Share This Page

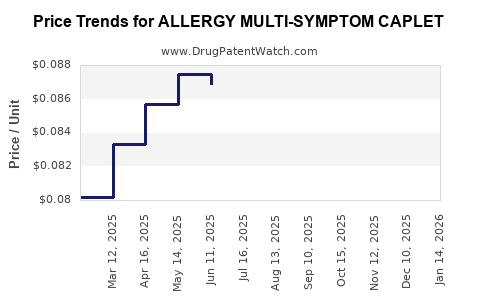

Drug Price Trends for ALLERGY MULTI-SYMPTOM CAPLET

✉ Email this page to a colleague

Average Pharmacy Cost for ALLERGY MULTI-SYMPTOM CAPLET

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ALLERGY MULTI-SYMPTOM CAPLET | 70000-0211-01 | 0.08429 | EACH | 2025-11-19 |

| ALLERGY MULTI-SYMPTOM CAPLET | 70000-0211-01 | 0.08564 | EACH | 2025-10-22 |

| ALLERGY MULTI-SYMPTOM CAPLET | 70000-0211-01 | 0.08360 | EACH | 2025-09-17 |

| ALLERGY MULTI-SYMPTOM CAPLET | 70000-0211-01 | 0.08218 | EACH | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Allergy Multi-Symptom Caplet

Introduction

The allergy medication market remains a key segment within the larger pharmaceutical landscape, driven by increasing prevalence of allergic conditions, consumer demand for effective over-the-counter (OTC) solutions, and ongoing innovation in drug formulations. The Allergy Multi-Symptom Caplet—a combination medication designed to alleviate symptoms such as sneezing, runny nose, itchy eyes, and congestion—serves a prominent role in this market. This analysis explores current market dynamics, key competitors, regulatory considerations, and future pricing trajectories for this therapeutic class.

Market Overview

Global and Regional Market Trends

The global allergy treatment market was valued at approximately USD 20 billion in 2022, with expectations of a compound annual growth rate (CAGR) of 6.2% through 2030 (source: Fortune Business Insights). North America dominates the market, accounting for over 40% of sales, propelled by high prevalence rates of allergic rhinitis and product accessibility.

Europe follows closely, with increasing awareness and OTC availability expanding the scope for multi-symptom caplets. Asia-Pacific presents a rapidly growing sector, driven by rising urban pollution, changing lifestyles, and expanding healthcare infrastructure.

Prevalence and Consumer Demand

According to the World Allergy Organization, approximately 30-40% of the global population suffers from allergic rhinitis, underscoring substantial demand for multi-symptom relief agents (source: WAO). Consumers increasingly prefer combination OTC caplets that offer comprehensive symptom control, boosting sales of multi-symptom formulations.

Product Landscape

Leading OTC brands such as Claritin (loratadine), Allegra (fexofenadine), and Zyrtec (cetirizine) have expanded their formulations to include multi-symptom caplets. The market features a mix of monopreparations and combination products, with newer entries emphasizing extended relief and fewer side effects.

Regulatory and Patent Landscape

Regulatory Considerations

In the United States, the Food and Drug Administration (FDA) regulates OTC allergy medications under monograph or New Drug Application (NDA) pathways, contingent on formulation complexity and claims. Multi-symptom caplets often require rigorous bioequivalence studies if formulation changes occur post-patent expiry.

European Medicines Agency (EMA) and other regional agencies employ similar standards, with increasing emphasis on safety, efficacy, and labeling clarity. Regulatory hurdles can impact market entry timelines and pricing strategies.

Patent and Exclusivity Dynamics

Many leading products entered the market over two decades ago, resulting in patent expirations and a shift toward generic competition. Innovative combination formulations, however, may secure new patents covering unique compositions or delivery methods, providing temporary market exclusivity. Patent expiries typically signal increased price competition and volume-based growth.

Market Drivers and Challenges

Drivers

- Rising allergic disease prevalence globally.

- Consumer preference for OTC, multi-symptom relief products.

- Continuous innovation in formulation science, including extended-release options and allergen-specific combinations.

- Increasing healthcare awareness and self-medication trends.

Challenges

- Price erosion due to generic entries.

- Regulatory hurdles for novel combinations.

- Consumer preferences shifting toward newer, potentially more effective or natural alternatives.

- Potential side effects influencing formulary and consumer choice.

Price Projection Analysis

Historical Pricing Trends

Historical retail prices for marketed allergy caplets have shown gradual decline driven by patent expiries and generic competition. For example, branded formulations that once sold at USD 15-20 per pack now often retail at USD 8-12 in North America. Multi-symptom products tend to command premiums of approximately 10-15% over monopreparations, reflecting their added value.

Future Price Outlook

Based on market trends, we project the following:

- Short-term (1-3 years): Prices to remain relatively stable, with potential minor adjustments driven by inflation, supply chain factors, and competitive pressures.

- Medium-term (3-5 years): Introduction of enhanced formulations may enable moderate price increases, especially if backed by patent protection or novel delivery mechanisms.

- Long-term (5+ years): As patent exclusivities and regulatory barriers wane, significant price reductions are expected, aligning with generic price points.

Pricing Influencers

Key factors influencing future prices include:

- Patent expirations: Accelerating generic entry lowers prices.

- Market penetration: Increased OTC availability pressures premiums.

- Innovation and differentiation: Patented enhanced formulations can command higher prices.

- Regulatory environment: Stringent requirements may elevate R&D costs, influencing initial pricing.

Competitive and Pricing Strategies

Manufacturers are adopting multiple strategies to optimize pricing:

- Bundling and subscription models to encourage loyalty.

- Value-based pricing, emphasizing novel formulations' efficacy benefits.

- Repositioning as premium products in certain markets to offset R&D costs.

- Localization of pricing to meet regional economic conditions, especially in emerging markets.

Opportunities and Risks

Opportunities:

- Development of next-generation multi-symptom caplets with multi-modal action.

- Expansion into untapped markets, especially in Asia and Latin America.

- Strategic partnerships and licensing to accelerate innovation and distribution.

Risks:

- Regulatory delays or restrictions on combination medicines.

- Market saturation with generic alternatives.

- Changes in consumer preferences toward alternative therapies or natural remedies.

Key Takeaways

- The global allergy treatment market is poised for sustained growth, driven by rising allergy prevalence and consumer demand for effective OTC solutions.

- Multi-symptom caplets occupy a lucrative market segment but face pricing pressures from patent expiries and generic competition.

- Innovation, patent protection, and strategic marketing are critical to maintaining premium pricing margins.

- Short-term stability is expected in prices, with moderate increases possible through new formulations; long-term pricing trends will lean towards reductions.

- Manufacturers should prioritize differentiation through novel delivery mechanisms and expand into emerging markets to maximize profitability.

FAQs

Q1: What factors most influence the pricing of allergy multi-symptom caplets?

A: Patent status, formulation uniqueness, manufacturing costs, regulatory environment, and competitive landscape significantly impact pricing.

Q2: How will patent expiries affect future pricing strategies?

A: Patent expiries typically lead to increased generic competition, resulting in lower prices and decreased market premiums.

Q3: What market segments offer the greatest growth potential?

A: Emerging markets in Asia-Pacific and Latin America offer growth opportunities due to rising allergy prevalence and expanding healthcare access.

Q4: Are natural or alternative therapies impacting the market?

A: Yes, growing consumer interest in natural remedies can influence demand for traditional pharmaceuticals, potentially exerting downward pressure on prices.

Q5: What role does innovation play in premium pricing?

A: Novel formulations, extended-release mechanisms, and targeted combinations enable companies to command higher prices and differentiate products.

References

- Fortune Business Insights. (2022). Global Allergy Treatment Market Size, Share & Industry Forecast.

- World Allergy Organization. (2020). Allergic Rhinitis Prevalence and Impact.

- U.S. Food and Drug Administration. (2023). OTC Drug Review and Regulation.

- European Medicines Agency. (2022). Guidelines on Market Authorization of OTC products.

- MarketWatch. (2023). Drug Pricing Trends and Patent Expiries.

This analysis provides a comprehensive view of the current landscape and future projections for the allergy multi-symptom caplet market, equipping business professionals with insights necessary for strategic decision-making.

More… ↓