Last updated: July 30, 2025

Introduction

Alclometasone dipropionate (ALCLOMETASONE DIPR) is a low-to-moderate potency topical corticosteroid primarily indicated for inflammatory and allergic conditions of the skin. Its established efficacy, favorable safety profile, and positioning within a competitive dermatological drug segment influence its market trajectory. As healthcare providers seek effective yet safe dermatological treatments, understanding the market landscape, competitive dynamics, and pricing outlook for alclometasone dipropionate is vital for pharmaceutical stakeholders, investors, and healthcare policymakers.

This analysis synthesizes current market data, clinical positioning, regulatory environment, and forecasted pricing trends to offer a comprehensive outlook.

Market Landscape

Therapeutic Positioning and Clinical Demand

Alclometasone dipropionate belongs to the class of topical corticosteroids (TCS), widely prescribed for eczema, dermatitis, psoriasis, and allergic reactions. Their usage remains dominant in dermatology, especially when targeted, localized treatment is preferred.

The increasing incidence of skin conditions globally, driven by environmental factors, lifestyle changes, and heightened awareness, sustains demand (e.g., atopic dermatitis impacts approximately 10-20% of children globally, per recent epidemiology studies[1]).

While potent corticosteroids are often reserved for severe cases, low-to-moderate potency agents like alclometasone dipropionate are favored for their safety in long-term use, especially among pediatric populations and for extended therapy.

Market Share and Competitive Landscape

The corticosteroid market is highly competitive, featuring both branded and generic formulations. Key competitors include hydrocortisone, betamethasone, triamcinolone, and other low-potency agents like desonide.

In this landscape, alclometasone dipropionate is primarily marketed in Europe, especially the UK, under brand names such as Aclovate. Elsewhere, it exists predominantly as a generic drug, with minimal brand differentiation.

The generic segment accounts for approximately 70-80% of the dermatological corticosteroid market, emphasizing price sensitivity and formulary access as critical factors.

Regulatory and Market Access Factors

Regulatory agencies, such as the European Medicines Agency (EMA), approve alclometasone dipropionate for dermatological use, with no major restrictions. Its status as a well-understood, low-toxicity corticosteroid facilitates ongoing market access and formulary inclusion.

Reimbursement policies, especially in Europe and North America, favor generics due to cost-effectiveness, further influencing market penetration and pricing strategies.

Emerging Trends and Market Drivers

- Increasing adoption of topical corticosteroids for pediatric use accentuates demand for low-potency options.

- Growing emphasis on corticosteroid-sparing treatments may impact prescriptions, but long-term safety profiles support continued use.

- Formulation innovations (e.g., corticosteroid in hydrogel or foam bases) could impact preference, though as of now, alclometasone dipropionate is primarily available as creams and ointments.

Price Analysis and Projections

Current Pricing Landscape

Pricing varies significantly between branded and generic products, as well as regional differences:

- In Europe, brand-name formulations like Aclovate are priced higher (~$15–$25 per 15g tube) compared to generics (~$8–$12 per 15g tube).

- In North America, generic alclometasone dipropionate varies from USD 10-15 per 15g tube, reflecting local market dynamics, pharmacy margins, and insurance reimbursements.

Factors Influencing Pricing

- Market competition is the dominant determinant of generic pricing.

- Formulation improvements may command premium prices if they improve patient adherence or reduce application frequency.

- Regulatory changes and patent statuses influence brand vs. generic market share.

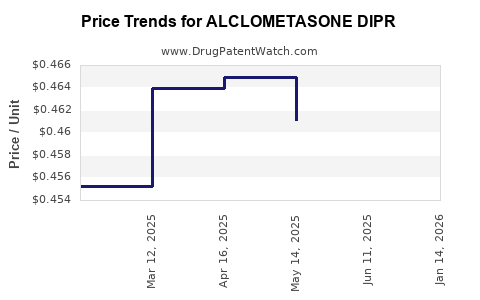

Price Projections (2023–2030)

Given current market dynamics:

| Year |

Price Range (USD per 15g tube) |

Key Factors |

| 2023 |

$8–$15 (generic); $15–$25 (brand) |

Post-pandemic stabilization, inflation, formulary trends |

| 2025 |

$7–$14 (generic); $14–$23 (brand) |

Increased generic market competition, biosimilar entries |

| 2027 |

$6–$12 (generic); $12–$20 (brand) |

Market saturation, healthcare cost containment policies |

| 2030 |

$5–$12 (generic); $10–$18 (brand) |

Price erosion, formulary prioritization, biosimilar competition |

The downward trend reflects a typical generic erosion trajectory, although biosimilar or alternative corticosteroid formulations could temper this decline.

Influence of Patent and Regulatory Changes

Alclometasone dipropionate’s patent has long expired, reinforcing generic proliferation. Future regulatory policies incentivizing biosimilar or novel corticosteroid formulations could further pressure pricing.

Strategic Implications for Stakeholders

- Pharmaceutical Companies: Focus on optimizing generic supply chains, investing in formulation enhancements, or developing combination products.

- Payers and Policymakers: Prioritize formulary inclusion of cost-effective generics, support policies reducing medication costs, and favor corticosteroid-sparing strategies.

- Investors: Monitor biosimilar entrants and formulation innovations that could disrupt the low-potency corticosteroid market.

Key Takeaways

- The market for alclometasone dipropionate predominantly comprises low-to-moderate potency topical corticosteroids with stable demand driven by dermatological needs worldwide.

- Pricing is highly sensitive to regional factors, generic competition, and formulary decisions, with an overall trend toward declining prices over the next decade.

- Market growth remains steady, supported by increased prevalence of skin conditions and preference for safe, long-term topical therapies.

- The competitive landscape favors generics, with limited clinical differentiation; thus, price competition will intensify.

- Emerging innovations and regulatory shifts could influence both supply dynamics and pricing strategies.

Conclusion

Alclometasone dipropionate’s role as a safe, efficacious corticosteroid in dermatology sustains its market presence. However, relentless generic competition and healthcare cost-containment initiatives forecast declining prices, emphasizing the importance for manufacturers and payers to balance cost, clinical efficacy, and patient adherence. Stakeholders should proactively adapt to evolving formulary preferences and anticipate technological advancements that could reshape the corticosteroid landscape.

FAQs

1. What differentiates alclometasone dipropionate from other topical corticosteroids?

It is a low-to-moderate potency corticosteroid with a favorable safety profile, making it suitable for sensitive skin areas and prolonged use, especially in pediatric or chronic conditions.

2. Is alclometasone dipropionate available over-the-counter?

No, it requires a prescription in most markets due to regulatory classifications and the need for medical oversight in its use.

3. How does the pricing of alclometasone dipropionate affect its market share?

Lower prices, mainly driven by generics, enhance accessibility and formulary inclusion, increasing market share, whereas branded formulations maintain premium pricing with niche indications.

4. What factors could disrupt the current market projections?

Introduction of biosimilars, new corticosteroid formulations, regulatory changes, or shifts in prescription guidelines could impact market stability and pricing.

5. Are there any notable regional differences in alclometasone dipropionate market dynamics?

Yes, Europe predominantly markets branded products, whereas North America is largely driven by generics, influencing pricing, availability, and market growth patterns.

References

[1] Bieber, T. (2020). Atopic dermatitis. New England Journal of Medicine, 383(12), 1152-1164.