Last updated: July 27, 2025

rket Analysis and Price Projections for Amitriptyline HCl

Introduction

Amitriptyline HCl, a tricyclic antidepressant (TCA), has sustained relevance in the treatment of major depressive disorder, neuropathic pain, migraine prophylaxis, and off-label uses. Despite the advent of newer antidepressants, Amitriptyline remains a cornerstone due to its cost-effectiveness and broad therapeutic profile. This article provides a comprehensive analysis of the current market landscape and offers price projections, considering factors such as patent status, manufacturing trends, regulatory environment, and competitive dynamics.

Market Landscape Overview

1. Therapeutic Demand and Off-Label Use

Amitriptyline's enduring therapeutic relevance is anchored in its efficacy for depression and off-label indications such as chronic pain and migraine. The global antidepressant market, valued at approximately USD 16 billion in 2022 (source: MarketWatch[1]), continues growing, with TCAs like Amitriptyline accounting for a significant share in the generic segment — particularly in low- and middle-income economies where cost sensitivity drives demand.

2. Market Segments and Key Geographies

The primary markets include North America, Europe, and Asia-Pacific. North America dominates in prescription volume due to high prevalence rates of depression and pain syndromes and a mature generics industry. Emerging markets witness rising adoption driven by increasing healthcare access and affordability.

3. Competitive Environment

Amitriptyline HCl is available predominantly as a generic product, with multiple manufacturers globally. Market share is fragmented, with no single company holding a dominant position. Major generic players such as Teva, Mylan, and Sun Pharma manufacture Amitriptyline, competing on price, supply chain efficiency, and product quality.

4. Patent and Regulatory Outlook

Amitriptyline’s patent expired decades ago, enabling widespread generic availability. Regulatory barriers are moderate; however, countries with stringent drug approval processes, such as the U.S. and EU, impose rigorous safety and efficacy demonstrations, affecting market entry timelines.

5. Manufacturing Trends

Manufacturing is focused on high-volume, cost-efficient production. Quality standards have intensified post-2010, especially under FDA and EMA regulations, enhancing product consistency but increasing compliance costs.

Market Challenges

- Generic Price Erosion: Increased generic competition leads to aggressive pricing strategies; a typical scenario has resulted in 30-50% price reductions over the last decade.

- Clinical Preference Shift: Growing preference for newer antidepressants with fewer side effects (e.g., SSRIs, SNRIs) diminishes Amitriptyline’s market share in developed regions.

- Regulatory Scrutiny: Off-label prescribing and safety concerns, including cardiotoxicity, prompt regulatory agencies to update labeling or restrict use, impacting demand.

Price Dynamics and Projections

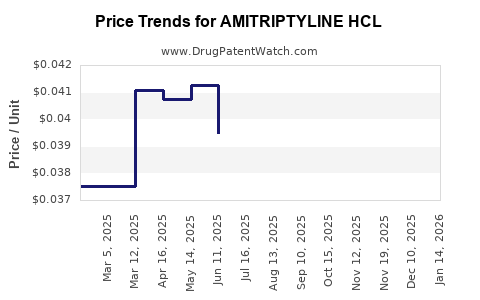

1. Current Price Benchmarks

- United States: Average wholesale prices (AWP) for a typical 25 mg tablet range from USD 0.03 to USD 0.07 per tablet (source: Red Book Online).

- European Markets: Prices are comparable, generally averaging EUR 0.02 to EUR 0.05 per tablet, with fluctuations based on country-specific regulations (source: ESP Pharma Price Index).

- Emerging Markets: Prices are often lower, approximately USD 0.01 to USD 0.03 per tablet, influenced by lower manufacturing and operating costs.

2. Factors Influencing Future Price Trends

- Market Saturation: Widespread generic availability will likely sustain competitive pricing.

- Manufacturing Cost Dynamics: Innovations toward continuous manufacturing and process optimization could marginally reduce production costs, stabilizing or slightly decreasing prices.

- Regulatory Impact: Any regulatory move restricting off-label use or imposing safety measures could cause supply adjustments, temporarily affecting prices.

- Supply Chain Disruptions: The COVID-19 pandemic underscored vulnerability in pharmaceutical supply chains. Future disruptions could induce price volatility.

3. Price Projections (2023–2028)

- Base Scenario: Prices for Amitriptyline HCl are projected to decline modestly by 1-3% annually, stabilizing in mature markets due to intense price competition.

- Bullish Scenario: In markets where supply chain disruptions or regulatory restrictions arise, prices could stabilize or increase slightly (2-4%), driven by scarcity.

- Bearish Scenario: Continued price erosion, with annual declines of 3-5%, driven by new entrants and technological efficiencies.

4. Regional Variations

- North America and Europe: Likely to see minimal fluctuation; prices will remain low due to high competition but stabilized by regulatory adherence.

- Emerging Markets: Potential for minor increases owing to supply chain improvements or regulatory hurdles, but overall lower price levels persist.

Market Drivers and Constraints

Drivers:

- Steady demand in managing depression and chronic pain globally.

- Cost advantages of generic manufacturing.

- Aging populations increasing prevalence of depression and neuropathy conditions.

Constraints:

- Competition from newer, better-tolerated antidepressants.

- Safety and side-effect concerns limiting off-label use.

- Regulatory vigilance, possibly restricting indications, affecting volumes.

Conclusion

Amitriptyline HCl maintains a pivotal position within the antidepressant and neuropathic pain markets, primarily due to its low cost and broad therapeutic window. Despite facing challenges like pricing erosion and shifting prescriber preferences, consistent demand sustains its market. Price projections indicate a steady decline in developed regions, with commodity-like price stability in emerging markets. The key to capitalizing on Amitriptyline’s market prospects lies in optimizing manufacturing efficiencies and navigating regulatory landscapes effectively.

Key Takeaways

- The global Amitriptyline HCl market remains sizable, particularly in cost-sensitive regions.

- Generics dominate, contributing to sustained low prices with gradual declines projected over the next five years.

- Regulatory and safety concerns could influence pricing and volume, especially in developed countries.

- Market growth hinges on demand in pain management, mental health, and neurological indications, with stable or slightly increasing demand projected in emerging economies.

- Stakeholders should monitor supply chain developments and regulatory updates closely for strategic positioning.

FAQs

Q1: What is the current price range for Amitriptyline HCl tablets globally?

A1: Prices for tablets vary by region, averaging USD 0.01 to USD 0.03 in emerging markets, USD 0.03 to USD 0.07 in North America, and EUR 0.02 to EUR 0.05 in Europe.

Q2: How do patent expirations influence Amitriptyline’s market pricing?

A2: Patent expiry facilitates generic entry, intensifying competition and driving down prices while making the drug more accessible.

Q3: What factors could reverse the declining price trend for Amitriptyline?

A3: Supply chain disruptions, regulatory restrictions on off-label use, or shortages could temporarily stabilize or increase prices.

Q4: Which markets are poised for the highest growth in Amitriptyline demand?

A4: Emerging markets in Asia and Latin America are anticipated to see the highest demand growth due to increasing healthcare access and affordability.

Q5: How might newer antidepressants impact Amitriptyline's market share?

A5: The adoption of SSRIs and SNRIs with favorable side-effect profiles could reduce Amitriptyline’s prescribing, particularly in developed markets, decreasing its market share.

References

[1] MarketWatch. "Antidepressants Market Size & Industry Analysis." 2022.