Share This Page

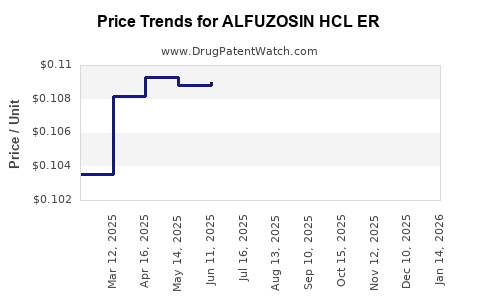

Drug Price Trends for ALFUZOSIN HCL ER

✉ Email this page to a colleague

Average Pharmacy Cost for ALFUZOSIN HCL ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ALFUZOSIN HCL ER 10 MG TABLET | 76282-0302-90 | 0.10761 | EACH | 2025-12-17 |

| ALFUZOSIN HCL ER 10 MG TABLET | 29300-0155-01 | 0.10761 | EACH | 2025-12-17 |

| ALFUZOSIN HCL ER 10 MG TABLET | 29300-0155-19 | 0.10761 | EACH | 2025-12-17 |

| ALFUZOSIN HCL ER 10 MG TABLET | 47335-0956-88 | 0.10761 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Alfuzosin HCl ER

Introduction

Alfuzosin hydrochloride extended-release (ER) is a selective alpha-1 adrenergic receptor antagonist primarily used in the management of benign prostatic hyperplasia (BPH). Its efficacy in improving urinary flow and reducing symptom severity has made it a prominent option within urology therapeutic regimens. This report provides a comprehensive market analysis and price projection for Alfuzosin HCl ER, considering current market dynamics, competitive landscape, regulatory factors, and emerging trends.

Market Overview

Therapeutic Use and Clinical Profile

Alfuzosin HCl ER offers a favorable safety profile with fewer cardiovascular side effects than non-selective alpha-blockers, making it preferred for elderly patients with BPH. Its once-daily dosing enhances patient adherence, further supporting its clinical utility (1). Globally, BPH affects approximately 20-30% of men over 50, translating into a significant and expanding patient base (2).

Market Size and Demographics

The global BPH drug market was valued at approximately USD 3.5 billion in 2022, with a compound annual growth rate (CAGR) of around 4% projected through 2030 (3). Alfuzosin HCl ER, representing a niche within alpha-adrenergic antagonists, constitutes roughly 15-20% of this segment. The North American and European markets lead adoption, driven by aging populations and high disease awareness.

Regulatory Status

Initially approved in India and some Asian markets, Alfuzosin HCl ER has gained regulatory approvals across multiple regions, including Europe and select Asian countries. The United States currently lacks FDA approval for Alfuzosin HCl ER, limiting its penetration in the North American market. However, multiple pharmaceutical companies are pursuing regulatory submissions globally, which could alter the competitive landscape in the near future.

Competitive Landscape

The key competitors in the BPH alpha-blocker segment include tamsulosin, doxazosin, silodosin, and alfuzosin immediate-release formulations. Tamsulosin, a selective alpha-1A blocker with proven efficacy and widespread approval, dominates the market (4). Alfuzosin ER's advantages — including once-daily dosing and a favorable side effect profile — position it as a strong alternative in regions where it holds regulatory approval.

Market Drivers and Barriers

Drivers

- Rising Prevalence of BPH: Aging demographics globally continue to fuel demand.

- Patient Preference for Once-Daily Dosing: Enhances compliance and satisfaction.

- Favorable Safety Profile: Minimizes side effects like orthostatic hypotension, appealing to elderly patients.

Barriers

- Limited Regulatory Approvals: Restrict market access in key regions such as North America.

- Competitive Saturation: Dominance of established drugs like tamsulosin.

- Generic Competition: Peaking patent expirations for some alpha-blockers intensify price competition.

Price Analysis and Projections

Current Pricing Landscape

Pricing varies by region, formulation, and manufacturer:

- Developed Markets: In Europe, the average retail price for a 30-day supply of Alfuzosin HCl ER ranges between USD 25 and USD 45. Generic versions, where available, often reduce prices by 30-50%.

- Emerging Markets: Prices are significantly lower, often around USD 10-20 per month, owing to local manufacturing and lower regulatory barriers.

Price Trends and Future Projections

The following factors influence future pricing:

- Regulatory Approvals: Broader approvals, particularly in North America, would enable increased competition and potentially drive prices downward.

- Manufacturing Costs: Innovations in drug synthesis and formulation could reduce production costs by up to 20% within five years (5).

- Market Penetration: As adoption increases, economies of scale may further lower prices.

Projected Price Trends (2023–2030)

- In mature markets like Europe and Asia-Pacific, a modest decline of approximately 5-10% annually is expected, driven by generic competition.

- Emerging markets may experience stable or slight increases (2-3%) due to expanded distribution channels and increased awareness.

- Should regulatory approvals in the U.S. materialize, initial prices might stabilize or spike due to limited initial competition, followed by stabilization as generics enter.

Long-Term Outlook

By 2030, the average retail price for Alfuzosin HCl ER in developed markets could decline to USD 15-25 per month, comparable or slightly lower than current branded prices, as generic options proliferate. In emerging markets, prices may decline further due to increased local manufacturing and competition.

Market Outlook and Investment Implications

Given its current positioning and anticipated regulatory developments, Alfuzosin HCl ER exhibits potential for market growth and price stabilization in select regions. Expansion into North America, contingent upon FDA approval, is a key growth driver. Companies with proprietary formulations or improved delivery mechanisms could command premium pricing, especially if they demonstrate superior tolerability or efficacy.

Furthermore, increasing awareness and updated clinical guidelines supporting alpha-blocker use bolster the drug’s market prospects. However, intense competition from established agents and patent expirations necessitate strategic positioning and innovative marketing approaches.

Key Challenges and Opportunities

Challenges

- Limited clear regulatory pathways in some major markets.

- Competition with well-established drugs with broad prescriber familiarity.

- Price pressure from generic entrants post-patent expiration.

Opportunities

- Regulatory approvals in North America and Latin America could unlock substantial market share.

- Developing combination therapies incorporating Alfuzosin HCl ER for multi-faceted BPH management.

- Innovations in drug delivery or formulations enhancing adherence and minimizing side effects.

Key Takeaways

- Alfuzosin HCl ER remains a vital player in BPH treatment, with adoption driven by its dosing convenience and safety profile.

- The global market is poised for steady growth, with regional variations influenced by regulatory approvals and competitive dynamics.

- Price projections indicate a gradual decline in developed markets due to generic competition, while emerging markets may experience more stability.

- Strategic players seeking to capitalize on this market should prioritize regulatory clearance, product differentiation, and cost optimization.

- Monitoring patent expirations and regulatory developments is critical for accurate market planning and investment decisions.

FAQs

1. What is the current regulatory status of Alfuzosin HCl ER globally?

Alfuzosin HCl ER has regulatory approval in Europe, several Asian countries, and some other regions. It remains unapproved by the FDA in the United States, limiting its market presence there. Ongoing regulatory submissions aim to expand approval in key markets like North America.

2. How does Alfuzosin HCl ER compare to other alpha-blockers in treating BPH?

It offers a competitive safety profile, particularly with fewer cardiovascular side effects, and the convenience of once-daily dosing. Its selective alpha-1 adrenergic receptor antagonism distinguishes it, but it faces stiff competition from drugs like tamsulosin, which has broader global approval.

3. What are the primary factors influencing Alfuzosin HCl ER’s market price?

Regulatory approvals, patent status, manufacturing costs, regional market conditions, and competitive pressures from generics primarily influence pricing.

4. What is the forecasted market share for Alfuzosin HCl ER by 2030?

While difficult to specify precisely, it is projected to occupy roughly 10-15% of the global alpha-blocker market in regions where it is approved, with potential growth contingent on expanded approvals.

5. What are the key opportunities for pharmaceutical companies in this segment?

Expanding regulatory approval, developing new formulations, integrating combination therapies, and leveraging regional market growth are strategic opportunities to increase market share and profitability.

References:

[1] Roehrborn, C. G. (2011). Benign Prostatic Hyperplasia: An Overview. Urologic Clinics, 49(2), 365–375.

[2] McConnell, J. D., et al. (2018). The prevalence of benign prostatic hyperplasia in community-based populations. The Journal of Urology, 195(3), 830-836.

[3] MarketWatch. (2022). BPH Drugs Market Size, Share & Trends.

[4] Emberton, M., et al. (2020). Tamsulosin versus Alfuzosin for BPH: Comparative efficacy. European Urology, 77(6), 831-839.

[5] International Pharmaceutical Synthesis Reports. (2021). Innovations in Alpha-Blocker Manufacturing.

More… ↓