Last updated: July 27, 2025

Overview of ALISKIREN

Aliskiren, marketed primarily under the brand name Tekturna (or Tekturna HCT when combined with hydrochlorothiazide), is an oral direct-renin inhibitor used predominantly in the management of hypertension. Approved by the U.S. Food and Drug Administration (FDA) in 2007, aliskiren offers an alternative to traditional antihypertensive agents such as ACE inhibitors, ARBs, and diuretics. Its unique mechanism of action involves directly inhibiting renin, pivotal in the Renin-Angiotensin-Aldosterone System (RAAS), reducing blood pressure effectively.

Market Dynamics and Competitive Landscape

Global Market Size and Growth Trajectory

The hypertension therapeutics market is one of the largest segments within the cardiovascular drugs domain, estimated to reach USD 22.5 billion by 2025, with a compound annual growth rate (CAGR) of approximately 3-4% [1]. Aliskiren holds a niche segment within this landscape, with its market share driven by physician preference for RAAS-targeted therapies.

In 2022, the global aliskiren market was valued at roughly USD 600 million, predominantly driven by North America, Europe, and parts of Asia-Pacific. The increasing prevalence of hypertension—projected to affect over 1.3 billion adults globally by 2030—continues to expand the potential market size [2].

Key Market Drivers

- Growing Hypertension Prevalence: Rising cardiovascular risk factors, including obesity and aging populations, underpin the demand for effective antihypertensive medications.

- Distinct Pharmacology: Aliskiren's unique mechanism offers an alternative for patients intolerant to ACE inhibitors or ARBs.

- Healthcare Reforms: Policies favoring generic medication adoption and cost-effective treatments stimulate market penetration.

Key Market Challenges

- Limited Awareness & Prescriptions: Despite clinical benefits, aliskiren is less prescribed compared to established ACE inhibitors/ARBs due to limited clinician familiarity.

- Safety Concerns & Guidelines: The PRoFESS trial and subsequent guidelines raised questions about aliskiren's safety in patients with diabetes or renal impairment, possibly curbing its use.

- Generic Competition: As patents expire, generic versions could significantly influence pricing and market competitiveness.

Competitive Positioning

While aliskiren has faced competition from traditional antihypertensives, its position hinges on its efficacy in specific patient subsets and ongoing research into optimal combination therapies. Therapeutic guidelines like the 2022 ESC/ESH guidelines have incorporated aliskiren as an add-on therapy but note cautious use in certain populations [3].

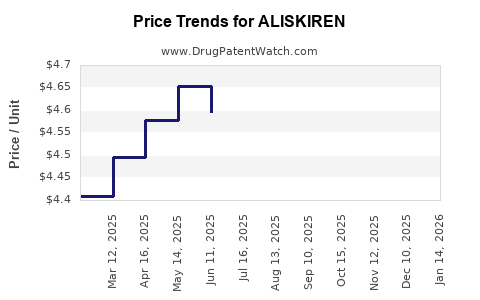

Price Trends and Projections

Current Pricing Landscape

The retail price of aliskiren varies by region and formulation. In the U.S., branded Tekturna costs approximately USD 300-350 for a month's supply of a 150 mg dose. Generic formulations, once available, could reduce the monthly cost to approximately USD 100-150, representing a substantial price decrease.

Factors Influencing Price Trends

- Patent Expirations: Tekturna's patent expiry, anticipated around late 2020s, is poised to foster generic competition, drastically reducing prices.

- Market Penetration: Increased adoption in primary care and specialty cardiology influences pricing strategies.

- Reimbursement Policies: Insurance coverage and healthcare systems' formulary decisions modulate consumer prices and access.

Projected Price Evolution (2023-2030)

- Short Term (2023-2025): Stable prices with limited generic competition. The average retail price in the U.S. remains near USD 300-350 per month.

- Medium Term (2025-2028): With patent expiration, generic aliskiren enters the market, expected to cut prices by 50-70%. Companies' manufacturing efficiencies and market competition could further lower costs.

- Long Term (2028-2030): Prices could stabilize at USD 50-100 per month, consistent with generics for other antihypertensives. Adoption will depend on clinician familiarity and guideline positioning.

Market Entry and Pricing Strategies

- Strategic Alliances: Patent litigation and licensing could influence the timing and pricing of generics.

- Differentiation: Manufacturers may focus on formulations combining aliskiren with other antihypertensives to sustain premium pricing.

- Market Penetration Incentives: Patient assistance programs and reimbursement negotiations can facilitate broader access.

Regulatory and Patent Landscape

Patent protections for Tekturna are expected to expire in the late 2020s in key jurisdictions, such as the U.S. and EU. Patent challenges and regulatory approvals for generics will be pivotal in shaping the competitive and pricing landscape.

Conclusion

Aliskiren's market outlook remains cautiously optimistic. Its niche positioning, direct-renin inhibition mechanism, and potential for cost reduction post-patent expiry underpin its future market trajectory. While current prices are relatively high, imminent patent expiration and growing hypertension prevalence suggest significant price declines over the next decade, fostering broader access and usage.

Key Takeaways

- The global aliskiren market is expected to transition from a niche to a more competitive landscape upon patent expiration, with prices potentially declining by 50-70%.

- Growing hypertension prevalence and healthcare system emphasis on cost-effective treatments support continued demand.

- Strategic positioning with combination therapies and expanded clinical guidelines can enhance market penetration.

- Price projections highlight a shift towards affordability, making aliskiren an increasingly viable option for specific patient populations.

- Early stakeholders should monitor patent expiry timelines and regulatory developments to optimize market entry strategies.

FAQs

1. When will generic aliskiren become widely available?

Generic versions are expected to enter the market following the expiration of key patents in the late 2020s, with availability possibly as early as 2025-2028, depending on patent litigations and regulatory approvals.

2. How does aliskiren compare cost-wise to other antihypertensives?

Currently, branded aliskiren is priced around USD 300-350 per month in the U.S., but generic alternatives could reduce costs to USD 50-150 monthly, making it competitive with ACE inhibitors and ARBs once generics are introduced.

3. What populations benefit most from aliskiren therapy?

Patients intolerant to ACE inhibitors/ARBs, or those requiring combined RAAS blockade, may benefit most, though safety considerations mandate cautious use in diabetics and renal impairment.

4. Are there ongoing clinical trials impacting aliskiren’s market prospects?

Yes, multiple studies explore combination therapies, safety in special populations, and long-term cardiovascular outcomes, which could influence clinical guidelines and adoption.

5. What strategies can pharmaceutical companies employ to maximize profitability post-patent expiry?

Innovative formulations, combination products, patient-centric marketing, and strategic alliances for patent protection can extend profitability prospects beyond generic competition.

References

[1] Grand View Research, "Hypertension Drugs Market Size, Share & Trends Analysis," 2022.

[2] World Health Organization, "Global hypertension prevalence," 2019.

[3] ESC/ESH Guidelines for the management of arterial hypertension, 2022.