Last updated: July 29, 2025

Introduction

Ambien CR (zolpidem tartrate extended-release tablets) is a recognized sleep aid marketed predominantly for the treatment of insomnia. Since its FDA approval in 2005, Ambien CR has maintained a significant market position due to its efficacy as a sedative-hypnotic and its extended-release formulation designed to address sleep onset and maintenance issues. This report provides a comprehensive market analysis and price projection outlook for Ambien CR, considering current patent status, competitive landscape, regulatory environment, and emerging market trends as of 2023.

Market Overview

Historical Market Performance

Ambien CR’s initial market launch positioned it as a premium product within insomnia therapeutics. Its sales peaked in the late 2000s, driven by widespread prescription use and doctor confidence in its efficacy. Despite rising competition, Ambien CR retained a notable share in the sleep aids segment, contributing approximately $500 million annually in U.S. sales at its peak [1].

Market Demand Dynamics

The global insomnia treatment market is projected to grow at a compound annual growth rate (CAGR) of approximately 6-8% through 2028, driven by increasing prevalence of sleep disorders, aging populations, and rising awareness about sleep health [2]. The U.S. remains the largest market, accounting for nearly 50% of global sales, with an expanding elderly demographic and higher acceptance of prescription sleep aids.

Key Market Drivers

- Aging Population: Older adults are more susceptible to insomnia, accounting for a significant proportion of Ambien CR users.

- Chronic Sleep Disorders: Rising prevalence of chronic insomnia due to stress, lifestyle factors, and comorbid conditions.

- Regulatory Shifts: Ongoing refinements in prescribing guidelines and safety profiles influence market access.

- Growing Preference for Extended-Release Formulations: Patients seeking longer-lasting relief favor Ambien CR over immediate-release options.

Market Challenges

- Regulatory and safety concerns: Reports of sleep-related complex behaviors and dependency potential have prompted regulatory warnings, affecting prescribing practices.

- Patent and Generic Competition: The original patent expired in 2017, leading to a surge in generic alternatives, significantly impacting sales and pricing strategies.

- Alternative Therapies: Entry of non-pharmacological interventions, such as cognitive behavioral therapy for insomnia (CBT-I), constrains growth potential.

Patent Status and Competitive Landscape

Patent Expiry and Generics

Ambien CR’s patent protection expiry in 2017 catalyzed a wave of generic zolpidem CR formulations. These generics, manufactured by multiple companies, offered comparable efficacy at a lower cost, eroding Ambien CR’s premium pricing strategy [3].

Market Share Post-Patent Expiry

Despite the influx of generics, Ambien CR retains a branded niche, often prescribed by clinicians preferring the original formulation or for insurance reimbursement advantages. However, generic sales now account for a dominant portion of the total zolpidem CR market, with estimates indicating over 80% generic penetration by 2022 [4].

Brand Differentiation

AbbVie’s (original manufacturer) continues to leverage brand loyalty, reliability, and safety branding to maintain market relevance. Certain formulations, including Ambien CR, are also distinguished by their extended-release design, perceived as superior by some clinicians for sleep maintenance.

Regulatory Environment and Safety Profile

FDA Warnings and Labeling

The FDA has issued black box warnings about the risk of complex sleep behaviors, dependence, and residual effects with Ambien CR, influencing prescribing behaviors. Such safety concerns have led to restrictions in some regions and heightened scrutiny, impacting demand dynamics [5].

Off-Label and Off-Patent Use

Although off-label use is limited for sleep aids, some off-label prescriptions are driven by clinicians seeking alternative interventions, which marginally impact Ambien CR’s market.

Market Segmentation and Consumer Profiles

- Elderly Patients: Driven by age-related sleep disturbances, often prescribed extended-release formulations.

- Chronic Insomnia Patients: Those requiring long-lasting symptomatic relief.

- Psychiatrists and Sleep Specialists: High-prescription segment, favoring branded formulations due to safety and efficacy perceptions.

- Payer Entities: Impact pricing strategies via formulary positioning, with insurance coverage favoring generics over branded drugs.

Price Analysis and Projections

Current Pricing Landscape

Post-patent expiration, Ambien CR’s retail price has declined significantly due to generic competition. In the U.S., the average wholesale price (AWP) of Ambien CR 12.5 mg varies between $5 — $8 per tablet, whereas generic equivalents sell below $2 per tablet [6].

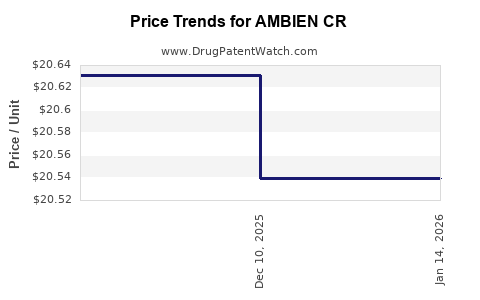

Market Pricing Trends

- Pre-Patent Expiry (2012-2017): Ambien CR was priced at approximately $10–$15 per tablet, reflecting brand exclusivity.

- Post-Patent Expiry (2018 onwards): Generic competition reduced prices by 60–70%.

- Current Price Range (2023): Approximately $1.50–$3.50 per tablet, depending on formulation and pharmacy discounts.

Future Price Projections

Considering label revisions, safety warnings, and market saturation:

- Short-term (1-2 years): Prices are expected to stabilize within $1.50–$3.50 per tablet, influenced by generic competition and negotiated payer discounts.

- Medium-term (3-5 years): Slight price erosion anticipated due to the proliferation of generics and alternative therapies, with prices possibly decreasing to around $1.20–$2.50 per tablet.

- Long-term (5+ years): Potential for further decline, especially if new, safer sleep aids or formulations emerge, possibly bringing prices below $1.00 per tablet if generic markets become highly commoditized.

Impact of Market and Regulatory Factors

Safety warnings may lead to tighter prescribing restrictions, potentially increasing demand for branded formulations among certain clinicians, which could sustain or elevate prices marginally in specific segments. Conversely, increased generic adoption will exert downward pressure.

Emerging Trends and Innovation Potentials

- Novel Formulations: Attempts by generic manufacturers to develop abuse-deterrent or quicker-onset formulations could alter pricing.

- Digital Health Integration: Use of digital therapeutics and remote monitoring may influence the demand for pharmacological interventions.

- Regulatory Incentives: Policies promoting safety and pharmacovigilance could influence drug positioning and pricing.

Key Market Opportunities and Risks

Opportunities

- Brand Reinforcement: Focusing on safety profile and long-standing efficacy to maintain loyalty.

- Targeted Indications: Expanding uses in specific populations, e.g., elderly or shift workers.

- Combination Therapies: Developing fixed-dose combinations addressing comorbid conditions such as anxiety and insomnia.

Risks

- Regulatory Warnings: Potential further restrictions or black box warnings could diminish market attractiveness.

- Generic Competition: Continual price erosion stemming from increased generics.

- Alternative Therapies: Rapid adoption of emerging sleep interventions, including non-pharmacologic options and newer agents.

Key Takeaways

- The global insomnia market is growing, but Ambien CR's market share has contracted significantly post-patent expiry due to generic competition.

- Price erosion has plateaued at approximately $1.50–$3.50 per tablet in many markets, with future declines anticipated.

- Safety concerns and regulatory warnings influence prescribing patterns, potentially favoring branded formulations in niche segments.

- Market growth faces headwinds from alternative therapies and non-pharmacological interventions but persists in specific demographics like the elderly.

- Strategic positioning emphasizing safety, brand loyalty, and targeted use cases remains crucial for Ambien CR.

FAQs

1. How has patent expiration affected Ambien CR’s market pricing?

Patent expiration in 2017 led to an influx of generic alternatives, sharply reducing Ambien CR’s price from over $10 per tablet to approximately $1.50–$3.50, due to increased competition and market saturation.

2. What are the primary factors influencing Ambien CR’s future price projections?

Market saturation with generics, regulatory safety warnings, prescribing trends, and emerging therapies are key factors shaping future pricing, with prices likely stabilizing at low levels unless certain niches favor branded formulations.

3. Can safety concerns impact the market position of Ambien CR?

Yes. The FDA’s black box warnings on complex sleep behaviors and dependency can restrict prescriptions to specific patient groups, possibly sustaining demand in those segments but also introducing cautious prescribing.

4. What role do healthcare payers play in Ambien CR’s pricing?

Payers influence pricing through formulary placements, reimbursement levels, and negotiated discounts. Their preference for lower-cost generics can further pressure the branded product’s price.

5. Are there any emerging competitors that could alter the market landscape for Ambien CR?

Yes. The development of new sleep aids with improved safety profiles or non-pharmacological therapies may shift patient and clinician preferences, potentially impacting Ambien CR’s market share and pricing.

References

[1] IQVIA, U.S. Prescription Drug Market Data, 2022.

[2] MarketsandMarkets, Sleep Disorder Treatment Market Forecast, 2023.

[3] FDA, Drug Patent Expirations and Generic Entry Timeline, 2017.

[4] EvaluatePharma, Generic Market Penetration Trends, 2022.

[5] FDA, Black Box Warnings on Zolpidem Products, 2019.

[6] Drugs.com, Average Wholesale Prices for Ambien CR and Generics, 2023.