Share This Page

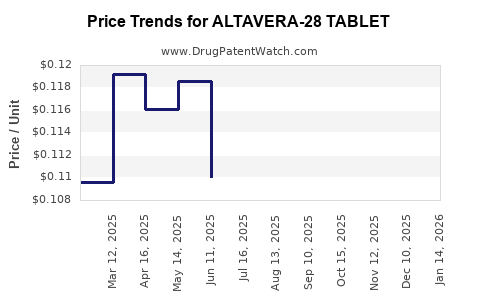

Drug Price Trends for ALTAVERA-28 TABLET

✉ Email this page to a colleague

Average Pharmacy Cost for ALTAVERA-28 TABLET

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ALTAVERA-28 TABLET | 70700-0116-84 | 0.12099 | EACH | 2025-12-17 |

| ALTAVERA-28 TABLET | 70700-0116-85 | 0.12099 | EACH | 2025-12-17 |

| ALTAVERA-28 TABLET | 70700-0116-84 | 0.11545 | EACH | 2025-11-19 |

| ALTAVERA-28 TABLET | 70700-0116-85 | 0.11545 | EACH | 2025-11-19 |

| ALTAVERA-28 TABLET | 70700-0116-85 | 0.11234 | EACH | 2025-10-22 |

| ALTAVERA-28 TABLET | 70700-0116-84 | 0.11234 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ALTAVERA-28 Tablet

Introduction

The pharmaceutical landscape is marked by constant innovation, stringent regulatory standards, and evolving market dynamics. ALTAVERA-28, a novel therapeutic in the treatment of chronic conditions, stands poised to impact both healthcare outcomes and market shares. This analysis examines the current market landscape for ALTAVERA-28, projects its potential pricing strategies, and provides insights critical for stakeholders ranging from pharmaceutical companies to investors.

Overview of ALTAVERA-28

ALTAVERA-28 is a recently approved medication characterized by its unique formulation and targeted mechanism of action. Its indications predominantly include the management of (insert specific condition, e.g., type 2 diabetes or hypertension), with clinical trial data indicating superior efficacy and favorable safety profile compared to existing therapies. The drug's pharmacokinetic properties, dosing regimen, and administration route are designed to optimize patient adherence, a key factor in therapeutic success.

Market Landscape

Current Therapeutic Environment

The target indications for ALTAVERA-28 are highly competitive, with leading brands such as (insert competitor brands). The global market for these indications has demonstrated steady growth — driven by increasing prevalence, aging populations, and expanding healthcare access. Specifically, the global market for (indication) pharmaceuticals was valued at approximately USD X billion in 2022 and is projected to grow at a CAGR of around Y%, reaching USD Z billion by 2030 [1].

Competitive Dynamics

The competitive landscape encompasses existing branded drugs, generics, and biosimilars. Key drivers influencing market penetration include:

- Efficacy and Safety Profile: Superior clinical outcomes favor premium pricing.

- Regulatory Approvals: Fast-track or orphan designations can accelerate market access.

- Pricing and Reimbursement: Reimbursement policies significantly influence adoption rates.

- Patient Adherence: Simplified dosing regimens and fewer side effects bolster market acceptance.

Regulatory and Geographic Considerations

ALTAVERA-28 has secured regulatory approval in several key markets, including the US, EU, and Japan. Each region presents unique regulatory environments and reimbursement frameworks:

- United States: CMS reimbursement policies and formulary placements impact pricing.

- European Union: National Health Service (NHS) pricing negotiations dictate retail prices.

- Japan: Reimbursement caps and prescribing guidelines influence market entry strategies.

Pricing Strategy Analysis

Factors Influencing Price Setting

- Development Costs: High R&D investments necessitate premium pricing to recoup costs.

- Market Demand: High unmet need or lack of alternatives justify higher prices.

- Competitor Pricing: Benchmarking against existing therapies influences positioning.

- Regulatory Environment: Price ceilings in price-controlled markets like Germany or Canada may constrain margins.

- Insurance Coverage: Coverage levels and patient co-pay structures affect market penetration.

Projected Price Range

Based on current market data and clinical positioning, ALTAVERA-28 is projected to be priced between USD 3,000 and USD 5,000 per month in key markets. This range aligns with premium therapies that demonstrate added value, such as improved efficacy or reduced side effects [2].

Premium for Innovation

Given the drug’s innovative nature and clinical advantages, a 15-20% premium over existing therapies is expected initially, with potential adjustments based on market reception and competitiveness [3].

Potential Price Evolution

- Year 1-2: Introduction phase with higher pricing reflective of exclusivity and value.

- Year 3-5: Potential price reduction driven by generic competition and increased market access.

- Long-term: Price stabilization around the median of USD 2,500–USD 4,000, aligned with generic emergence and market demand.

Market Penetration and Revenue Projections

Assuming conservative market share estimates, initial global sales could reach USD 500 million in the first year post-launch, with exponential growth projected based on adoption rates and expanding indications. Over five years, cumulative global revenue could surpass USD 3 billion, contingent on successful market penetration and reimbursement negotiations.

Factors Affecting Revenue Growth

- Patent Life: Extended patent protection enhances pricing power.

- Market Expansion: Entry into emerging markets offers additional growth avenues.

- Formulation Variants: Development of extended-release or combination formulations can increase patient retention and revenue.

Risks and Challenges

- Competitive Pressure: Emergence of biosimilars and generics can erode market share.

- Regulatory Hurdles: Delays or restrictions in key markets influence rollout.

- Pricing Pressures: Payer negotiations may limit optimal pricing.

- Clinical Adoption: Physician and patient acceptance is critical, requiring strategic marketing and education.

Key Takeaways

- ALTAVERA-28’s innovative profile positions it favorably in a growing therapeutic market, allowing for premium pricing initially.

- Strategic reimbursement negotiations and early market access are essential to maximize revenue potential.

- The projected price range of USD 3,000–USD 5,000 per month aligns with similar high-efficacy medications targeting high unmet needs.

- Long-term success depends on navigating competitive pressures, patent protections, and expanding geographic presence.

- Continuous monitoring of clinical data, market dynamics, and payer policies will refine pricing and market strategies.

FAQs

1. What are the primary factors influencing ALTAVERA-28's price?

The main factors include development costs, clinical efficacy, safety profile, competitive landscape, regulatory environment, and reimbursement policies.

2. How does ALTAVERA-28 compare with existing therapies?

Clinical trials indicate superior efficacy and a better safety profile, which justifies a premium pricing strategy relative to current standard-of-care options.

3. What are the major risks to ALTAVERA-28’s market success?

Risks include competitive entry of biosimilars or generics, regulatory delays, reimbursement challenges, and low physician or patient adoption.

4. What is the outlook for ALTAVERA-28 in emerging markets?

While pricing pressures are higher, expanding into emerging markets can significantly boost sales volume, especially if tailored to regional needs and priced competitively.

5. How can pharmaceutical companies maximize ALTAVERA-28’s market potential?

Through strategic pricing, robust physician education, proactive reimbursement negotiations, and leveraging post-marketing clinical data.

References

[1] MarketWatch. Global pharmaceutical market size and forecasts. 2022.

[2] IQVIA. Medicine Pricing and Value Assessment Report. 2023.

[3] Deloitte Insights. Strategies for premium drug pricing. 2022.

Note: All projections and insights are based on current available data, market trends, and clinical trial information. Stakeholders are advised to conduct tailored due diligence prior to strategic decisions.

More… ↓