Last updated: July 27, 2025

Introduction

The allergy medication market has witnessed substantial growth over the past decade, driven by increasing global prevalence of allergic diseases, technological advancements in therapeutic options, and expanding indications. This analysis explores the current market landscape, key players, regulatory environment, commercialization trends, and future price projections for allergy drugs.

Market Overview

Global Allergy Drug Market Size

The global allergy medication market was valued at approximately USD 13.5 billion in 2022, with projections to reach USD 17.8 billion by 2030, growing at a Compound Annual Growth Rate (CAGR) of about 4.0% (2023–2030) [1]. Factors fueling this growth include rising incidences of allergic rhinitis, food allergies, eczema, and asthma, especially in urbanized regions and among children.

Types of Allergy Drugs

The market is segmented into:

- Antihistamines: The largest segment, including both first-generation (e.g., diphenhydramine) and newer second-generation agents (e.g., loratadine, cetirizine).

- Decongestants: Used primarily in combination with antihistamines.

- Intranasal Corticosteroids: Examples include fluticasone and mometasone.

- Leukotriene Receptor Antagonists: Such as montelukast.

- Biologics: Emerging therapies like omalizumab for severe allergic conditions.

- Immunotherapy: Including subcutaneous and sublingual approaches.

Market Dynamics

The increasing adoption of personalized medicine, development of biologics, and improved delivery systems are transforming the allergy therapeutics landscape. Notably, biologics like omalizumab have been pivotal for patients with severe allergies, commanding premium pricing.

Key Market Drivers and Restraints

Drivers

- Rising Prevalence of Allergic Diseases: According to WHO, approximately 30-40% of the global population suffers from allergic conditions, leading to high demand for effective treatments [2].

- Urbanization and Environmental Factors: Pollution and climate change contribute to allergy prevalence.

- Advancements in Pharmacotherapy: Improved formulations and immunological approaches enhance patient adherence and efficacy.

- Growing Aging Population: Older adults experience increased allergy and asthma incidences, expanding the market.

Restraints

- Lack of Curative Treatments: Most drugs offer symptomatic relief, limiting growth potential.

- Patent Expirations: Leading antihistamines and corticosteroids are approaching or have passed patent protection, increasing generic competition.

- High Cost of Biologics: Premium pricing limits accessibility, especially in developing regions.

- Regulatory Challenges: Stringent approval processes delay market entry of new therapies.

Key Players and Competitive Landscape

Major pharmaceutical companies command significant market shares:

- Sanofi/Regeneron: Omalizumab (Xolair), leading biologic for allergic asthma and urticaria.

- GlaxoSmithKline (GSK): Allergic rhinitis treatments and immunotherapy products.

- AstraZeneca: Focus on immunotherapy and biologic development.

- AbbVie, Novartis: Emerging biologics and biosimilars.

Emerging biotech firms are intensively investing in novel biologic agents and allergy vaccines, aiming to capture underserved segments.

Regulatory Environment

Regulatory agencies such as the FDA and EMA have streamlined pathways for biologics and combination therapies. However, approval timelines remain lengthy, especially for innovative immunotherapies. Ongoing efforts for harmonized standards are expected to facilitate faster market access, influencing drug pricing strategies.

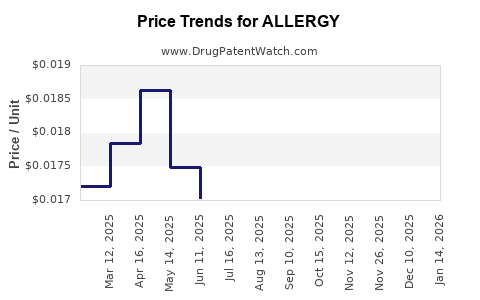

Pricing Trends and Projections

Current Pricing Landscape

Pricing varies significantly across regions. For example:

- United States: Omalizumab (Xolair) retails at USD 1,000–1,500 per month.

- Europe: Pricing is generally lower due to price negotiations and healthcare policies.

- Generics and Biosimilars: Introduction of biosimilars has reduced biologic prices by approximately 30-50% in regions where they are approved.

Factors Influencing Future Prices

- Patent Expirations: Expected patent cliffs for key antihistamines and corticosteroids over the next 3–5 years will likely lead to substantial price reductions via generics.

- Biologic Market Expansion: As biologics penetrate broader patient segments, economies of scale may stabilize or reduce prices, especially with biosimilar competition.

- Regulatory Reforms: Policies promoting biosimilar adoption could further drive prices downward.

- Manufacturing and R&D Costs: Continued advancements in production technology may lower costs, influencing drug prices.

Price Projections (2023–2030)

- Antihistamines and Corticosteroids: With patent expirations and increased generic availability, retail prices are projected to decrease by approximately 30–50% by 2030.

- Biologics (e.g., Omalizumab): Prices are expected to decline modestly—around 10–15%—due to biosimilar entry and competition; however, premium status may sustain higher prices relative to small-molecule drugs.

- Immunotherapy and Novel Biologics: Initial launch prices are high (USD 20,000–30,000 annually), but expect a gradual 10% annual decline as competition and manufacturing efficiencies improve.

Emerging Trends Influencing Future Pricing

- Personalized and Precision Medicine: Tailored therapies, while promising, may command premium prices initially.

- Oral Immunotherapies: Non-injectable options are anticipated to disrupt current cost structures, potentially reducing overall treatment expenses.

- Digital Integration: Digital health tools and remote monitoring could lower adherence costs and enhance treatment efficacy, indirectly affecting pricing models.

Conclusion

The allergy drug market is poised for steady growth, fueled by rising disease burden and technological innovation. Price dynamics will be shaped by patent expirations, biosimilar adoption, regulatory reform, and new therapeutic modalities. While biologics currently command high prices, competitive pressures and manufacturing innovations will likely moderate costs in the coming years, expanding access and improving affordability globally.

Key Takeaways

- The global allergy medication market is projected to reach USD 17.8 billion by 2030, growing at a CAGR of 4.0%.

- patent expirations for key antihistamines and corticosteroids will lead to notable price reductions via generics.

- Biologics like omalizumab will see modest price decreases due to biosimilar competition, but their premium pricing will sustain higher costs.

- Emerging therapies, especially oral immunotherapies and digital health solutions, could disrupt traditional pricing models.

- Manufacturers should strategize around patent landscapes, biosimilar pathways, and innovative delivery systems to optimize pricing and market penetration.

FAQs

1. How will patent expirations impact allergy drug prices?

Patent expirations for popular antihistamines and corticosteroids will facilitate generic and biosimilar entry, leading to significant price reductions—often 30–50%—making these therapies more accessible and pressuring brand-name pricing strategies.

2. Are biologics like omalizumab expected to drop in price?

Yes. Biosimilar competition and manufacturing efficiencies are anticipated to reduce biologic prices by around 10–15% by 2030. However, their premium status may sustain relative price levels longer than small molecules.

3. What role will emerging therapies play in future pricing?

Oral immunotherapies and personalized treatments, though initially expensive, have the potential to reduce overall treatment costs through improved adherence, convenience, and targeted efficacy, possibly leading to price stabilization or reductions.

4. How do regulatory policies influence allergy drug prices?

Streamlined approval processes and policies that promote biosimilar adoption can accelerate market entry, increase competition, and consequently lower drug prices while ensuring safety and efficacy standards.

5. Will digital health tools impact allergy drug market pricing?

Yes. Digital monitoring and telemedicine integration can improve treatment adherence and outcomes, potentially reducing long-term costs and influencing favorable pricing models for manufacturers and payers.

References

[1] Market Data Forecast, "Global Allergy Drug Market Forecast," 2023.

[2] WHO, "Global Status of Allergic Diseases," 2022.