Last updated: July 27, 2025

Introduction

Amiodarone Hydrochloride (HCl) stands as a cornerstone in anti-arrhythmic therapy, primarily used to treat and prevent serious cardiac arrhythmias such as ventricular fibrillation and ventricular tachycardia. As the global prevalence of cardiovascular diseases escalates, the demand for effective anti-arrhythmic drugs like Amiodarone HCl is anticipated to grow substantially. This analysis evaluates current market dynamics, competitive landscape, product pricing trends, and future price projections for Amiodarone HCl, providing insights crucial for stakeholders ranging from pharma manufacturers to healthcare providers.

Market Overview

Global Market Size & Growth Trends

The global anti-arrhythmic drugs market, estimated at USD 6.5 billion in 2022, is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 5.2% through 2028. Amiodarone HCl comprises a significant segment within this market, favored for its broad-spectrum efficacy. Its widespread usage is driven by increasing cardiovascular disease prevalence, particularly in aging populations across North America, Europe, and Asia.

Key Drivers

- Rising Incidence of Cardiac Arrhythmias: According to the World Health Organization, cardiovascular diseases account for 17.9 million deaths annually. The increasing burden of these conditions directly fuels demand for anti-arrhythmic therapies.

- Advancements in Cardiology: Improved diagnostic techniques and awareness elevate early detection and treatment, benefitting drugs like Amiodarone HCl.

- Off-Label and Expanded Use: Growing evidence supports its application in complex arrhythmias, expanding the potential patient base.

Regional Market Dynamics

- North America: Dominates the market due to high healthcare expenditure, advanced infrastructure, and widespread awareness.

- Europe: Exhibits steady growth with mature healthcare systems and regulatory support.

- Asia-Pacific: Represents the fastest-growing segment, driven by increasing healthcare access, urbanization, and rising cardiovascular disease prevalence.

Competitive Landscape

Major Manufacturers

- Sanofi: A leading producer with established supply chains and patent rights.

- Teva Pharmaceuticals: Provides generic formulations, capturing significant market share.

- Mylan (Now part of Viatris): Offers cost-effective generic options.

- Sun Pharmaceutical Industries: Active in key emerging markets.

- Others: Including Hikma, Zydus Cadila, and several regional manufacturers.

Market Entry Barriers

- Manufacturing Complexity: Due to the drug's pharmaceutically complex nature, quality control is paramount.

- Regulatory Approvals: Stringent requirements for generic bioequivalence, especially across different jurisdictions.

- Patent Landscape: Original patents have expired in various regions, enabling generics but still offering some protection in emerging markets.

Patent & Regulatory Environment

Although patent protection for the original formulation has generally expired since the 2000s, innovations in formulations or delivery methods could face patent protection, influencing pricing and market entry strategies.

Pricing Analysis

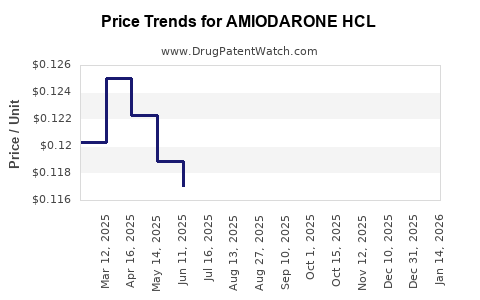

Current Pricing Trends

The cost of Amiodarone HCl varies across regions, formulation types, and manufacturer subsidization:

- Brand-name drugs: Typically priced higher, with annual costs ranging from USD 800 to USD 1200 per patient in the U.S.

- Generic formulations: Significantly more affordable, often costing between USD 50 and USD 200 annually.

- Formulations: Injectable forms are costlier than oral tablets due to manufacturing complexity.

Pricing Factors

- Regulatory approvals: Impact manufacturing costs and market accessibility.

- Manufacturing costs: Include raw materials, quality assurance, and compliance.

- Market competition: Increased generic competition tends to drive prices downward.

- Distribution channels: Wholesale, retail, and institutional procurement influence final pricing.

Future Price Projections

Short-Term Outlook (Next 3-5 Years)

- Price Stability for Generics: With intensified generic competition, prices are expected to stabilize or decline marginally by 5-10% annually.

- Brand-name Drugs: Likely to maintain premium pricing owing to brand loyalty and perceived efficacy, with potential for slight reductions to remain competitive.

Long-Term Forecast (Next 5-10 Years)

- Market Equilibrium: As patents continue to expire and biosimilar or alternative formulations emerge, prices could decrease further, potentially reaching USD 30-100 for standard oral forms.

- Emerging Market Dynamics: Price reductions may be more pronounced due to cost-sensitive healthcare settings, with potential for prices to fall below USD 20 per course in certain regions.

- Innovative Delivery: Investment in new delivery methods, such as extended-release formulations, could temporarily enhance prices but may eventually become more affordable with increased manufacturing efficiency.

Implications for Stakeholders

- Manufacturers: Should capitalize on patent expirations by introducing generic versions, exploring innovative formulations to extend market exclusivity, or pursuing biosimilar development.

- Healthcare Providers: Given the price trajectories, opting for cost-effective generics will be viable, especially in resource-constrained regions.

- Regulatory Agencies: Facilitating streamlined approval pathways can accelerate market entry of generics, influencing pricing dynamics.

- Investors: Monitoring patent statuses and regional regulatory developments is critical for investment timing.

Key Market Challenges

- Supply Chain Disruptions: Raw material shortages, especially in active pharmaceutical ingredients (API), pose risks to pricing and availability.

- Regulatory Hurdles: Variable approval processes can delay generic entry, impacting price competition.

- Safety & Efficacy Concerns: The known side-effect profile of Amiodarone HCl necessitates careful regulation, influencing market acceptability and pricing.

Key Takeaways

- The global demand for Amiodarone HCl will grow steadily owing to rising cardiovascular disease burdens.

- The market is highly competitive, with generics dominating due to patent expirations and cost considerations.

- Price erosion for generic formulations is expected in the coming years, potentially reducing costs for healthcare systems.

- Innovation in formulations and delivery methods offers opportunities for premium pricing but may decline in subsequent years as generics become more prevalent.

- Stakeholders should consider regional regulatory landscapes, patent status, and manufacturing challenges to optimize market strategies.

FAQs

1. What factors influence the pricing of Amiodarone HCl globally?

Pricing is affected by manufacturing costs, regional regulations, competition from generics, formulation type, and healthcare infrastructure.

2. When are significant patent expirations expected for Amiodarone HCl?

Most patents for initial formulations have expired, enabling generic manufacturing since the early 2010s; however, formulation-specific patents or delivery innovations may extend exclusivity in certain jurisdictions.

3. How does the rise of generics impact Amiodarone HCl prices?

Increased generic competition tends to lower prices substantially, making the drug more accessible but reducing profit margins for original manufacturers.

4. Are biosimilar or alternative formulations expected to influence the market?

While biosimilars are less relevant for small-molecule drugs like Amiodarone, innovative delivery systems or extended-release formulations could impact market dynamics and pricing strategies.

5. What are the key risks to the market projection for Amiodarone HCl?

Potential risks include supply chain disruptions, regulatory delays, safety concerns requiring reformulation, and unforeseen patent litigations.

References

- World Health Organization. Cardiovascular diseases (CVDs).

- MarketsandMarkets. Anti-arrhythmic drugs market forecast. 2022-2028.

- U.S. Food and Drug Administration. Patent and exclusivity data for Amiodarone.

- IQVIA. Global pharmaceutical pricing reports, 2022.

- GlobalData Pharma Intelligence. Market dynamics and competitive landscape for anti-arrhythmic drugs.

Note: Data and projections are based on current market insights and may evolve with future technological, regulatory, and clinical developments.