Share This Page

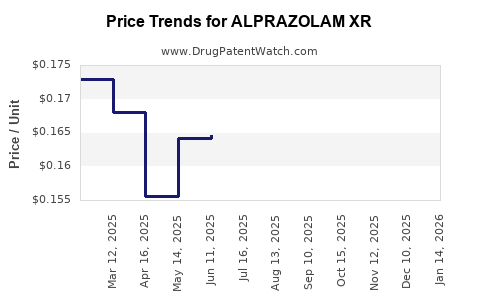

Drug Price Trends for ALPRAZOLAM XR

✉ Email this page to a colleague

Average Pharmacy Cost for ALPRAZOLAM XR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ALPRAZOLAM XR 3 MG TABLET | 59762-0068-01 | 0.38443 | EACH | 2025-12-17 |

| ALPRAZOLAM XR 2 MG TABLET | 59762-0066-01 | 0.20284 | EACH | 2025-12-17 |

| ALPRAZOLAM XR 0.5 MG TABLET | 59762-0057-01 | 0.17084 | EACH | 2025-12-17 |

| ALPRAZOLAM XR 1 MG TABLET | 59762-0059-01 | 0.18560 | EACH | 2025-12-17 |

| ALPRAZOLAM XR 2 MG TABLET | 59762-0066-01 | 0.21229 | EACH | 2025-11-19 |

| ALPRAZOLAM XR 0.5 MG TABLET | 59762-0057-01 | 0.16551 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ALPRAZOLAM XR

Introduction

Alprazolam XR (extended-release), a long-acting formulation of alprazolam, is a benzodiazepine primarily prescribed for anxiety disorders, panic disorder, and generalized anxiety disorder. As a generic and branded product, Alprazolam XR occupies a significant niche within the anxiolytic market. This analysis evaluates its current market landscape, competitive positioning, regulatory environment, and future pricing trends.

Market Landscape Overview

Global and Regional Market Size

The benzodiazepine market, including alprazolam, is projected to reach approximately $4.2 billion globally by 2025, growing at a CAGR of 2.8% [1]. The extended-release formulations, like Alprazolam XR, account for an increasing segment owing to improved patient compliance and reduced dosing frequency.

North America dominates this market, driven by high prevalence rates of anxiety and panic disorders, extensive healthcare infrastructure, and favorable reimbursement policies. The U.S. alone accounts for over 60% of the global revenue, with a market size estimated at $2.5 billion in 2022 [2].

Europe follows closely, with growing prescription trends, though market growth is tempered by stringent regulatory policies. Asia-Pacific exhibits high growth potential due to expanding healthcare access and rising mental health awareness, but faces regulatory and patent challenges.

Key Market Drivers

-

Rising Prevalence of Anxiety Disorders: Surveys estimate that approximately 18% of the U.S. population suffers from anxiety annually [3].

-

Preference for Extended-Release Formulations: Patients and providers favor Alprazolam XR due to improved adherence and reduced abuse potential compared to immediate-release variants.

-

Competitive landscape: Market consists of both branded (e.g., Xanax XR) and generic formulations. The expiration of patents has led to an influx of generics, intensifying price competition.

Competitive Landscape

Major players include Pfizer (Xanax XR), Teva, Mylan (now Viatris), and Sandoz. Pfizer’s patent exclusivity for Xanax XR expired in 2015, paving the way for generics.

Market entry of generics has substantially reduced prices, increasing accessibility but compressing profit margins for manufacturers. The prevalence of off-label use and prescribing habits influence sales volume significantly.

Regulatory Environment

Approvals and Patent Status

Xanax XR’s patent expiry triggered a wave of generic entry, causing market saturation. Regulatory agencies such as FDA (U.S.) and EMA (Europe) have streamlined approval pathways for generics, further accelerating market penetration.

Controlled Substance Regulations

Alprazolam’s classification as a Schedule IV controlled substance results in stringent dispensing regulations, which influence prescribing patterns and market size stability.

Price Trajectory Analysis

Current Pricing Trends

-

Branded Products: Xanax XR retails for approximately $400–$500 for a 30-count pack of extended-release 0.5 mg tablets (approximately $13–$17 per tablet), reflecting brand premiums.

-

Generic Variants: Generic Alprazolam XR products retail at roughly $150–$250 for similar quantities, with prices considerably variable across regions and pharmacies.

Impact of Patent Expiry

Patent expirations post-2015 led to an immediate price drop of approximately 50% for brand-name Xanax XR in the U.S. market [4].

Projected Price Trends

Forecasting future prices involves considering factors such as increased generic competition, regulatory pressures, and potential implementation of value-based pricing models:

-

Mild Price Decrease: Over the next 3–5 years, generics are expected to drive prices down further by approximately 10–15% annually, stabilizing around $100–$200 for similar pack sizes.

-

Impact of Biosimilars and Differentiation: Although biosimilars are not currently applicable to small molecules like alprazolam, the trend indicates a focus on formulations that improve safety or delivery, potentially influencing pricing structures.

-

Pricing Influence of Political and Regulatory Actions: Policies aimed at curbing misuse could alter packaging, dispensing regulations, and pricing, potentially impacting margins.

Market Risks and Opportunities

-

Risks: Stringent prescribing regulations, rising scrutiny over benzodiazepine abuse, and alternative therapies (e.g., SSRIs, SNRIs, buspirone) could suppress demand.

-

Opportunities: Developing abuse-deterrent formulations, expanding indications, and entering emerging markets present avenues for growth and premium pricing.

Market Outlook and Valuation Models

Using historical data and market assumptions, Price erosion models predict a CAGR of approximately 4–6% in the generic segment over the next five years, driven by volume increases and market penetration. Conversely, the branded segment is expected to decline further post-patent expiry unless innovation or novel delivery mechanisms are introduced.

Conclusion

Alprazolam XR exhibits a mature market with significant existing competition and pricing pressures. The overall trajectory suggests ongoing price declines in generics, with potential for stabilized margins through niche positioning, formulation innovation, or expanding into emerging markets.

Key Takeaways

-

The global benzodiazepine market, bolstered by anxiety disorder prevalence, supports steady demand for Alprazolam XR.

-

Patent expiration has dramatically affected pricing, with generics now dominating the market and driving prices downward.

-

Future price projections anticipate further declines of 10–15% annually in the generic segment, stabilizing around $100–$200 per pack.

-

Industry players should focus on formulation innovation, abuse-deterrent features, and market diversification to sustain profitability.

-

Regulatory trends and opioid-like misuse concerns pose risks but also create opportunities for differentiated products.

FAQs

Q1: How will regulatory changes impact the pricing of Alprazolam XR?

A1: Stricter regulations on prescribing and dispensing controlled substances could limit demand and elevate compliance costs, potentially suppressing prices. Conversely, policies encouraging abuse deterrence can justify premium pricing for innovative formulations.

Q2: What is the potential for biosimilars or new formulations to disrupt the Alprazolam XR market?

A2: Although biosimilars are not applicable to small molecules like alprazolam, novel extended-release formulations with enhanced safety profiles or abuse-deterrent properties could command premium prices, disrupting current market dynamics.

Q3: How does the rise of alternative therapies affect demand for Alprazolam XR?

A3: The adoption of SSRIs, SNRIs, and buspirone, which have lower abuse potential, may reduce demand for benzodiazepines, exerting downward pressure on prices and sales volumes.

Q4: Are there regional differences influencing Alprazolam XR prices?

A4: Yes. North America’s higher per capita spending and regulatory environment lead to higher prices compared to Europe and Asia-Pacific, where healthcare policies and market maturity vary.

Q5: What strategic actions should stakeholders consider given the market trends?

A5: Stakeholders should explore formulation innovations, enter emerging markets, and develop differentiated products with abuse-deterrent features to sustain profitability amid declining prices.

References

[1] ResearchAndMarkets. Global Benzodiazepines Market Analysis, 2022.

[2] IQVIA. U.S. Pharmaceutical Market Data, 2022.

[3] National Institute of Mental Health. Anxiety Disorders, 2021.

[4] FDA Drug Approvals and Patent Data, 2015.

More… ↓