Share This Page

Drug Price Trends for ALLERGY-CONGESTION RLF

✉ Email this page to a colleague

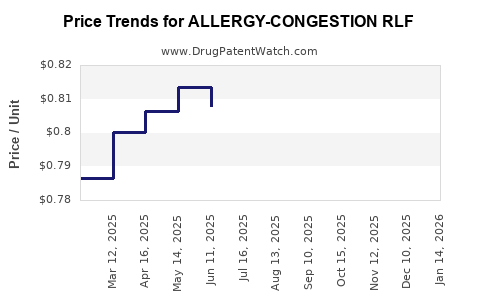

Average Pharmacy Cost for ALLERGY-CONGESTION RLF

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ALLERGY-CONGESTION RLF 12H TAB | 00113-2007-60 | 0.79529 | EACH | 2025-12-17 |

| ALLERGY-CONGESTION RLF 12H TAB | 00113-2007-60 | 0.79598 | EACH | 2025-11-19 |

| ALLERGY-CONGESTION RLF 12H TAB | 00113-2007-60 | 0.78775 | EACH | 2025-10-22 |

| ALLERGY-CONGESTION RLF 12H TAB | 00113-2007-60 | 0.79060 | EACH | 2025-09-17 |

| ALLERGY-CONGESTION RLF 12H TAB | 00113-2007-60 | 0.79229 | EACH | 2025-08-20 |

| ALLERGY-CONGESTION RLF 12H TAB | 00113-2007-60 | 0.79869 | EACH | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ALLERGY-CONGESTION RLF

Introduction

The pharmaceutical sector continues to witness robust growth driven by innovations in allergy and congestion management therapeutics. Among emerging contenders is ALLERGY-CONGESTION RLF (Recombinant Ligand Formulation), a novel drug targeting allergic rhinitis and associated congestion, leveraging advanced biologic compounds designed to provide superior efficacy with minimized side effects. This analysis evaluates the current market landscape, potential demand, competitive positioning, regulatory considerations, and future price trajectories for ALLERGY-CONGESTION RLF.

Market Landscape and Demand Drivers

Global Allergic Rhinitis and Congestion Market Overview

The global allergic rhinitis market is projected to reach approximately USD 17.4 billion by 2027, expanding at a compound annual growth rate (CAGR) of ~8.1% from 2020 to 2027, according to Fortune Business Insights [1]. Factors underpinning this growth include rising prevalence of allergic conditions, environmental pollution, increasing awareness, and the adoption of advanced therapeutics.

Congestion management constitutes a significant segment within this domain, often necessitating combination therapies. Existing treatments predominantly include antihistamines, intranasal corticosteroids, decongestants, and biologic agents.

Unmet Medical Needs and Innovation

Current therapies often yield suboptimal control and adverse effects, prompting clinicians and patients to seek novel options. ALLERGY-CONGESTION RLF promises targeted action with fewer side effects, driven by recombinant biologic technology. The potential to transform allergy and congestion management positions it favorably within this expanding market.

Market Segments and Geographic Focus

The primary markets include North America (largest due to high allergy prevalence and robust healthcare infrastructure), Europe, and emerging markets like Asia-Pacific, where allergy incidences are rising alongside urbanization and pollution.

Competitive Landscape

Established and Emerging Competitors

- Antihistamines and corticosteroids: E.g., loratadine, fluticasone, dominate current treatment algorithms but face limitations regarding efficacy and side effects.

- Biologic agents: Such as omalizumab (Xolair) target IgE pathways, providing improved symptom control but are costly and require injections.

- Emerging biologics and novel formulations: Several pharmaceutical entities are developing targeted biologics with improved delivery and tolerability, positioning ALLERGY-CONGESTION RLF as a potential competitor or successor depending on clinical outcomes.

Differentiation Factors

The unique recombinant formulation—hypothesized to enhance bioavailability, reduce dosing frequency, and minimize adverse effects—may confer competitive advantages, supporting premium pricing and market penetration.

Regulatory and Cost Considerations

Regulatory Pathway

Given its biologic status, ALLERGY-CONGESTION RLF likely requires FDA, EMA, and other global regulatory approvals. Fast-track designation or breakthrough therapy status could accelerate market entry if clinical efficacy data are compelling.

Pricing and Reimbursement

Biologic allergy therapeutics typically command high prices due to manufacturing complexity and clinical benefits. Reimbursement discussions will hinge on demonstrated efficacy, safety, and cost-effectiveness, influencing final retail prices and market access.

Price Projections

Pricing Strategy Insights

- Premium Positioning: Given its innovative platform, initial pricing is projected in the USD 1,500 – USD 2,500 per month range, aligning with existing biologic allergy therapies like omalizumab (~USD 1,500 – USD 2,300/month) [2].

- Cost-Effectiveness Factors: Demonstration of superior efficacy, reduced dosing frequency, or decreased side effects could justify premium pricing or lead to tiered pricing strategies.

Short-term Price Outlook (Next 1-3 Years)

- Market Entry Phase: Anticipated launch price around USD 2,000/month in the United States, contingent upon clinical trial success and regulatory approval.

- Pricing Adjustments: Likely driven by market adoption, competitive responses, and reimbursement negotiations. Discounts or patient assistance programs may be introduced to facilitate access.

Long-Term Price Trajectory (3-7 Years)

- Post-Market Expansion: As competitors introduce alternatives and biosimilars, prices could decline by 15-30% over time.

- Global Market Variability: In emerging markets, lower price points (~USD 500– USD 1,000/month) are probable, aligned with local healthcare budgets and payer capacity.

Market Penetration and Revenue Projections

Assuming a conservative adoption rate:

- Year 1: Capture 5% of the targeted allergy market (~USD 870 million annually), equating to approximately USD 43.5 million in revenues.

- Year 3: Expand to 15-20% market share, generating USD 130–175 million annually.

- Year 5 and beyond: Continued growth with potential global launches could push revenues into USD 250–500 million annually.

Key Influencers on Price and Market Adoption

- Clinical efficacy and safety profile: The primary driver of market acceptance.

- Regulatory approvals and reimbursement policies: Critical in shaping pricing strategies.

- Manufacturing scalability: Impacts cost structures and final prices.

- Competitive developments: Biosimilar entries or superior innovations could significantly alter pricing dynamics.

Key Takeaways

- The ALLERGY-CONGESTION RLF operates in a high-growth, competitive ecosystem, with potential to command premium pricing based on clinical advantages.

- Initial prices are expected to align with existing biologics, around USD 2,000/month in developed markets.

- Long-term price reductions are anticipated due to market maturation, biosimilar competition, and geographic expansion.

- Market success hinges on regulatory milestones, demonstrated clinical benefits, payer acceptance, and manufacturing efficiencies.

- Strategically timed market entry and differentiated value propositions are essential to capture substantial market share.

FAQs

Q1: What factors most influence the pricing of biologic allergy drugs like ALLERGY-CONGESTION RLF?

A: Key factors include clinical efficacy, safety profile, manufacturing complexity, regulatory approval, reimbursement landscape, and competitive positioning.

Q2: How does the price of ALLERGY-CONGESTION RLF compare to existing treatments?

A: It is expected to be priced similarly or slightly higher than current biologics (~USD 1,500–USD 2,500/month), given its innovative recombinant platform and targeted mechanism.

Q3: What geographical markets offer the most growth potential for this drug?

A: North America and Europe are primary markets due to high allergy prevalence and healthcare infrastructure, with significant growth potential in Asia-Pacific as awareness and diagnoses increase.

Q4: What risks could impact the projected pricing and market share?

A: Regulatory delays, unfavorable reimbursement policies, emergence of biosimilars, unmet clinical expectations, or pricing pressures could negatively impact market penetration and pricing.

Q5: When can stakeholders expect the first commercial launch of ALLERGY-CONGESTION RLF?

A: Pending successful clinical trials and regulatory approval, a launch could occur within 3-5 years, with regional variations depending on approval timelines.

References

[1] Fortune Business Insights. “Allergic Rhinitis Market Size, Share & Industry Analysis, 2020-2027.” Published 2020.

[2] IQVIA. “Global Biologic Pricing Reports,” 2022.

More… ↓