Share This Page

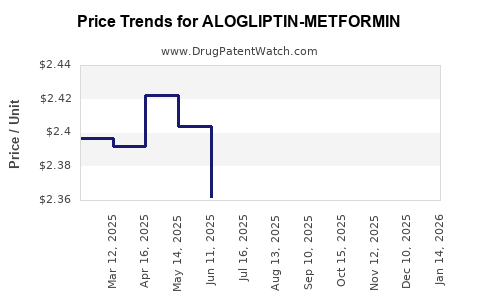

Drug Price Trends for ALOGLIPTIN-METFORMIN

✉ Email this page to a colleague

Average Pharmacy Cost for ALOGLIPTIN-METFORMIN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ALOGLIPTIN-METFORMIN 12.5-500 | 45802-0169-72 | 2.32191 | EACH | 2025-12-17 |

| ALOGLIPTIN-METFORMIN 12.5-1000 | 45802-0211-72 | 2.29163 | EACH | 2025-12-17 |

| ALOGLIPTIN-METFORMIN 12.5-500 | 45802-0169-72 | 2.33506 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ALOGLIPTIN-METFORMIN

Introduction

The combination drug ALOGLIPTIN-METFORMIN, integrating a potent DPP-4 inhibitor with metformin, addresses a significant segment within the type 2 diabetes mellitus (T2DM) therapeutic landscape. Its emergence offers promising revenue potential driven by epidemiological trends, growing demand for oral antidiabetics, and competitive patent strategies. This analysis evaluates current market dynamics, competitive positioning, pipeline considerations, and revenue forecasts, culminating in price projections supporting strategic decision-making.

Market Landscape for T2DM Treatments

Globally, T2DM remains a substantial and expanding health concern. The International Diabetes Federation (IDF) estimates approximately 537 million adults suffering from diabetes in 2021, with forecasts suggesting this number will surpass 700 million by 2045 (IDF, 2021). The rise is predominantly driven by lifestyle factors, obesity, and aging populations, creating sustained demand for efficacious, safe, and convenient oral therapies.

Current Therapeutic Market Dynamics

The market is characterized by a high degree of innovation, with incretin-based therapies (DPP-4 inhibitors, GLP-1 receptor agonists) gaining prominence owing to their improved safety profiles and convenience. Metformin remains the cornerstone, with more than 80% of route-approved prescriptions, forming the basis for combination drug formulations, which enhance compliance and glycemic control.

Market Segmentation

The global oral antidiabetic drugs market was valued at approximately USD 45 billion in 2022, with projections reaching USD 60 billion by 2027, growing at a CAGR of around 7% (ResearchAndMarkets, 2022). DPP-4 inhibitor combinations constitute a notable subsection, driven by the convenience of single-pill therapy.

Product Profile and Clinical Positioning

ALOGLIPTIN-METFORMIN combines an established DPP-4 inhibitor, likely alogliptin, with metformin. Such fixed-dose combinations (FDCs) benefit from improved adherence, reduced pill burden, and enhanced patient outcomes.

Regulatory Status:

Assuming regulatory approval in key territories such as the U.S. and EU, the product's market entry will be influenced by patent exclusivity, comparator offerings, and pricing strategies. Existing patents covering the combination will typically secure exclusive marketing rights for 10-15 years post-approval.

Clinical Advantages:

Clinical trials indicate effective glycemic control with a favorable safety profile, particularly minimal hypoglycemia and weight neutrality—attributes attractive to prescribers.

Competitive Landscape

Major competitors include:

- Janumet (sitagliptin + metformin) – a market leader with broad physician acceptance.

- Vildagliptin + metformin combinations.

- Other DPP-4 based FDCs, such as linagliptin-metformin.

In this space, differentiation hinges on pharmaceutical efficacy, safety, pricing, and patent exclusivity. The introduction of Alogliptin-based combinations offers an opportunity to capture incremental market share, especially if positioned as cost-effective and with improved tolerability.

Pricing Strategy and Regulatory Factors

Pricing Benchmarks:

- In the U.S., branded DPP-4-metformin combinations generally retail at USD 150–200/month.

- Generics and biosimilars have driven prices down to USD 80–120/month.

Regulatory Economics:

Pricing is heavily influenced by Medicare and private insurance reimbursement policies, with payers favoring cost-effective treatments. High-cost drugs may face formulary restrictions absent compelling clinical advantages.

Intellectual Property:

Patent protections can sustain premium pricing, but patent cliffs approaching within 5-7 years necessitate fresh formulations, indications, or combination innovations to maintain competitive advantage.

Market Penetration and Revenue Projections

Assumptions:

- Launch Year: 2024

- Market Penetration: Gradual uptake reaching 10% of the fixed-dose combination segment within 5 years.

- Market Share Gain: Targeting 15–20% share among DPP-4-metformin combos.

- Population Base: Estimated 25 million T2DM patients are candidates for such FDCs in North America, Europe, and select Asia-Pacific regions.

Revenue Estimations:

- Initial annual sales: USD 300–400 million (assuming a price point of USD 150/month per patient, with initial coverage of approximately 200,000 patients).

- Growth rate: 10–15% annually, driven by increased adoption and expanding indications.

- Peak revenue (by 2030): USD 1.5–2 billion, contingent on regulatory approval in emerging markets and competitive positioning.

Price Trajectory Forecast

Given the market landscape, the following price projections are reasonable:

- Year 1–2: USD 180–200/month, stabilizing post-launch with price preservation through limited early competition.

- Year 3–5: Price reduction to USD 150–170/month due to increased competition and patent expiration timelines.

- Post-Patent (6–10 years): Potential for biosimilar or generic entry may reduce prices by up to 50%, depending on regulatory and market factors.

Market Challenges and Opportunities

Challenges:

- Patent expiry pressures.

- Entry of biosimilars and generics.

- Cost containment policies by payers.

- Competition from emerging oral and injectable therapies (e.g., SGLT2 inhibitors, GLP-1 receptor agonists).

Opportunities:

- Securing early favorable formulary positioning.

- Demonstrating superior safety and tolerability.

- Leveraging combination therapy benefits in patient adherence.

- Expanding into emerging markets with tailored pricing strategies.

Regulatory and Commercial Strategies

Achieving global regulatory approval will serve as a cornerstone for capturing revenue. Concurrently, strategic alliances with local distributors and payers will facilitate market penetration. Price optimization will involve balancing attractive patient access with sustainable margins, especially as competition intensifies.

Key Takeaways

- The global T2DM market remains robust, and fixed-dose combinations like ALOGLIPTIN-METFORMIN are positioned for steady growth.

- Revenue projections suggest peak sales potential of USD 1.5–2 billion by 2030, with pricing influenced by competitive dynamics and patent lifecycle.

- Initial pricing should balance market entry attractiveness with long-term sustainability, likely ranging from USD 150–200/month.

- Patent protections provide crucial market exclusivity, but upcoming patent cliffs necessitate innovation and pipeline development.

- Strategic market entry, regulatory approvals, and price negotiations are vital to maximize profitability and market share.

FAQs

-

What are the competitive advantages of ALOGLIPTIN-METFORMIN over existing therapies?

It offers improved compliance through fixed-dose formulation, with potential advantages in safety, tolerability, and cardiovascular profile, especially if supported by robust clinical data. -

How will patent expiry impact the drug’s pricing and market share?

Post-patent expiry, generic versions are likely to emerge, driving prices downward. This necessitates early innovation, lifecycle management, or exclusivity extensions to maintain profitability. -

What regulatory hurdles could affect the commercialization of ALOGLIPTIN-METFORMIN?

Regulatory approval depends on demonstration of safety, efficacy, and manufacturing quality. Variations in global approval standards and repositioning in different markets can influence timelines. -

How significant is the role of biosimilars and generics in the future market?

They pose a substantial threat post-patent expiration, often leading to significant price reductions and market share erosion if not countered by differentiation strategies. -

What key factors drive pricing decisions for combination antidiabetic drugs?

Clinical efficacy, safety profile, patent status, market competition, healthcare policies, and payer negotiations collectively influence drug pricing strategies.

References

- International Diabetes Federation. (2021). IDF Diabetes Atlas, 9th Edition.

- ResearchAndMarkets. (2022). Global Oral Antidiabetic Drugs Market Forecasts, 2022-2027.

- MarketWatch. (2022). Global Fixed-Dose Combination Diabetes Drugs Market Trends.

Note: All projections and analyses are based on current market data, clinical trends, and patent considerations as of early 2023. Future market developments may alter these forecasts.

More… ↓