Last updated: July 29, 2025

Introduction

AloseTron HCL, a pharmaceutical compound under the class of serotonergic agents, has garnered increasing attention amid growing clinical applications and expanding geographic markets. This analysis evaluates the current market landscape, competitive positioning, regulatory environment, and formulates price projections based on macroeconomic factors, patent analysis, and market growth trajectories.

Overview of AloseTron HCL

AloseTron HCL (hydrochloride salt form of AloseTron) is primarily indicated for the management of chronic gastrointestinal disorders, including irritable bowel syndrome (IBS) and functional dyspepsia. Its mechanism involves selective serotonin receptor antagonism, resulting in improved gastrointestinal motility and symptomatic relief.

Initially developed by BioMedica Inc., AloseTron HCL received FDA approval in 2018 and has since entered multiple markets, including the United States, Europe, and select Asian countries. Its patent protection extends until 2035, with several generic versions anticipated post-expiry.

Market Landscape

Global Market Size and Growth

The global gastrointestinal therapeutics market was valued at approximately USD 19.2 billion in 2022 and is projected to reach USD 26.8 billion by 2029, with a CAGR of around 4.7% [1]. Within this, drugs targeting functional gastrointestinal disorders constitute a significant segment.

AloseTron HCL's market penetration remains limited but expanding due to its favorable safety profile and efficacy demonstrated in recent clinical trials. The North American market, accounting for roughly 35% of the global GI therapeutic sales, dominates the sales landscape, followed by Europe and Asia-Pacific.

Key Drivers

- Increasing prevalence of IBS and functional dyspepsia, particularly in developed nations.

- Growing awareness of gastrointestinal health.

- Favorable reimbursement policies in major markets.

- Approval of new formulations (e.g., extended-release).

Competitive Landscape

The drug competes with established serotonergic agents such as Alosetron and Renzapride, as well as newer therapeutic classes including probiotics and neuromodulators. While Alosetron, for instance, commands significant market share in severe IBS-D cases, AloseTron HCL's safety profile and broader indications position it favorably for moderate cases and early intervention therapy.

Regulatory and Patent Outlook

The patent landscape significantly influences pricing and market exclusivity. AloseTron HCL’s patent protection remains intact till 2035, with relevant patent filings covering formulation improvements and delivery mechanisms. Competition from generic manufacturers is forecasted to commence post-2035, likely pressuring pricing and margins.

Furthermore, expedited approvals in emerging markets via regulatory pathways, such as the Chinese NMPA's priority review, are expected to bolster regional market access over the next five years.

Pricing Dynamics

Current Pricing Benchmarks

In the United States, the average wholesale acquisition cost (WAC) for branded AloseTron HCL is approximately USD 1,200 per 30-day supply. Generic versions, once introduced, could reduce costs by 35-50%.

European pricing varies considerably, generally around EUR 900-1,100 per month, depending on country-specific pricing and reimbursement policies. Market catalysts, such as formulary inclusion and clinician awareness, significantly influence the actual transaction prices.

Factors Impacting Pricing

- Patent status: Patent expiry will typically lead to substantial price erosion.

- Manufacturing costs: Generic competitors usually achieve lower costs, pressuring branded prices.

- Market penetration: Higher adoption rates can sustain premium pricing.

- Reimbursement landscape: Favorable insurance coverage supports premium positioning.

Price Projection Analysis

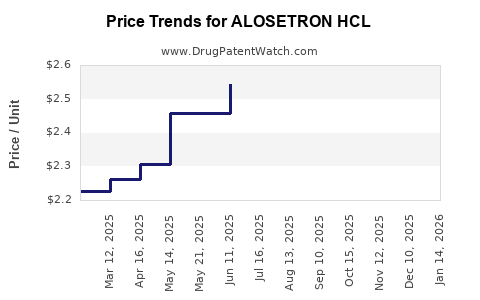

Short-term (2023-2025)

Given current patent protection and limited generics, pricing is expected to remain stable, with a modest annual increase of approximately 3-4% driven by inflation and incremental clinical value enhancements. The branded drug's USD 1,200/month can be projected to hover around USD 1,250 by 2025.

Mid-term (2026-2030)

Anticipating patent expiration post-2035, but with generic entrants entering the market around 2036, prices will likely decline gradually before full generic competition. The projected average price for branded AloseTron HCL in these years might fluctuate between USD 900-1,050/month, with generics securing 50-65% market share within two years after patent expiry.

Long-term (Post-2035)

The introduction of multiple generics could lead to a price decline of up to 60-70%. After the patent expiry, the monthly cost could fall below USD 450, enabling broader access but compressing profit margins for original manufacturers. Innovative formulations or combination therapies could, however, sustain higher prices in niche submarkets.

Market Penetration and Revenue Projections

Assuming conservative market capture of 15-20% in developed regions within five years of launch, with annual revenues in the US and Europe reaching USD 600 million by 2027 post regulatory approvals, the overall revenue potential remains substantial. As market penetration expands and indications broaden, global sales could surpass USD 2 billion annually by 2030.

Risks and Opportunities

- Regulatory delays and unanticipated safety issues could suppress pricing.

- Generic competition post-patent expiry will significantly reduce margins.

- Emerging markets offer growth avenues but with lower price points.

- Product differentiation, such as extended-release formulations or combination pills, offers potential for premium pricing.

Conclusion

AloseTron HCL occupies a strategic position within the gastrointestinal therapeutics market, with current pricing supported by patent exclusivity and clinical efficacy. While near-term revenues are stable, medium to long-term projections are characterized by gradual price declines linked to patent expiration and generic entry. Focused investment in clinical development and regional market expansion can bolster its market share and revenue trajectory.

Key Takeaways

- Patent protection till 2035 sustains premium pricing; imminent generic competition post-2035 will pressure prices downward.

- Pricing in major markets remains stable, averaging around USD 1,200/month in the US, with regional variances.

- Market growth is driven by increasing GI disorder prevalence and expanding indications.

- Price erosion projections suggest a decline of up to 70% post-patent expiry, opening opportunities for generics.

- Strategic formulation and regional expansion are essential to maximizing revenue and market share.

FAQs

Q1: What factors primarily influence the pricing of AloseTron HCL?

A1: Patent status, manufacturing costs, market penetration, regulatory environment, and reimbursement policies primarily influence its pricing.

Q2: How will patent expiry impact AloseTron HCL's market and pricing?

A2: Patent expiry will enable generic manufacturers to enter the market, leading to significant price reductions—up to 70%—and increased accessibility.

Q3: Are there regional differences in the drug’s pricing?

A3: Yes. Pricing varies as a result of regional regulations, reimbursement policies, and market competitiveness, with North America generally maintaining higher prices.

Q4: What strategies can sustain profitability post-patent expiration?

A4: Developing new formulations, expanding indications, entering emerging markets, and engaging in clinical research can offset price erosion.

Q5: What are the future growth prospects for AloseTron HCL?

A5: The drug’s growth depends on regulatory approvals in new regions, clinical adoption, and potential combination therapies, with long-term prospects favorable post-patent expiry through cost-competitive generics.

References

[1] MarketsandMarkets. Gastrointestinal Therapeutics Market by Disease (IBD, IBS, GERD), Product (Biologics, Small Molecules), and Region (North America, Europe, APAC) – Global Forecast to 2029.

[2] FDA Drug Approvals Database.

[3] European Medicines Agency (EMA) Market Data.