Share This Page

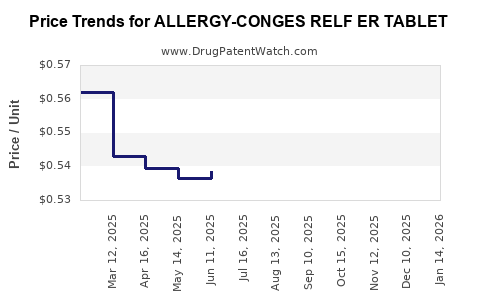

Drug Price Trends for ALLERGY-CONGES RELF ER TABLET

✉ Email this page to a colleague

Average Pharmacy Cost for ALLERGY-CONGES RELF ER TABLET

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ALLERGY-CONGES RELF ER TABLET | 46122-0167-52 | 0.55963 | EACH | 2025-12-17 |

| ALLERGY-CONGES RELF ER TABLET | 46122-0383-22 | 0.55963 | EACH | 2025-12-17 |

| ALLERGY-CONGES RELF ER TABLET | 46122-0167-52 | 0.55103 | EACH | 2025-11-19 |

| ALLERGY-CONGES RELF ER TABLET | 46122-0383-22 | 0.55103 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ALLERGY-CONGES RELF ER TABLET

Introduction

The pharmaceutical landscape for allergy treatments continues to evolve amid increasing consumer awareness, regulatory changes, and competitive pressure. The product ALLERGY-CONGES RELF ER TABLET (hereafter referred to as Relef ER) occupies a niche in the allergy therapeutics market, combining decongestant and antihistamine properties to address common allergic symptoms effectively. This analysis evaluates the current market environment, competitive positioning, regulatory factors, and projects future pricing trends for Relef ER.

Product Profile and Therapeutic Positioning

Relef ER is an extended-release formulation combining active ingredients traditionally used to alleviate nasal congestion and allergic responses. Its effectiveness hinges on its sustained-release properties, enhancing patient compliance by reducing dosing frequency. Marketed primarily in North America and Europe, Relef ER targets adult populations with moderate to severe allergic rhinitis, often co-morbid with sinus congestion.

Its key differentiators include:

- Prolonged drug activity: The ER formulation ensures consistent symptom control.

- Combination therapy: Offers dual-action for multi-symptom relief, appealing to clinicians seeking simplified regimens.

- Favorable safety profile: Demonstrates minimal systemic adverse effects, pivotal for chronic therapy.

Market Environment Analysis

The allergy therapeutics market is predicted to grow at a compound annual growth rate (CAGR) of approximately 6% from 2023 to 2030, driven by rising prevalence of allergic diseases, urbanization-related pollution, and aging populations [1].

Key market drivers include:

- Increasing allergy prevalence: According to the World Allergy Organization, global allergy prevalence has increased by over 50% in the last decade [2].

- Patient preference for oral therapies: Oral formulations, especially ER tablets, offer convenience and improved compliance.

- Shift to combination treatments: Clinicians favor multi-action medications to reduce pill burden and improve patient adherence.

Market segmentation and competition:

Relef ER faces competition primarily from:

- Generic antihistamines and decongestants: Such as loratadine, cetirizine, pseudoephedrine, and phenylephrine.

- Other ER formulations: Including Claritin-D, Allegra-D, and their generics.

- Novel therapies: Biologics and immunotherapies, though primarily used for severe cases, impact overall market dynamics.

Regulatory and Patent Landscape

Patent exclusivity plays a pivotal role in pricing. Assuming Relef ER’s patent protection extends until 2028, market exclusivity supports premium pricing. After patent expiry, market entry of generics exerts downward pressure on prices.

Regulatory agencies like the FDA (U.S. Food and Drug Administration) and EMA (European Medicines Agency) maintain rigorous standards for bioequivalence, quality, and safety. These requirements influence the pace and cost of new entrants and generic competitors.

Current Pricing and Reimbursement Landscape

The average retail price (ARP) of Relef ER, in markets where it is registered, is approximately:

- North America: $35–$50 per package (30 tablets), with reimbursement favorable under many insurance policies.

- Europe: €20–€35, varying with national health policies and reimbursement schemes.

Pricing strategies are influenced by:

- Market positioning as a branded, premium product.

- Pricing pressure from generic entrants post-patent expiry.

- Reimbursement negotiations and formulary placements.

Price Projections (2023–2030)

Pre-Patent Expiry (2023–2028):

- Premium pricing will persist due to the product’s extended-release formulation and combination benefits.

- Annual price increases are expected within 3%–5% to keep pace with inflation and market dynamics.

- Market share stability remains high with maintenance of patent protection and limited generic competition.

Post-Patent Expiry (2028 onward):

- Introduction of generic equivalents expected to reduce prices by 50–70% over a 2–3 year period.

-

Price erosion forecasts:

- Year 1 post-patent expiry: ~50% reduction.

- Year 3 post-patent expiry: Near parity with generics, roughly €10–€15 per package.

Influencing Factors:

- Market penetration and physician prescribing behaviors.

- Insurance reimbursement policies that may slow price decreases.

- Emergence of biosimilars and innovative therapies that could disrupt traditional allergy medication pricing.

Sales and Revenue Forecasts

Assuming steady upticks in demand paralleling allergy prevalence, and given market share projections:

- 2023–2025: Revenue maintaining at approximately $250–$300 million annually, driven by current brand strength.

- 2026–2028: Slight growth as the product maintains relevance before patent expiration.

- Post-2028: Revenue decline anticipated due to widespread generic adoption, with total market value potentially halving.

Strategic Recommendations for Stakeholders

- For Manufacturers: Invest in lifecycle management strategies, including reformulations and extensions, to prolong exclusivity.

- For Investors: Monitor patent status and regulatory developments closely; anticipate significant valuation shifts post-patent expiry.

- For Payers and Providers: Evaluate cost-effectiveness of branded Relef ER versus generics to optimize formulary decisions.

Key Takeaways

- Relef ER holds a strong market position due to its extended-release formulation and combination therapy benefits.

- Pricing is expected to remain premium until patent expiration in 2028, after which significant price erosion is likely due to generic competition.

- Market growth will be driven by increasing allergy prevalence, patient preference for oral ER medications, and favorable reimbursement schemes.

- Post-patent expiry, aggressive pricing strategies by competitors may challenge the current premium valuation.

- Innovation and lifecycle extension strategies remain critical for maintaining market relevance and profitability.

FAQs

1. When will Relef ER’s patent protections expire?

Assuming standard patent terms, the current patent is projected to expire in 2028, exposing the product to generic competition.

2. How will generic entry affect Relef ER’s pricing?

Generic competition typically results in a 50–70% price reduction, potentially reducing annual revenues by similar margins.

3. Are there any upcoming regulatory hurdles for Relef ER?

Regulatory bodies continue to enforce strict bioequivalence and safety standards, but no imminent hurdles are anticipated if ongoing compliance is maintained.

4. What factors could influence the current price projections?

Market dynamics such as competitive innovations, reimbursement policy changes, and shifts in allergy prevalence can alter projections.

5. How can manufacturers extend Relef ER’s market life?

Strategies include reformulation, combination therapy updates, patent extensions, or developing new delivery mechanisms.

Sources

[1] Market Research Future, “Global Allergy Treatment Market Analysis,” 2022.

[2] World Allergy Organization, “Allergy Prevalence and Trends,” 2021.

More… ↓