price Trends for AMLODIPINE-ATORVAST

✉ Email this page to a colleague

Average Pharmacy Cost for AMLODIPINE-ATORVAST

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| AMLODIPINE-ATORVAST 10-10 MG | 66993-0270-30 | 1.61147 | EACH | 2025-12-17 |

| AMLODIPINE-ATORVAST 10-20 MG | 00378-4518-93 | 1.39178 | EACH | 2025-12-17 |

| AMLODIPINE-ATORVAST 10-10 MG | 62332-0762-30 | 1.61147 | EACH | 2025-12-17 |

| AMLODIPINE-ATORVAST 10-20 MG | 60505-3484-03 | 1.39178 | EACH | 2025-12-17 |

| AMLODIPINE-ATORVAST 10-10 MG | 00378-4517-93 | 1.61147 | EACH | 2025-12-17 |

| AMLODIPINE-ATORVAST 5-80 MG | 66993-0269-30 | 2.36071 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Amlodipine-Atorvastatin

Introduction

Amlodipine-atorvastatin combines two widely prescribed medications: amlodipine, a calcium channel blocker used primarily for hypertension and angina, and atorvastatin, a statin used to lower LDL cholesterol and reduce cardiovascular risk. The fixed-dose combination (FDC) offers added convenience and improved adherence for patients with comorbid hypertension and hyperlipidemia. Growing awareness of cardiovascular disease (CVD), expanding indications, and the strategic positioning of combination therapies position amlodipine-atorvastatin as a significant market segment.

This report provides an in-depth market analysis and price projection overview for Amlodipine-atorvastatin, highlighting current trends, competitive landscape, regulatory considerations, and future pricing dynamics.

Market Overview

Global Market Size and Trends

The global antihypertensive and lipid-lowering agents markets are both experiencing steady growth driven by the increasing prevalence of CVD, aging populations, and a shift towards combination therapies to enhance compliance [1]. The combined therapy market is expected to expand at a compound annual growth rate (CAGR) of approximately 5-7% over the next five years.

Specifically, the Amlodipine-atorvastatin FDC market is growing alongside broader trends emphasizing polypharmacy management with a focus on fixed-dose combinations, particularly for primary and secondary prevention of cardiovascular events [2].

Prevalence & Demographics

- Cardiovascular diseases account for roughly 32% of global deaths, with hypertension and hyperlipidemia being key modifiable risk factors [3].

- An estimated 1.3 billion adults worldwide have hypertension, with many also suffering from hyperlipidemia.

- The aging demographic and increasing urbanization contribute to the rising demand for combination therapies.

Regulatory Landscape

Regulatory agencies like the FDA and EMA have approved various fixed-dose combinations, but approval pathways vary depending on regional standards. The complexity of demonstrating bioequivalence and improved patient outcomes influences market entry timelines.

Competitive Landscape

Key Players

Major pharmaceutical companies with existing portfolios in antihypertensive and lipid-lowering agents significantly influence the amlodipine-atorvastatin market:

- Pfizer and its successor entities, as they historically marketed Lipitor (atorvastatin) and amlodipine individually.

- AstraZeneca, Novartis, and Teva are bringing competing FDC products to market.

- Generic manufacturers are increasingly contributing, especially post-patent expirations, which intensify price competition.

Market Penetration & Challenges

While the market is promising, challenges include:

- Regulatory hurdles for approval of FDCs.

- Limited acceptance in some regions due to concerns about dosing flexibility.

- Existing monotherapy and dual therapy options provide significant competition.

Pricing Dynamics and Price Projections

Current Pricing Landscape

In established markets like the U.S., branded Amlodipine-atorvastatin FDCs retail at approximately $150–$200 for a 30-day supply, reflecting brand premiums and administrative costs. Generic versions, once available, typically reduce costs by 50–70%, with prices dropping to $60–$80 monthly (per dose strengths).

In emerging markets (e.g., India, Brazil), prices are substantially lower, with monthly costs often below $20, influenced by local market conditions and regulatory policies.

Factors Influencing Future Prices

- Patent Status & Generic Entry: The expiration of key patents (e.g., for Lipitor) will induce price declines. Multiple generic manufacturers entering the scene can push prices downward.

- Regulatory Approvals of New Formulations: Approval of enhanced formulations or biosimilars may influence market prices.

- Healthcare Coverage & Reimbursement Policies: Government and private insurer policies significantly impact drug pricing and affordability.

- Market Penetration & Competition: Increased competition drives prices down, while high adoption rates for FDCs maintain premium pricing in certain markets.

Price Projection (Next 3-5 Years)

- Developed Markets: Prices are expected to decline by approximately 10–15% annually post-generic entry, reaching around $50–$100 per month for standard doses.

- Emerging Markets: Price reductions will be moderate, with clinical and regulatory factors primarily shaping costs, typically maintaining under $20–$30 monthly.

Long-term Outlook

The overall trend favors lower prices driven by patent expirations, increased competition, and health system negotiations. However, branded premiums may persist in some markets where awareness and brand loyalty remain significant.

Market Drivers & Barriers

Drivers

- Increasing prevalence of CVD and risk factor control.

- The convenience of fixed-dose combinations improving adherence.

- Healthcare policies favoring cost-effective medications.

- Patent expirations fueling generic competition.

Barriers

- Regulatory delays in approval processes.

- Concern over dosing flexibility in FDCs.

- Market saturation with existing monotherapies.

- Price sensitivity in low- and middle-income economies.

Conclusion and Future Outlook

The amlodipine-atorvastatin market is set to expand significantly over the next five years, driven by demographic shifts, clinical guideline endorsements endorsing combination therapy, and ongoing patent expiries fostering price competition. Price projections indicate a downward trajectory, making the therapy more accessible globally, especially through generics and biosimilars.

Pharmaceutical companies seeking market share should focus on regulatory strategies, affordability, and educational initiatives highlighting the benefits of fixed-dose combination therapies for cardiovascular risk management.

Key Takeaways

- The global market for Amlodipine-atorvastatin is poised for growth, forecasted at a CAGR of 5-7% driven by increased CVD prevalence and favoring of fixed-dose combinations.

- Current pricing varies significantly, with branded formulations costing $150–$200/month in developed markets and generics potentially under $50/month.

- Patent expirations and increased generic competition will induce substantial price reductions, especially in mature markets.

- Regulatory challenges and market acceptance influence pricing strategies and adoption rates.

- Future success hinges on balancing cost reductions with regulatory compliance, patient adherence, and health authority support.

FAQs

1. When will generic versions of Amlodipine-Atorvastatin become available?

Patent expirations for key components like atorvastatin are already underway in many jurisdictions, typically leading to generic availability within 1-3 years, depending on regional patent laws and regulatory processes [4].

2. How does the fixed-dose combination benefit patients compared to separate medications?

FDCs simplify medication regimens, improve adherence, reduce pill burden, and potentially enhance clinical outcomes in patients requiring both antihypertensive and lipid-lowering therapies.

3. What are the major regulatory hurdles for market entry of Amlodipine-Atorvastatin?

Regulators assess bioequivalence, safety, efficacy, and manufacturing quality. Approval often requires bridging studies, and some regions impose strict requirements for fixed-dose combination approval, potentially delaying market entry.

4. How will emerging markets influence the global price of Amlodipine-Atorvastatin?

Growing demand and price sensitivity in emerging markets incentivize local manufacturing and generic competition, which will further reduce prices, extending access to broader populations.

5. What factors could impact future pricing trends?

Key factors include patent litigation outcomes, regulatory approval of biosimilars, healthcare reimbursement policies, competitive dynamics, and global economic conditions.

References

- World Health Organization. Cardiovascular diseases (CVDs). WHO Fact Sheet. 2021.

- Statista. Fixed-dose combination therapies growth forecast. 2022.

- World Health Organization. Global status report on noncommunicable diseases. 2014.

- U.S. Food and Drug Administration. Orange Book: Approved Drug Products with Therapeutic Equivalence Evaluations. 2023.

More… ↓